Diversity, Equity & Inclusion Insights

VetCTAP Aims to Increase Veteran Employment Rate

The VetCTAP program concept grew out of the personal experience of Sandra Fichter (former US Army Officer), who is a Human Resources (HR) professional. In her HR role, Sandra reviewed resumes from transitioning veterans that did not accurately reflect all of their skills. Sandra could predict that they would not be selected for jobs they qualified for because they did not effectively communicate their strengths and skills. This realization led to the birth of the VetCTAP workshop series.

Sandra recruited senior learning and development expert, Janis Whitaker and other HR professionals to create a job search workshop series. The program was built around three key elements: one-on-one coaching, utilizing HR professionals as facilitators and coaches, and reaching military members before they leave the service, allowing for a smooth and successful career change.

The VetCTAP workshop series (formerly CTAP) began in 2012 successfully assisting military, veterans, and spouses through their career transition. The program has sustained a 90% success rate of graduates obtaining the career of their choice. VetCTAP’s success is not possible without HR and business professionals who volunteer to teach and coach, and donors who share in the passion of supporting veterans and spouses in transition, and helping those veterans find employment in the career of their choice, where they can comfortably provide for themselves and their families.

Disclaimer: The information provided in this article is intended for general informational purposes only. It should not be considered as financial, legal, investment or other professional advice. Readers should consult with the relevant professionals for specific advice related to their situation.

We are not affiliated, associated, authorized, endorsed by, compensated or in any way officially connected with any other company, agency, or government agency in this article. All product, service and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Before making any decisions based on the information contained in this article, you are strongly advised to refer to alternative, independent sources of information to substantiate the basis for your decision. It is your sole responsibility to satisfy yourself prior to using the information in any way and to seek appropriate advice before taking or refraining from taking any action in reliance on any information contained in this article.

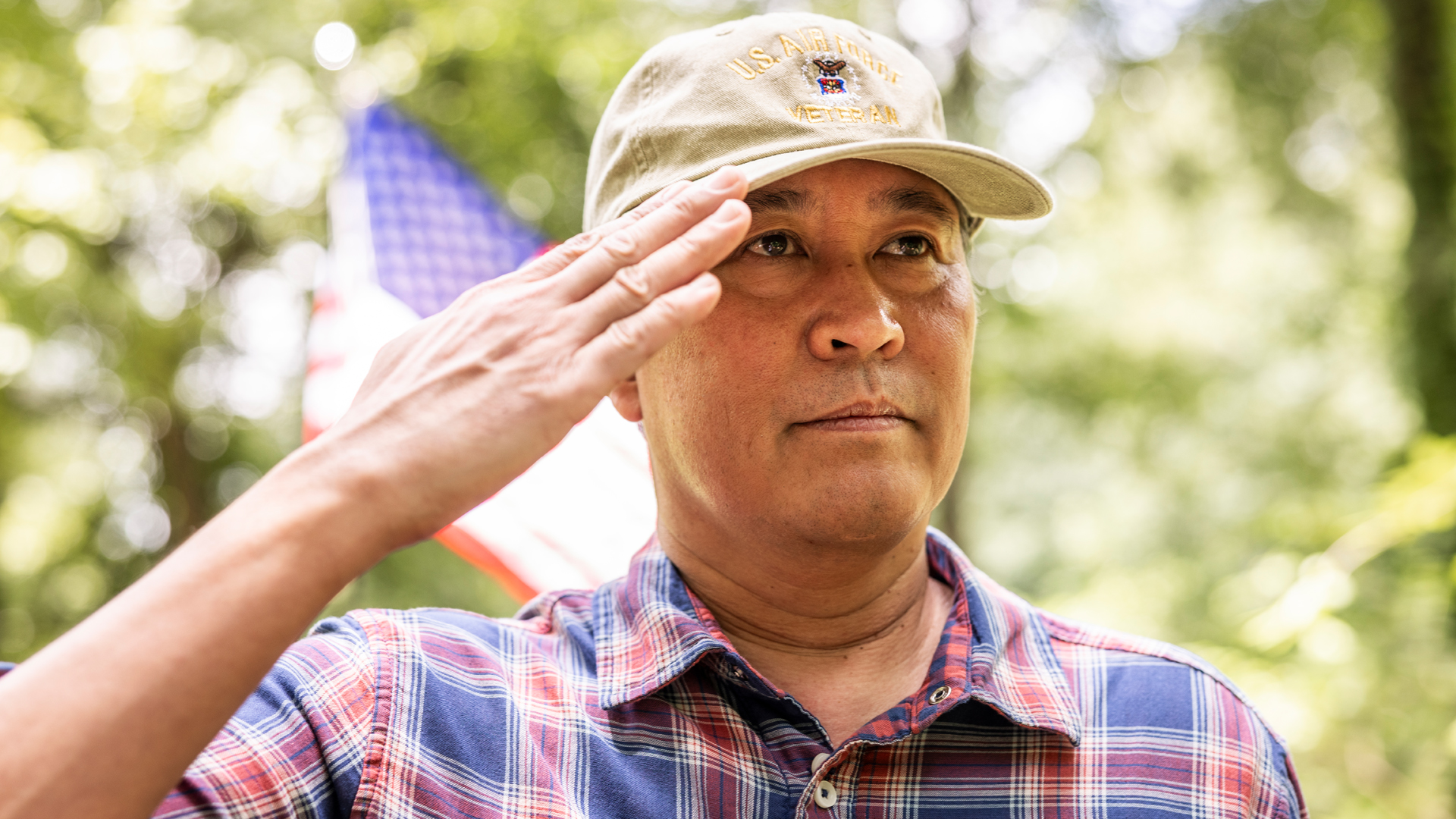

Honoring our Heroes: Veterans Day, November 11, 2023

Veterans Day is a solemn reminder of the sacrifices made by these heroes to protect our freedom, uphold our values, and preserve our way of life.

These veterans have faced adversity on the front lines, away from their homes and loved ones, often in the harshest conditions. They have demonstrated courage, resilience, and unwavering dedication. Their service transcends political divides, uniting us in our collective gratitude for their sacrifice.

Veterans Day is a day of remembrance, reflection, and appreciation. It is an opportunity to express our profound thanks to those who have worn the uniform, to recognize the challenges they’ve faced during and after their service, and to provide our support as they transition back into civilian life.

As a nation, we must not only celebrate Veterans Day with parades and ceremonies, but also strive to make a lasting impact by supporting our veterans through initiatives that offer education, employment, and healthcare. These heroes deserve nothing less for their immense contributions to our country.

Let us stand together and salute the veterans who have given so much for us, on this Veterans Day and every day. Their sacrifices remind us that freedom is not free, and our gratitude should be boundless.

Diversity, Equity & Inclusion Insights

Military Spouse Grateful for Center Scholarship

To The American College of Financial Services Center for Military and Veterans Affairs

I wanted to take a moment to express my sincere gratitude for your generous support through the Center for Military and Veterans Affairs scholarship program. I am honored to be a recipient of this scholarship, which will enable me to pursue new training in wealth management as a military spouse.

Your invaluable contribution has provided me with an extraordinary opportunity to enhance my knowledge and skills in the field of wealth management. I have always been passionate about financial literacy and enabling individuals to achieve financial stability and independence. This scholarship will allow me to transform this passion into a reality, and I am committed to making the most of this opportunity … using my newfound knowledge to empower military families.

I want to express my sincere appreciation for your recognition of the unique challenges faced by military spouses and your commitment to their personal and professional growth. By investing in my education and training, you are not only supporting me as an individual but also making a positive impact on the entire military community.

Thank you once again for your invaluable support which has not only lightened the financial burden but also reaffirmed my commitment to making a positive impact on the lives of military families. I will always be grateful for the opportunity you have given me and will strive to pay it forward by helping others in the future.

With heartfelt appreciation,

Sheree Couts

Retirement Planning On-Demand Webcasts

New Trends in Retirement Income Planning – Beyond the Use of Monte Carlo

How Advisors Can Help Clients Solve The Roth 401(k) Puzzle

For a Goldilocks Retirement: Save, Invest, Annuitize

The Retirement Thinker — With Wade Pfau

The American College of Financial Services to Launch Online Learning and CE Platform for Financial Advisors

Ethics In Financial Services News