About The College Diversity, Equity & Inclusion Financial Planning Retirement Planning Podcasts

What’s Next in Lifelong Learning

In this episode of our Shares podcast, Chief Marketing and Strategy Officer Jared Trexler and College President and CEO George Nichols III, CAP® sit down for a wide-ranging discussion on The College’s major accomplishments in 2024, how the financial services industry and higher education are changing, and how The College is moving to meet the moment in 2025 and beyond.

George Nichols III, CAP® currently serves as the 10th president and CEO in the storied history of The American College of Financial Services. Nichols joined The College after a 17-year stint at New York Life, where he held principal roles in sales, P&L, strategic initiatives, and public policy. In 2007, Nichols was named to the company's executive management committee. He also served as executive vice president in the Office of Governmental Affairs. Before joining New York Life, Nichols was the state of Kentucky's first Black insurance commissioner, leading regulation of the state's $10 billion insurance industry through his expertise in health insurance reform and financial services integration. He gained this knowledge through stints as the executive director of the Kentucky Health Policy Board, vice president of marketing for Athena of North America, executive director of product development with Blue Cross Blue Shield of Kentucky, CEO of Central State Hospital in Louisville, and executive assistant to the Commissioner of the Kentucky Department for Mental Health Services.

Nichols has been acclaimed for his efforts to drive transformative change in diversity, equity, and inclusion in the financial services profession and elsewhere. Savoy, a leading Black business and lifestyle magazine, named him among the "Most Influential Black Corporate Executives" twice: in 2012 and 2018; and among the “Most Influential Black Corporate Directors” in 2021. He was named to Forbes' inaugural 2021 edition of "The Culture 50 Champions." Nichols was also honored as one of "The Ten to Watch in 2021" by WealthManagement.com, and in 2022, he won a ThinkAdvisor LUMINARIES award for Executive Leadership, followed by InvestmentNews’ recognition in 2023 for the year’s See It, Be It role model. Additionally, Nichols is the inaugural recipient of the Alonzo Herndon Award by Business Insurance Magazine.

Any views or opinions expressed in this podcast are the hosts’ and guests' own and do not necessarily represent those of The American College of Financial Services.

More From The College

- See More Content from Our President

- View Our Strategic Priorities

- Enroll in Our Tax Planning Certified Professional™ (TPCP™) Program

Financial Planning Retirement Planning Insights

Ambassadors Talk Tax Planning at FinServe Summit

Duffy, an associate professor of business planning who also serves as director for the TPCP™ Program, joined FinServe Network ambassadors Terry Parham, Jr., CFP®, ChFC®, CLU®, RICP®, WMCP®, MSFP, Angie Ribuffo, CFP®, RICP®, ChFC®, CDFA®, CLTC®, WMCP® and Drew Gerling, MSFS, CFP®, ChFC®, CLU®, CAP®, FIC, RICP® for the conversation on tax planning. Duffy began by highlighting findings from The College’s 2024 Advisory Services Survey, which stated that out of nearly 400 professionals surveyed, over half used tax planning strategies in their work with clients.

When asked, the ambassadors enthusiastically backed up the results of the survey, testifying they also found themselves using elements of tax planning in their day to day in different capacities.

“Almost any person can benefit from lowering their tax bill, and if you’re not doing tax planning, you’re most likely leaving money on the table,” Parham said. “Clients I talk with every day are usually interested in understanding taxes, but the tax code is so long and complex it’s often daunting for them.”

Gerling agreed with Parham’s assessment. “Tax planning is the one thing all clients seem to share. It’s critical to have that skill set because it’s the foundational element entire plans are built upon,” he said.

Tax Planning Conversations With Clients

Duffy continued by asking the panelists how they bring tax planning into their advisory discussions. The ambassadors agreed that advisors who want to provide tax planning to clients need to look “beyond the hood of the car” and make plans for years down the road, rather than simply addressing the here and now as a CPA or other tax preparer might.

“Clients often feel taxes are an immovable object,” Gerling said. “They’re set in stone and you can’t do anything to change them. This is a misunderstanding we need to break them of by being very direct and modeling the changes that can come with proper tax planning.”

This, as Duffy noted, is what gets many financial professionals hung up: the difference between “tax planning” and “tax advice,” the latter of which is frowned upon by compliance departments and legal regulations. The TPCP™ Program also accents this difference by providing comprehensive, tax-informed planning knowledge to advisors.

“I tell my clients my job is to look into the future; your tax preparer is looking at the now,” Ribuffo said. “Together, we will give you a comprehensive picture, but I’ll be the one looking at year-over-year data and extrapolating information.”

Tax Planning Beyond Individuals

As Duffy and the panel noted, tax planning as part of financial planning goes beyond just individuals and families; it can also play an important role in retirement planning, business planning, and other areas.

“There’s a common misconception you’ll be in a lower tax bracket during retirement because you’re not earning money anymore, but actually the opposite can sometimes be true,” Gerling said. “Clients need to understand the impacts that required minimum distributions (RMDs) and the taxes involved in Social Security, Medicare, and other areas can have on their savings and generational wealth.”

The panel also accented how crucial tax planning is to a sound retirement plan, as well as building or exiting a business through matters such as employment payroll, employee benefits, and business structures.

“There’s a long runway of life after retirement, and we need to help clients land as gently and safely as we can,” Ribuffo said. “You can accumulate as much wealth as you want before you retire, but the one thing that can derail all your hard work if you’re not careful is taxes.”

More From The College

- Meet Our FinServe Network

- Enroll in Our Tax Planning Certified Professional™ (TPCP™) Program

- Learn About Our Retirement Income Certified Professional® (RICP®) Designation

- Watch the Webinar on How to Integrate Tax Planning Into Your Practice

Ethics In Financial Services Retirement Planning Insights

Can You Reduce Systematic Risk in Your Client’s Portfolio?

Index funds have become a dominant feature of investment portfolios. This year, investments in index, or “passive” funds surpassed active investment strategies for the first time in history (Morningstar, 2024). Moreover, individuals in the U.S. are now more invested in the markets than ever before, according to 2023 data from the Federal Reserve. While these investing shifts have brought numerous benefits, there may also be unintended consequences, including vulnerability to the effect of unethical business practices on retirement portfolios. Systems-level asset management is one way to safeguard portfolios against systematic risk.

Index Investing Takes Center Stage

An index fund is one that tracks the performance of a financial index, such as the S&P 500, by investing in all the stocks or bonds of that index. These funds were initially created in the ‘70s to make it easier for investors to diversify their portfolios, thereby reducing their risk exposure. Over half a century later, ease of access has led to a preference for index strategies, surpassing fifty percent of the market share of all funds in 2024. Moreover, the trend is buoyed by widespread retail investing in financial markets, including through indirect investments in 401(k) retirement accounts (WSJ Article, December 2023).

While an active management strategy attempts to beat the total market returns through trading securities to outperform benchmarks, the goal of an index strategy (sometimes called passive investing) is to match the return of “the market,” as defined by the selected index (e.g., FTSE, S&P, Dow, etc.).

The benefits of index funds include expanded access to capital markets for those who may not have the expertise, or time, to manage an actively traded portfolio. Additionally, index investing not only allows ease of access to portfolio diversification, but also appeals to those who believe an investor can’t reliably “beat the market” through single stock ownership. And finally, index funds can be more cost-effective than actively managed funds because managers tend to charge lower fees when tracking an index, thus putting more money back into investors’ pockets.

Systematic Risks Remain, Despite Widespread Diversification

Despite the widespread popularity of diversification through index funds, investors remain vulnerable to systematic risk. When investors diversify through index strategies, they seek protection against volatility in their portfolio because of idiosyncratic risks that arise when putting all your eggs in one basket. For instance, if an investor is overweighted in healthcare stocks, the financial loss resulting from policy change that impacts healthcare would be greater. By diversifying, investors put their eggs in multiple baskets for protection against these specific risks unique to individual sectors or stocks.

Even with diversification, however, portfolios remain vulnerable to systematic risks, such as inflation, war, recessions, and other geopolitical or macroeconomic trends. These are risks that impact the entire market. While diversification protects against idiosyncratic risks, its widespread adoption by investors hasn’t improved exposure to systematic threats. As investors have embraced diversification, what determines their portfolios’ long-term value will be the economy’s intrinsic value, not the relative value of each company in the portfolio. (The Shareholder Commons, 2022). Furthermore, because more individuals are invested in financial markets today than at any time in history, systematic threats could lead to broader financial challenges.

Yet, as Jon Lukomnik and James Hawley argue (2019), the structure of the asset management industry—including the proliferation of undifferentiated products and complex fee structures—combined with the pervasiveness of index investing, has led to portfolios that overlook systematic risks. This makes investors vulnerable to long-term economic threats such as geopolitical issues and climate change (Lukomnik & Hawley, 2019). This threat is particularly pernicious when planning for retirement, which is necessarily long-term.

Glossary of Terms |

|

|---|---|

Idiosyncratic or Specific Risk |

These risks are at the level of a company/enterprise, or an industry. They arise because of management decisions, legal or compliance matters, or technological changes that affect a particular sector of the economy. |

Systematic Risk |

In finance, systematic risk refers to non-diversifiable risks to investments. Such risks are non-diversifiable because they impact the entire market. These risks include pandemics, geopolitical crises, inflation, climate change, and other events that originate from the same source and affect a broad number of securities. Beta, which is a mathematical measure of market volatility, also measures systematic risk. |

Index, or “Passive,” Investing |

An index fund is one that tracks the performance of a financial index, such as the S&P 500, by investing in all the stocks or bonds of that index, or by using other investing techniques to try to replicate the risk and return of the index, or benchmark. This approach to investing, sometimes also called “passive” investing, aims to replicate notable aspects of “the market,” as defined by the selected index (e.g., FTSE, S&P, Dow, etc.). |

Active Investing |

An active investment management strategy attempts to beat the total market returns through trading securities to outperform benchmarks set by financial indices. |

A Systems Lens on Investing Can Address Unethical Business Practices

In recent years, there has been an increasing negative impact of commercial activity on society, also known as externalities. There are numerous statistics to demonstrate this point; one stark example is that by 2050, the continued expansion of global commercial activity is likely to deplete access to critical freshwater resources by one half of the Earth’s total capacity (Albert, et. al., 2021).

Systems investors analyze financial markets by taking into consideration the effect of corporate externalities on the financial, social, and environmental systems on which our capital markets rely. Neglecting externalities can exacerbate risks to these systems. Viewed through a systems lens, this type of market analysis recognizes that the externalities of one business impact the potential success of the entire market through negative feedback loops, thus affecting an entire portfolio. A diversified investor recognizes that externalities produced by one company creates costs borne by other companies in their portfolio. Diversified index investors often own the entire market, and therefore will be financially impacted by these externalities.

We have seen these consequences in the global financial crisis of 2008 to 2009, ultimately resulting in overall financial market instability. As these risks created by companies externalizing costs materialize, asset values may sharply decline, leading to broader market disruptions and increased financial volatility.

This may sound like environmental, social, and governance (ESG) investing or responsible investing, but it’s different. While ESG investors create portfolios that integrate environmental and social considerations with financial returns, systems-level investors seek paradigm shifts on issues that can bring about widespread change to benefit the entire market. (Flamer, 2024). On one hand, a responsible investor might, for instance, exclude companies from a portfolio because of personal values (e.g., gun manufacturers) or select ESG funds that generate social and environmental rewards (e.g., green energy). System-level investing, on the other hand, attempts to affect overall market returns through opportunities to influence enterprise risk and return, with an eye towards the long-term resilience of capital markets (Burckart & Lyndenberg, 2021).

The example above about depleting freshwater resources can demonstrate this distinction. Traditional financial analysis deems environment-related costs like clean-up initiatives as expenses to be minimized. For instance, a shareholder in any one beverage company has an incentive for that company to spend just enough on clean water initiatives to ensure that company’s access to clean water, even if those expenditures create externalities that negatively impact others (e.g., by dumping toxins into a different water basin).

A systems-level approach identifies industries in which water use is most intensive (e.g., chemical manufacturing, agriculture, beverages), conducts a portfolio-level analysis of their water footprint to analyze the relevant feedback loops. Then, the analysis identifies the weakest performers within them for engagement. Because such an investor has portfolio exposure to numerous companies that need fresh water, they will support water management practices that do not deplete access to water for other businesses.

In this way, the feedback loops of the ecological systems are integrated into financial market analysis.

Strategies for Investors

Putting these considerations into practice requires strategic effort by asset managers and owners. The dearth of analysis about systematic phenomena could be a blind spot in long-term investing.

To improve the resiliency of the financial markets, asset managers need skills in both searching for new investment opportunities and stewarding existing assets in index funds, contends economist John Kay (2015). His critique of the industry is that “chasing alpha” through fee-generating buy/sell trades to try to anticipate market expectations is shortsighted because it overlooks opportunities to meaningfully assess drivers of asset value (Kay, 2015). Trading might benefit enterprise-level risk/return, but doesn’t address market-level systematic risks. Investment stewardship activities can be used to shift the perspective of corporate managers toward the portfolio-level interests of diversified shareholders.

One prominent approach is beta stewardship, which is investment stewardship that prioritizes reduction of corporate externalities. While stewardship through ESG integration seeks opportunities for a double bottom line (do well financially by doing good for the planet), beta stewardship recognizes that such an approach is not enough, because systematic risks affect the overall market, not just one company. Thus, even if some companies in a portfolio benefit from issuing green bonds or buying carbon offsets for sustainability projects, discrete efforts will not be enough to solve the impending environmental challenges that all businesses confront.

Beta stewardship involves analysis of the feedback loops in economic systems, and advocates that companies manage business consistent with systems-level effects. A recognized example of beta stewardship is Climate Action 100+, an investor-led initiative targeting the world’s largest corporate greenhouse gas emitters to take steps to avoid externalities that affect economic growth, food production, infrastructure, and water supplies.

Another organization that provides systems-level analysis is The Shareholder Commons. Among their proposed beta stewardship practices is the concept of guardrails, which are measurable and universalizable parameters for corporate activities that cause externalities borne by the overall market. One example of a guardrail is reducing corporate overuse and misuse of antibiotics/antimicrobials in animal agriculture and human health care and hygiene products (The Shareholder Commons, 2022). Antimicrobial resistance is a threat to human health; this occurs when microbes transform over time, no longer responding to disease treatment through antibiotics. Current health care and business practices accelerate this trend. Each single company has an incentive to continue antibiotic and antimicrobial use at current levels because it can enhance production processes, even if they contribute to long-term resistance among the entire population. Developing a standard approach and commitment across companies through guardrails aims to move the needle on an intractable systems-level challenge.

Planning for the Future

Some may think strategic efforts toward systems analysis should be limited to pension funds that manage large, defined benefit programs. But the well-documented shift towards defined contribution plans, such as 401(k) retirement plans, means individual retirees are more invested in the market today than any time in history (Blackrock, 2024). I believe a systems-level lens on managing assets is needed to benefit all investors.

All investors have a role to play in planning for the future:

- Asset managers should prioritize systems-level approaches by examining case studies that describe a business case for systems change and integrating these approaches into their stewardship practices.

- Financial advisors should probe managers on their approach to protecting against systematic risk, and how systems investing factors into their analysis.

- Individual investors should select managers and financial professionals that think critically about long-term performance, and the effects of systematic market risks on retirement plans.

We can achieve these objectives by identifying organizations that have published their stewardship codes and engagement practices, as well as those that promote transparency relating to corporate governance priorities.

Additionally, the financial industry should invest in high-quality research that can further demonstrate how ethical business practices contribute to financial resilience. Now that’s a basket we would all be willing to put our eggs in for the long-term.

Footnotes

Burckhart, W. & Lydenberg, S. (2021), 21st Century Investing: Redirecting financial stragies to drive systems change. Berrett-Koehler Publishers

Lukomnik, J. & Hawley, J. P. (2021), Moving Beyond Modern Portfolio Theory. Routledge.

Lukomnik, J. & Hawley, J.P. (2019), The Purpose of Asset Management, Pension Insurance Corporation.

Kay, J.A. (2015). Other People’s Money: the real business of finance. Profile Books.

Albert et. al. (2021). Scientists' warning to humanity on the freshwater biodiversity crisis. Ambio, a journal of environment and society, 50(1): 85 - 94. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7708569/

Flamer, C. (March 14, 2024). ESG vs. Systems-Level Investing. The Institute for Corporate Governance, Kelley School of Business. Retrieved October 28, 2024. https://icgblog.kelley.iu.edu/2024/03/14/esg-vs-system-level-investing-featuring-caroline-flammer/

South Pole Carbon Asset Management Ltd.(2020, June 16). An Investor Guide on Basin Water Security Engagement: Aligning with SDG 6. https://assets.ceres.org/sites/default/files/An%20Investor%20Guide%20on%20Basin%20Water%20Security%20Engagement_%20Aligning%20with%20SDG%206.pdf

The Shareholder Commons (2022, September). Antimicrobial resistance and the Engagement Gap: Why investors must do more than move the needle, and how they can. https://theshareholdercommons.com/wp-content/uploads/2022/09/AMR-Case-Study-FINAL.pdf

The Shareholder Commons (2024). Stewardship Practices. Retrieved October 28, 2024. https://theshareholdercommons.com/system-stewardship/#stewardship-practices

Hannah M. (December 18, 2023). More Americans Than Ever Own Stocks. Wall Street Journal. https://www.wsj.com/finance/stocks/stocks-americans-own-most-ever-9f6fd963

Blackrock, Inc. (2024). Larry Fink’s 2024 Annual Letter to Investors: Time to rethink retirement. https://www.blackrock.com/corporate/investor-relations/larry-fink-annual-chairmans-letter

More from The College

- Get Involved with the American College Cary M. Maguire Center for Ethics in Financial Services

- Read Our Latest Retirement Insights

Financial Planning Retirement Planning Insights

Strategies to Mitigate the 10-Year Rule

Tuesday, October 29, 2024, from 2:00 p.m. - 3:00 p.m. ET

Join Professor of Practice Jeffrey Levine, CFP®, CPA/PFS, ChFC®, RICP®, CWS, AIF, BFA™ to discuss current categories of beneficiaries and the post-death distribution rules that apply to each group, methods beneficiaries can use to minimize taxes on future distributions, how retirement account owners can proactively help reduce the future tax burden on their beneficiaries, and more.

This webcast is only available in Knowledge Hub+. Log into Knowledge Hub+ via your Learning Hub.

What is Knowledge Hub+?

Knowledge Hub+ is a just-in-time learning and CE platform developed by The American College of Financial Services that curates the wisdom of leading academics, change-makers and innovators, financial planning experts, and practice management leaders into one easy-to-use learning experience for financial professionals.

Knowledge Hub+ delivers the added value of automated reporting of CE credit to the CFP Board and The College’s records, making it easier for financial professionals to fulfill their thirty-hour CE requirements every two years without administrative headaches.

With exclusive live events and new content added quarterly, there’s always something new to learn with Knowledge Hub+.

Professional Credentials and Financial Literacy

In their recent paper, “Assessing Retirement Income Literacy of Consumers and Financial Advisors: What Is the Value of Financial Professional Designations?,” Eric Ludwig, PhD, Certified Financial Planner® (CFP®) and Chet Bennetts CFP, Chartered Financial Consultant® (ChFC®), Chartered Life Underwriter® (CLU®), Retirement Income Certified Professional® (RICP®), analyze the results of The College’s recent Retirement Income Literacy Study (RILS) and the impact professional designations have on financial advisors’ retirement income literacy.

Why Does Retirement Income Literacy Matter?

Ludwig and Bennetts begin their argument by explaining the need for retirement income literacy, both among Americans in general and specifically among financial advisors. They point to a shift in responsibilities, as individuals are shouldering a greater burden for planning their retirement than they have in past generations. This trend suggests that individuals who wish to retire comfortably and attain all their financial goals will need either some level of retirement income literacy themselves or advice from someone else with significant retirement income literacy.

As for financial advisors, their field covers a variety of topics. According to Ludwig and Bennetts, “Each of these areas requires specialized knowledge, similar to other professions where expertise is essential to effective practice. However, unlike fields such as medicine or law, where specific credentials are mandatory, the financial planning industry allows for more variability in professional qualifications. This situation raises important questions about the role of voluntary credentials in signaling expertise and their relationship to actual competence in critical areas such as retirement income planning.”

"...unlike fields such as medicine or law, where specific credentials are mandatory, the financial planning industry allows for more variability in professional qualifications. This situation raises important questions about the role of voluntary credentials in signaling expertise and their relationship to actual competence in critical areas such as retirement income planning.”

Ludwig and Bennetts draw upon two theoretical perspectives to formulate a hypothesis regarding the importance of designations among financial advisors. The first is Signaling Theory, which, in the context of financial planning, suggests that advisors can set themselves apart from competitors through professional designations. Ludwig and Bennets state, “designations serve as signals of an advisor's competence and commitment to their field.”

The other theory the duo draws upon is known as the Human Capital Theory. This theory contends, “that individuals can increase their productivity and earnings through investments in education, training, and other forms of knowledge acquisition.” By pairing these two theories together, Ludwig and Bennetts propose that designations not only signal a higher level of competency, they “correlate with actual increases in relevant knowledge and competence.”

Analyzing Trends

To support this assertion, Ludwig and Bennetts turn to the RILS for more information. “[The Retirement Income Literacy Scale] used in this survey consists of 38 questions covering 11 domains of retirement income planning. These domains include life expectancy, Social Security, life insurance, annuities, taxes, inflation, housing, Medicare, long-term care, investments, and retirement plans.”

In analyzing these results, several trends emerge. Consistently, Americans have answered correctly on 31% of responses. However, several demographics tend to affect these scores:

- Men tend to score higher than women

- Individuals with higher net worth tend to score higher than individuals with a lower net worth

- Individuals who work with a financial advisor tend to score higher than those who do not

As Ludwig and Bennetts suggest, “both individual characteristics and professional financial guidance may play a role in retirement income literacy.”

Financial professionals who participated in the study were found to score well. As Ludwig and Bennetts analyze the data, they also point out that, “Those with professional designations scored notably higher (87%) compared to those without designations (78%).” This marked difference between advisors with professional designations and advisors without professional designations indicates a statistically significant positive impact of professional designations, even among individuals who score several times better than the average American.

As they continue their analysis of the findings, Ludwig and Bennetts review the impact of multiple designations on a financial professional’s retirement income literacy. According to their findings, multiple designations do correlate to increased retirement income literacy, dropping off in statistical significance at the fourth designation.

As for specific designations, four emerged as significant predictors of increased RILS scores, including the CFP®, RICP®, ChFC®, and CLU®.

Based on these findings, Ludwig and Bennetts assert that, “Financial advisors with designations … demonstrated substantially higher retirement income literacy compared to those without designations.”

Impact

For financial advisors, these results point towards the importance of pursuing professional designations. These designations not only suggest increased competency to potential clients, they act as real indicators of increased competency.

Advisory firms may also consider taking action on these findings. Without a consistent standard for additional education in the industry, firms that want to establish themselves as credible sources of retirement planning advice could consider supporting advisors in their pursuit of the four designations studied:

- CFP® Certification Education

- Chartered Financial Consultant® (ChFC®)

- Chartered Life Underwriter® (CLU®)

- Retirement Income Certified Professional® (RICP®)

As for clients, Ludwig and Bennetts state, “these findings emphasize the importance of working with designated financial professionals, particularly when seeking retirement planning advice. The higher RILS scores among designated professionals suggest that these advisors are better equipped to navigate the complexities of retirement income planning, potentially leading to more effective strategies and better retirement outcomes for clients.”

Overall, the findings as presented by Ludwig and Bennetts point to the importance of designations for clients, advisors, and firms. They close by stating that, “By investing in relevant designations and continually enhancing their knowledge, financial advisors can better serve their clients and contribute to improved retirement outcomes in an increasingly complex financial landscape.” Ultimately, all parties involved benefit from specialized financial knowledge.

More From The College:

- Learn about the American College Center for Retirement Income.

- Learn about the retirement planning conference, Horizons.

Retirement Planning Wealth Management Podcasts

Money and Meaning in Retirement Planning

In this episode, host Eric Ludwig, PhD, CFP® talks with retirement planning experts Daniel Crosby, PhD, and Jamie Hopkins, Esq., LLM, CFP®, ChFC®, CLU®, RICP® to examine the latest in behavioral finance knowledge and insights present in Crosby’s upcoming book, The Soul of Wealth. They discuss how to ensure your clients’ happiness and wellbeing in retirement, the power of psychology in financial planning, the importance of understanding clients’ money stories, and more.

Jamie Hopkins, Esq., LLM, CFP®, ChFC®, CLU®, RICP® is the chief executive officer of Bryn Mawr Capital Management. He has extensive wealth management experience, bringing innovative thinking, transformative leadership, and a strong reputation for fostering client relationships. He leads and grows Bryn Mawr Capital Management business and helps shape the thought leadership around planning in the profession. A Wall Street Journal bestselling author, educator, and executive speaker, Hopkins serves on numerous advisory boards around the financial services industry and formerly as a national trustee member of NAIFA. He is also the founder and president of the 501(c)(3) non-profit, FinServ Foundation and was named as a top 10 Investopedia 100 Top Financial Advisor for 2023.

Daniel Crosby, PhD is a psychologist and behavioral finance expert who helps organizations understand the intersection of minds and markets. His first book, Personal Benchmark: Integrating Behavioral Finance and Investment Management, was a New York Times bestseller. His second book, The Laws of Wealth, was named the best investment book of 2017 by the Axiom Business Book Awards and has been translated into 10 languages. His latest work, The Behavioral Investor, was Axiom's best investment book of 2019 and is a comprehensive look at the neurology, physiology, and psychology of sound financial decision-making. When he's not decoding market psychology, Crosby is a father of three, a fanatical follower of the St. Louis Cardinals, an explorer of the American South, and an amateur hot sauce chef.

Any views or opinions expressed in this podcast are the hosts’ and guests' own and do not necessarily represent those of The American College of Financial Services.

More From The College:

Diversity, Equity & Inclusion Retirement Planning Insights

FinServe Ambassador Career Changing Drive to Serve

A U.S. Air Force veteran, Ribuffo went into the service directly out of college after getting a degree in nursing. Along with her husband, also a service member, she was stationed at an American base in Germany – where, under the terms of government agreements at the time, she was prevented from working as a nurse and had to find an alternative.

“I ended up working at the family support center on the base, and part of my job was to help military families with personal finances,” she said. “That was where I got my first taste of how I could change people’s lives through financial advising.”

Challenges of Career-Changing

When she and her husband left the military years later, Ribuffo said a financial advisor they had previously worked with noticed her skill and recommended she consider financial services as a new career path. She ended up joining a major firm as a junior advisor. The year, however, was 2008 – not an easy time to be going into the industry.

“The first few years were very difficult for me,” she said. “Not only was it bad luck and timing, but I was the only woman in an all-male office. It was hard for me to do business the way they wanted me to, and a lot of times it didn’t feel right to me.”

Seeking support from fellow women in the business, Ribuffo discovered and joined her local chapter of Women in Insurance and Financial Services (WIFS) in her home state of Alaska – and found an affirming and life-changing community.

“I always hoped there were other women out there, who were going through the same things I was, who I could talk to about things, and who could give me encouragement to do business the way I wanted to,” she said. “At the first meeting I went to, I was self-conscious about my age and told the group I needed some perspective, and they couldn’t have been more welcoming. Because of them, I stayed in the industry.”

“I always hoped there were other women out there…who could give me encouragement to do business the way I wanted to…Because of them, I stayed in the industry.”

Empowerment Through Education

Despite her difficulties with her first firm, Ribuffo said they were open to her pursuing additional education as a financial advisor, and the CFP® certification seemed like a sensible place to start.

“I was encouraged to look around for a good prep course to prepare for my CFP® exam, and The College’s on-demand CFP® Certification Education Program fit my busy schedule well,” she said. “I eventually became part of a cohort group within my company all studying for and sitting for the exam at the same time.”

During the course of those studies, The College launched its Retirement Income Certified Professional® (RICP®) Program, and Ribuffo said she was immediately drawn to its promise of specialized planning knowledge to serve her growing number of retiree and pre-retiree clients.

“I remember talking to a business development professional from The College about the RICP® Program, and while they encouraged me to take the program, they weren’t sure I’d be able to do it and the CFP® Certification Education Program at the same time,” she said. “Well, I just took that as a challenge and did both programs at once – I got my dual certifications within months of each other!”

While she has since gone on to get other College designations including the Wealth Management Certified Professional® (WMCP®) and the Chartered Financial Consultant® (ChFC®), Ribuffo says the RICP® remains her favorite thanks to its in-depth, product-agnostic, and client-focused approach to retirement planning.

“Seeing subject matter experts from across the industry having conversations with each other and debating different strategies was hugely beneficial for me because it gave me permission to think outside the box,” she said. “It showed me there’s no one perfect solution to retirement planning and that it always comes down to what your clients’ goals are and what a successful retirement looks like to them. The knowledge I gained was invaluable, and I know I’ll always rely on The College to tell me what the next big thing in the industry will be.”

“[The RICP®] showed me [retirement planning] always comes down to what your clients’ goals are…The knowledge I gained was invaluable, and I know I’ll always rely on The College to tell me what the next big thing in the industry will be.”

Supporting Communities Through Financial Services

With her background in retirement planning and military service, Ribuffo says many of the clients she currently serves in her independent practice, Raion Financial Strategies, are military members and federal employees looking for help in understanding the complex web of benefits and savings vehicles available to them. Like many other advisors, she notes retirement planning has in recent years become a much more “do-it-yourself” process, with consumers expected to work things out for themselves with 401(k)s and savings accounts, rather than being provided with prescribed options like a pension plan.

“Oftentimes the expansion of options to military members, veterans, and their families for financial planning haven’t been accompanied by more explanation of how to use them,” she said. “Things are changing and improving, but it’s often slow-moving for the people who most need it.”

These are the situations, Ribuffo said, where a knowledgeable financial advisor in tune with the issues facing these communities can make a big difference – something the industry should also keep in mind when recruiting or approaching women.

“Many people will tell you recruitment numbers for women are climbing, and that’s great. But the flip side of that is retention has not improved,” she said. “More women are being drawn into the industry, but aren’t given a compelling reason to stay. They need to be able to see a successful career path for the future, whether it’s advising or not, and have the mentors and advocates we always hear them say they’re looking for. A mentoring program should be table stakes if you’re a financial services company today.”

“More women are being drawn into the industry, but aren’t given a compelling reason to stay. They need to be able to see a successful career path for the future…and have the mentors and advocates we always hear them say they’re looking for.”

While women as CEOs are becoming a somewhat more common sight in the industry, Ribuffo said more women are needed in middle management positions to really improve representation. She also offered advisors and professionals new to the field advice that would be especially useful in approaching female clients.

“Women as clients want to be heard and understand what is going on, and our industry is often full of jargon,” she said. “I remember having to ask my husband to clarify some of the things our advisor talked about before I joined the industry. Building a relationship with your clients, especially women, is key. Women crave more financial literacy and independence, and if you present yourself authentically, it creates trust, which solidifies that relationship. Listen to what brought them in to see you today – and from there, you can move forward.”

More From The College

Retirement Planning On-Demand Webcasts

Timely Topics for Retirement Planners

Listen in as our team of thought leaders discuss important topics such as how to election-proof retirement plans, the Chevron case, new rules for required minimum distributions (RMDs), and more.

Financial Planning Retirement Planning Insights

2024 Advisory Services Survey

The new 2024 Advisory Services Survey explores key similarities and differences in service offerings and client needs among three types of financial professionals: dually registered advisors (Duals), investment advisor representatives (IARs), and those who are either insurance agents (IAs) or registered representatives (RRs). The results reveal opportunities for independent advisors to differentiate their practices, as well as areas in which captive advisors have clear advantages.

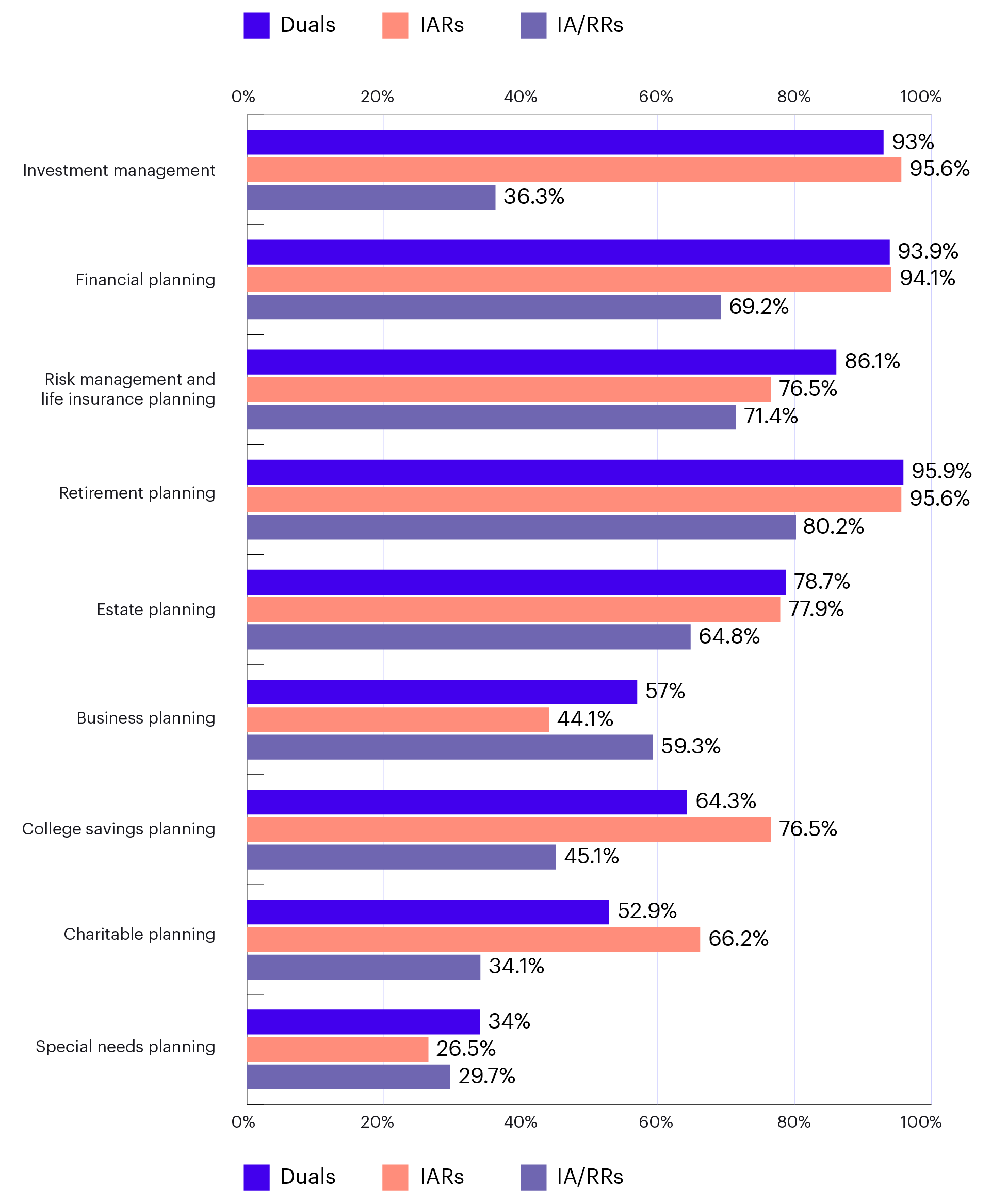

What Services Do Advisors Offer?

The survey began by asking advisors about the services they are currently offering to clients. Across all three advisor types, the data shows independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients, including: charitable planning, college savings planning, estate planning, retirement planning, risk management, financial planning, and investment management.

“Independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients.”

However, IARs are less likely to offer special needs planning and both IARs and Duals fall short in offering business planning services – with only 57% of dually registered advisors and a mere 44% of IARs offering such services.

Services Currently Offered

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

What Strategies Do Advisors Use?

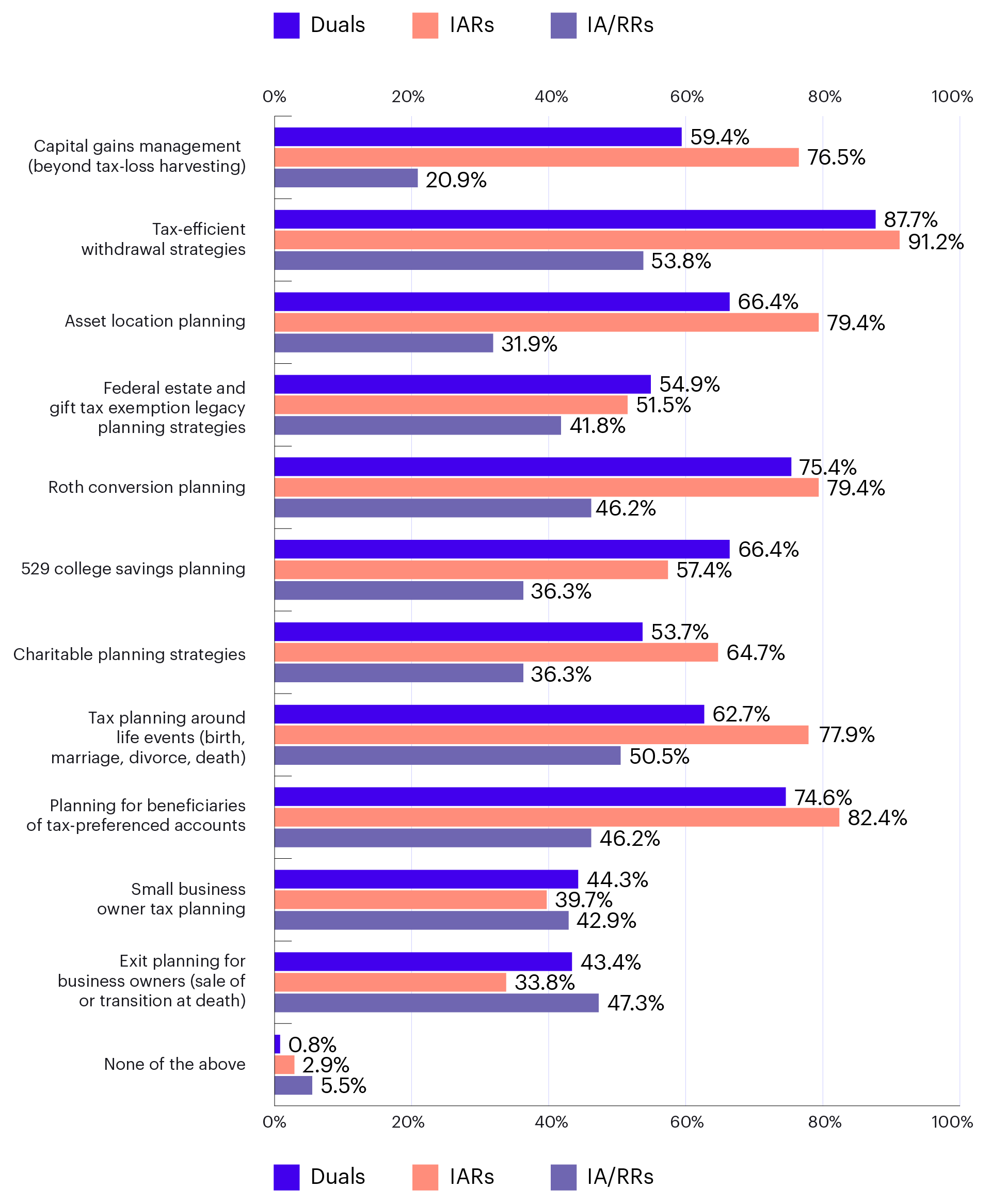

The data further suggests that independent advisors are leading the way in using various strategies – especially tax-informed planning strategies – to deliver the many services they offer clients. Financial professionals who are dually registered or IARs have a competitive advantage in delivering tax-informed planning strategies to differentiate their practices.

In contrast, insurance agents and registered representatives are often required to comply with the restrictions of their home office in regard to tax planning services. However, our research suggests that over half of these insurance agent and registered representative respondents employ tax-efficient withdrawal strategies (54%) and conduct tax planning around life events with their clients (51%).

Strategies Currently Used

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

Unfortunately, with many home offices not offering a comprehensive education on tax planning services, it would seem that the respondents currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.

“[Advisors] currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.”

What Services Are Not Being Offered?

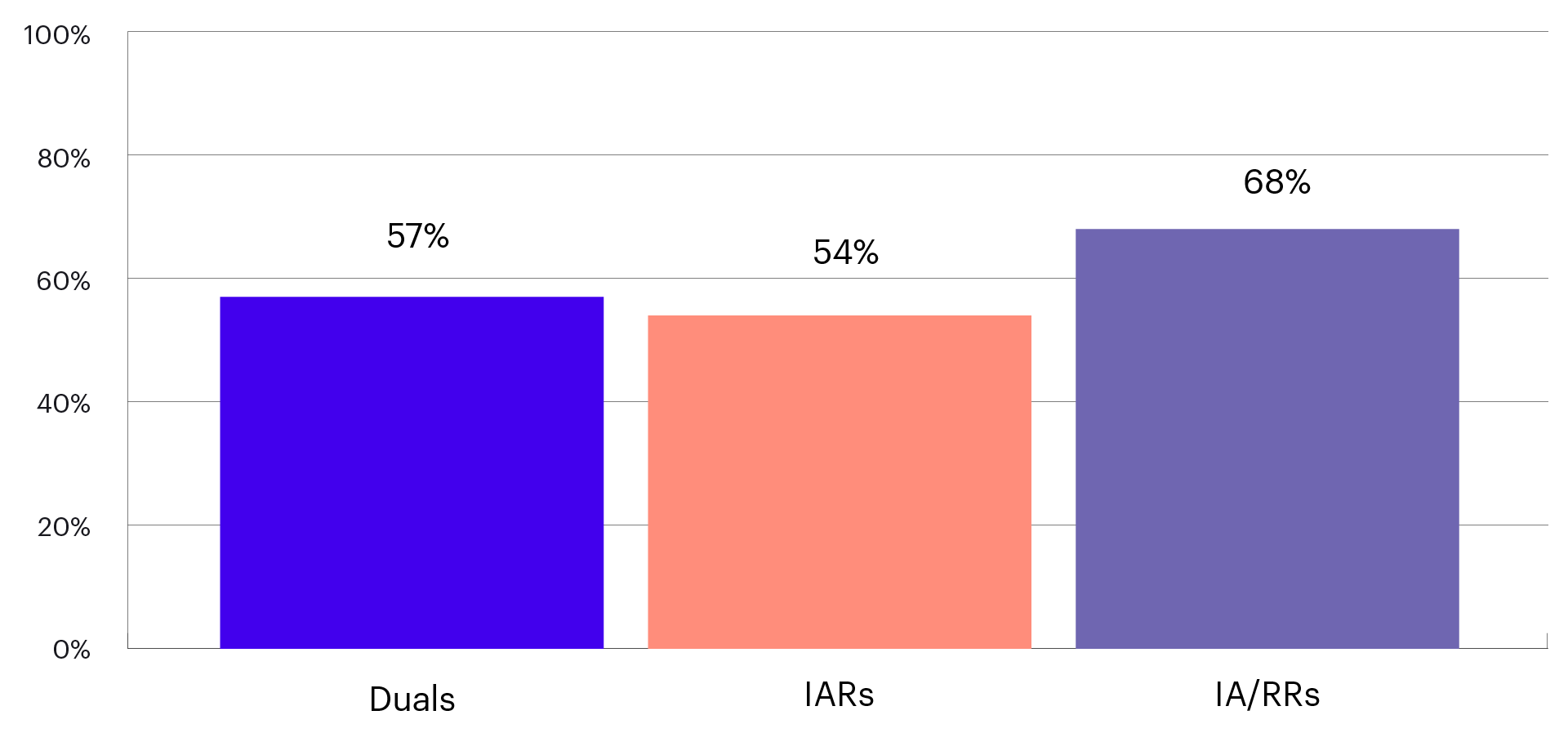

Finally, the survey asked advisors about the services their clients frequently request – to reveal any gaps in their current offerings. When reviewing this data, one significant outlier emerges. More than 68% of insurance agents and registered representatives, 54% of IARs, and 57% of dually registered advisors reported small business owner tax planning as the most frequently requested service among those they are not currently providing.

This represents a sizable unmet need that could prove to be a differentiator for any advisors willing to add these services to their menu. Yet, without comprehensive education on tax planning services or robust tax planning resources, how can we ensure that financial professionals across the financial services ecosystem do tax planning well?

Strategies Not Used But “Always” or “Often” Requested

Small Business Owner Tax Planning:

The American College of Financial Services. Advisory Services Survey. 2024.

Financial Planning Is Tax Planning

When reviewing the results of this survey in totality, an interesting trend emerges. Many advisors partake in some form of tax-informed financial planning. Independent advisors are more likely to say they engage in tax planning than others – but more than half of all types of advisors are currently employing tax-advantaged strategies. However, across all categories, advisors are not meeting the needs of their clients when it comes to small business tax planning, a valuable service that many advisors could benefit from offering to their clients.

Fortunately, financial advisors can address this gap through a new designation at The College. The Tax Planning Certified Professional™ (TPCP™) program is The College’s latest offering to the financial services industry and addresses this need. As advisors look to implement advanced tax strategies in their own practices, the TPCP™ program can help them by equipping participants with the skills to identify and evaluate these strategies for individuals and small businesses with a focus on maximizing tax benefits while ensuring compliance with current legislation.

The program covers a number of different topics including tax planning during the accumulation phase and the less frequently covered topic of tax planning during retirement (or the decumulation phase).

Enrollment for this powerful new designation launches in November and, with advisors already lining up to be among the first to call themselves a Tax Planning Certified Professional™, the time is perfect to seize this opportunity and join them as you look to grow your practice by improving your ability to meet the needs of your clients.

More From The College

Author

Subscribe to Newsletter

Related Posts