Specialize in Tax-Informed Planning

Tax Planning is Financial Planning

Learn about the TPCP® Program’s unique features and knowledge offerings in this program overview with Professor of Practice Jeffrey Levine, CFP®, CPA/PFS, ChFC®, RICP®, CWS, AIF, BFA™.

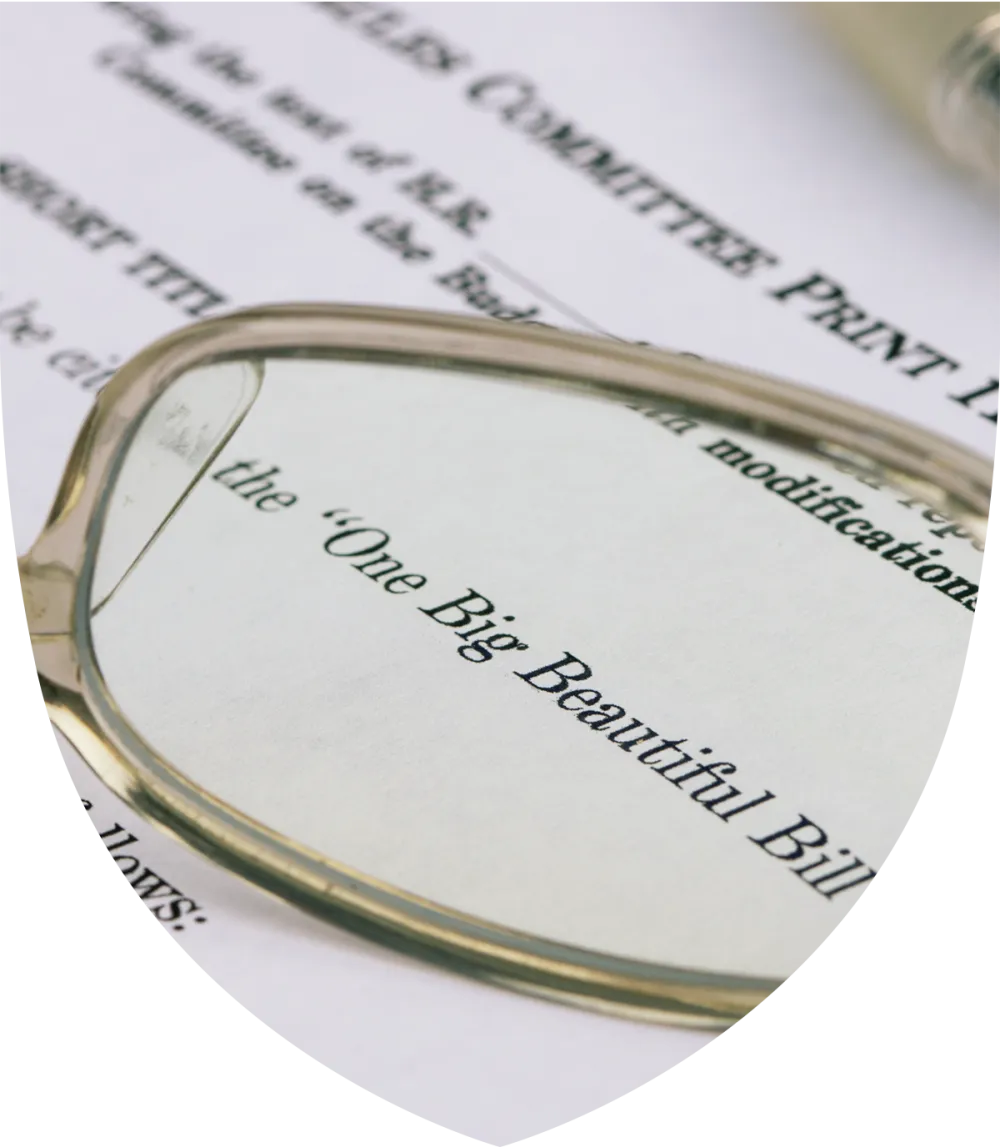

Get the Latest Tax Planning Updates

Inside New Signature Tax Legislation

Major changes brought on by the One Big, Beautiful Bill Act are prompting advisors to create proactive strategies around tax planning, estate planning, investing, and more. See what’s inside this landmark law.

TPCP® Program Overview

Admissions Requirements

There are no prerequisite courses required to begin the TPCP® Program (other than a high school diploma or equivalent). You can participate in the program and complete the required courses at any time in your career, but at least three years of experience in the financial services industry is required to use this tax planning certification program. We recommend that students take a basic income tax planning course, such as HS 321 Fundamentals of Income Taxation or MSFP 554 Income Taxation, prior to enrollment.

To meet the program’s requirements and receive the TPCP® designation, you must:

- Successfully complete the three required courses on tax strategy

- Achieve a 70% or higher final grade on each course (unit quizzes will account for 20% of final grade, while the final exam will account for 80%)

- Have at least three years of experience in financial planning

- Agree to comply with The American College Code of Ethics and Procedures

What You'll Learn

The all-online TPCP® Program equips learners with the skills to identify, evaluate, and implement comprehensive tax strategies for individuals and businesses owners across their lifespan, focusing on maximizing tax benefits while ensuring compliance with current legislation.

Your learning outcomes of gaining specialized knowledge include:

- The ability to navigate complex tax situations, employing tailored tax-informed strategies for estate planning, retirement planning and savings distribution, and investment management to achieve optimized, goal-oriented tax planning solutions

- Familiarity with unique situations, such as: divorce, planning for individuals with special needs, and incorporating philanthropic intentions into estate planning for optimized tax advantages

- Foundational knowledge on key tax implications of various investment vehicles, such as Health Savings Accounts (HSAs) and 529 plans

- Understanding of retirement and investment strategies, including Roth conversions, IRC Section 1031 exchanges, and strategies for minimizing state and federal taxes for high-net-worth individuals and business owners

Course Delivery

Complete our three predominantly video-based tax planning courses online at your own pace and receive support from the nation’s preeminent academics and thought leaders as well as our academic advising team.

Our program features:

- All-Online Resources: All-virtual lessons organized in sequential units and supported by short videos, knowledge checks, quizzes, and case studies.

- Testing: There is no high-stakes cumulative exam in the TPCP® Program; each course features its own quizzes, knowledge checks, and a final course exam.

- Expert Instruction: Get the latest insights delivered by preeminent thought leaders and researchers — including virtual office hours with tax planning expert and professor of practice Jeffrey Levine, CFP®, CPA/PFS, ChFC®, RICP®, CWS, AIF, BFA™!

- Flexible E-learning: So you can complete coursework on your schedule.

Tuition Overview

Courses to Complete

Three

Typical Completion Time

<5 Months

Single Courses

Just $995 per course

Single courses in the TPCP® Program are only $995 each. To complete the full program, complete the three required courses below:

- TPCP 101 Tax Planning During the Accumulation Phase — Provides a foundation to support the first stage of the client lifecycle to help improve the likelihood that investment growth will outpace tax liability.

- TPCP 102 Tax Planning During Retirement — Focuses on withdrawal strategies and other considerations for the decumulation stage of the client lifecycle after they start taking income from their investments.

- TPCP 103 Tax Planning for End of Life and Special Situations — Covers ways to minimize client tax liability in various scenarios that may occur at any time and have significant tax implications.

Three-Course Package

$2,695

Bundle together the full TPCP® Program containing all three required courses for only $2,695 (a $290 savings from individual course purchases!).

- TPCP 101 Tax Planning During the Accumulation Phase — Provides a foundation to support the first stage of the client lifecycle to help improve the likelihood that investment growth will outpace tax liability.

- TPCP 102 Tax Planning During Retirement — Focuses on withdrawal strategies and other considerations for the decumulation stage of the client lifecycle after they start taking income from their investments.

- TPCP 103 Tax Planning for End of Life and Special Situations — Covers ways to minimize client tax liability in various scenarios that may occur at any time and have significant tax implications.

Enroll Now If:

What Your Peers Say

80%

Of investors believe their advisors should be focused on minimizing their tax obligations.1

70%

Of consumers with at least $250,000 in investable assets want help with tax and retirement planning.2

50%

Of independent advisors say advanced tax planning is a significant knowledge gap for them.3

See Where We Stand

As the first and only tax planning designation, see why the TPCP™ Program is an unparalleled advanced planning designation.

Scroll left to right to compare

| See Where We Stand As the first and only tax planning designation, see why the TPCP™ Program is an unparalleled advanced planning designation. | The American College of Financial ServicesTPCP™ Tax Planning Certified Professional™ | The American College of Financial ServicesCFP® Certification Education Program/Chartered Financial Consultant® (ChFC®) | The American Institute of Certified Public Accountants (AICPA)Certified Public Accountant (CPA) |

|---|---|---|---|

| CURRICULUM 100% FOCUSED ON TAX PLANNING | |||

| ONLY THREE COURSES TO COMPLETE | |||

| FINISH IN <12 MONTHS |

Learn From the Leaders in Tax Planning

TPCP® Program FAQs

The Tax Planning Certified Professional® (TPCP®) is a specialized designation credential offered by The American College of Financial Services that provides financial professionals with comprehensive tax planning training. Unlike the tax planning role of a CPA or attorney, whose income tax planning advice focuses on individual items and current expenses, our tax planning courses focus on giving professionals insights into tax-informed planning over a long-term time horizon; in other words, becoming a tax planning specialist who considers the bigger picture and how clients’ decisions now and in the future can lead to minimizing their tax burdens and maximizing their income.

To earn this tax planning certification, you must complete the three-course program including all associated classwork and a final exam for each course. You can take our tax planning courses online, with subject matter including tax implications of investment vehicles, retirement planning and savings distribution, and minimizing state and federal taxes for individuals and business owners.

The course delivery method is an on-demand, self-study, e-learning format. Finding time to meet in a mandatory live classroom setting can be difficult for working professionals, so this interactive, self-paced delivery method allows greater flexibility. Students can complete courses when the time is convenient for them and earn the designation in five months or less!

From the time they enroll, students will have up to three months to work through each course’s material, which consists of videos and text lessons, knowledge checks, case studies with application questions, and unit quizzes. A student can expect to have about 25-35 hours of coursework per course. Once students complete the course, they will have another month to take their final course exam.

While some designation and certification programs may cover tax impacts on financial planning, the Tax Planning Certified Professional® (TPCP®) designation is the only tax planning certification program that covers the lifetime implications of tax-informed planning on clients and offers in-depth knowledge from top thought leaders in the field on advanced tax planning. You can earn the TPCP® designation in 12 months or less through The American College of Financial Services’ e-learning experience and become a tax planning specialist.

The business case for tax planning training is strong: studies have shown 80% of investors believe their advisor should be focused on minimizing their tax obligations, and 70% of consumers with at least $250,000 in investable assets want help with tax planning. Our tax planning program was created to meet this growing need: our 2024 Advisory Services Survey found 50% of independent advisors identified advanced tax planning as a significant knowledge gap. Additionally, many of the usual elements of financial planning inherently involve some degree of tax planning knowledge; tax planning training, therefore, is important to becoming a better-informed professional and improving client satisfaction.

The TPCP® Program is focused on tax strategies rather than on technical explanations of the law and offers more applied comprehensive, lifecycle, tax planning knowledge rather than a hybrid of foundational tax knowledge and application. The TPCP® Program builds on tax knowledge because it is focused on strategies to improve an advisor's ability to provide tax-informed financial planning. For example, TPCP 101 goes deeper and expands further than HS 321 (Fundamentals of Income Taxation) on income taxation topics. TPCP 102 and 103 goes into retirement distribution taxation strategies and estate planning strategies that go well beyond typical retirement and estate planning courses.

The Tax Planning Certified Professional® (TPCP®) designation is a comprehensive tax planning designation that differs greatly from an Enrolled Agent (EA) or Certified Public Accountant (CPA). EAs and CPAs are focused on tax compliance and tax reporting, not tax planning, whereas the TPCP™ is exclusively focused on comprehensive tax-informed planning. EA status, which is a credential awarded by the IRS, is an intermediate level certification when compared to the TPCP™ designation and CPA.

Yes! If you are recertifying designations earned through The College, the new TPCP® Program courses can be used toward your CE requirement. Each course will earn you 30 PRP credits.

Yes! TPCP 101 provides 13 CFP® CE credits. TPCP 102 provides 12 CFP® CE credits. TPCP 103 provides 12.5 CFP® CE credits.

Final exams will be taken through Pearson Vue testing centers. You will visit the Pearson VUE website to schedule your exam and will be able to choose whether you’d like to take the exam at one of many in-person testing centers or remotely via Pearson VUE’s online testing system. Click here for more information on scheduling and taking your exam.

1 Herbers and Company Service Market Growth Study. 2023.

2 RIA Growth and Specialized Knowledge Survey. The American College of Financial Services. 2022.

3 Orion Study. 2021.