Conversation with the President: Looking to the Future of Financial Services

In this installment of “Conversations with the President,” I take a look back at where the profession and The College has been throughout our history and where I see the profession, and The College, going in an ever-changing landscape.

One Year Later: Systematic Inequality Will Turn to Sustainable Change...Step by Step

Some 1,300 miles southwest, Tulsa’s Greenwood District was built "for Black people, by Black people" just after the turn of the 20th century. Black entrepreneurs flocked to Greenwood Avenue, believing there was economic strength in numbers. By pooling resources, "Black Wall Street" flourished, even if its dwellers became increasingly isolated and segregated by a railroad, where standing on the wrong side of the tracks put a successful Black in the crosshairs of Jim Crow oppression.

Unlike Wall Street, where success brought greater access, opportunities, and the early formation of patriarchal dynasties, success on Black Wall Street brought suspicion, jealously, rage, racism, and eventually riots.

While the Greenwood District burned, the Financial District prospered. Fifty years after the Greenwood Massacre, growing up in the segregated South far from lower Manhattan, my eyes saw disparate Americas simply while tagging along as my father drove my mother to work. Now, post-segregation, and a century after Greenwood went up in flames, race still defines the individual perspectives of American exceptionalism.

Last June, following the death of George Floyd on my birthday, I shared my thoughts on America’s relationship with race – a complicated, imperfect journey of divergent interests, bouts of abject failure, but also real progress for some Blacks, who have risen to positions of power and prestige often through the guidance and advocacy of white mentors and sponsors.

Yet, success has still reached too few. Those stories are the exception.

Since then, these injustices have continued against Blacks, Asians, Hispanics, and others based on ethnicity, gender, economic standing, and sexual orientation. Despite weeks-long marches, sermons preaching peace, and corporate America’s resonance to this national issue, cruelty remains in vogue, and wealth disparities remain fixed in a system still benefitting the same glad-handing, access-selling, and multi-generational privilege. Wealth still begets wealth.

Wealth touches so many parts of equality – wages, homeownership, community policing, and access to quality healthcare, as well as long-term financial literacy and planning. It’s a big problem, but as evidenced by the above tale of two cities, it’s not new. Solutions always seem driven by a PR newswire, or a success story to share with shareholders, and they’re typically funded by fleeting capital and organized in silos.

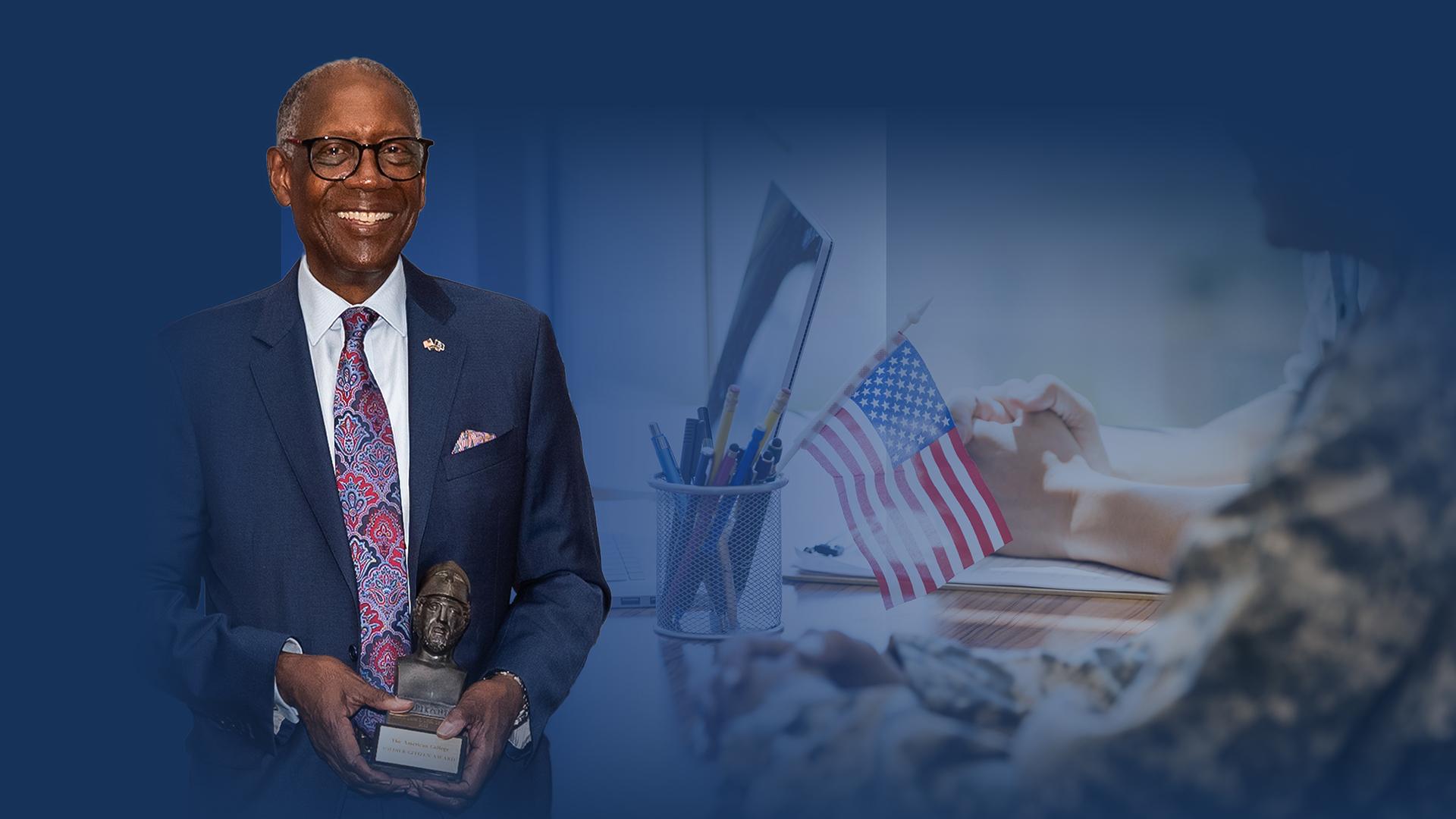

In the months following the national awakening to these issues, I and our team at The American College of Financial Services did a lot of soul searching and a lot of conversing with each other, our colleagues, and our industry peers. We were intentionally deliberate and thoughtful in building a research-driven, applicable, and executable plan to drive sustainable, economic change in underserved and underrepresented communities. I thank our entire College community for their work, support, and encouragement, as well as The College’s Board of Trustees, President’s Roundtable, and President’s Advisory Council, which have not only offered strategic counsel, but have opened their networks to help us engage in productive dialogue across the financial services industry and given of their treasures.

As an accredited, non-profit institution serving an industry responsible for fostering the generational wealth-building of predominantly white families, it’s been fascinating, and heartening, to see the industry’s circuitous, complex reckoning with its role in the wealth gap, but also to hear leading voices share their voyages to effect lasting, economic change for the underserved and to uplift diverse perspectives in this profession.

Many of these leaders believe in our plan – a development that continues to yield reaffirmation and forward momentum just one year after our team’s first internal discussion. In that time, we’ve achieved so much, including:

- The creation of Four Steps Forward, a big, bold plan to promote upward mobility and wealth building, starting first with Black communities across America. It’ll define an approach that we’ll apply to other groups in need.

- The formation of The American College Center for Economic Empowerment and Equality, which is destined to become the flagship center for research, thought leadership, curriculum and course development, programming, and scholarships aimed at closing the wealth gap and cultivating lasting relationships between financial services and all underserved groups.

- The hiring of the Center’s inaugural Executive Director, Karim Hill, who brings decades of financial services and community-corporate partnership experience investing capital to uplift underrepresented and underserved populations.

- The development of a robust, engaging website, www.theamericancollege.edu/equality, to broadly articulate the Center’s path forward and engage partners who will assist us along the way.

- A partnership with The Society for Financial Education and Professional Development to amplify financial education and economic mobility programs with the next generation of Black leaders at Historically Black Colleges and Universities.

- The launch of a research project on trust between Black women and financial services, with a preliminary report expected later this summer.

- The beginning of our work on the curriculum for an executive leadership program. We plan to enroll our first cohort for a Q1 2022 start.

We’re just scratching the surface, but we aren’t in a rush. I’m as eager as anyone to narrow the gap, but I’m more interested in the long-term solutions that close it. Today’s disparities weren’t caused by a few bad apples or propagated by political whims; they’re so deeply embedded in our system, that Band-Aids are no more than concealer.

To follow the clarion call of former Supreme Court Justice Thurgood Marshall, we must express the poised urgency that moves us forward with intention. To actually “do better,” we must embrace that there’s no other choice. That in America, we can’t allow some to traverse sidewalks as an avenue to success, while others of different cultures and creeds lay face down in their footprints.

We can’t be okay with unequal pay for equal work. We can’t shrug our shoulders at the real, lasting effects that wealth disparities have on educational disparities, longevity, generational divides, and public trust. And we can’t expect to fix all of this in a week, month, or year.

Sustainable change takes time. As I wrote last June, "As a nation, we start conversations on race I don’t think we ever intend on finishing. This time must be different."

One year later, I believe it is.

Remembering Our Guardians of America's Majesty

And that is just one cemetery. Dotting countrysides and hugging cityscapes sit the plots of military veterans, bonded by service and unique in their stories. Many were called to service, with high school dropouts linking arms with Rhodes scholars, those with generational linkages to servitude covering for their fellow cadets. Military members are truly all in this together.

We owe these military men and women such thanks and grace; both those who have returned home from war, and those who perished in service to something bigger than themselves. Memorial Day is a calendar reminder that we all need to put the small things in perspective of those who fought the battles for our freedom, safety, and security.

The American College Center for Veterans Affairs aims to do its part through educational support and career opportunities in the financial services industry. Last year, while restricted in our in-person fundraising by the COVID-19 pandemic, 249 donors—including 112 first-time donors—contributed to the Center and helped us award 250 scholarships, which was a 100% increase in scholarships from the previous year! Many of the Center’s donors were inspired by Campaign: Gratitude, a video storytelling series that told the captivating, heroic tales of military heroes who have returned home to earn rewarding careers in financial services, all thanks to the generosity and support of our donors, and the work of our Center and College family.

This year, the 7th annual Clambake and Soldier-Citizen Award returns with a virtual event on September 9, and a Veterans Symposium is being planned for November 10. We thank you in advance for helping transform the lives of our active-duty service members, veterans, and their spouses.

This weekend, as we celebrate America and all its beauty, remember those who stood, and still stand, on the front lines to forever cement the majesty that is America.

Happy Memorial Day.

The 2021 InvestmentNews 40 Under 40: Lindsey Lewis

The annual “40 Under 40” are chosen by a team of reporters and editors from nearly 1,000 online nominations. “The 2021 class of 40 Under 40 honorees stood out in a remarkable year,” said George B. Moriarty, Chief Content Officer of InvestmentNews. “This diverse group represents the great things the financial advice industry will accomplish in the future.” This year, The American College of Financial Services is proud to announce that Lindsey Lewis, Director and Chair of The College’s Center for Women in Financial Services, has been selected as one of the featured professionals!

In her current position, Lindsey oversees most of the Women’s Center’s day-to-day activities, including original research, social media activity, event coordination, podcast production, and more as she works to promote the advancement of women in the financial services profession through research, education, and awareness. Prior to joining The College, Lindsey worked as a CFP® practitioner for Soltis Investment Advisors and Vanguard. In these roles, she served clients as a CFP® professional to facilitate holistic financial planning for individual clients and meet institutional clients’ needs. Lindsey is also an active mentor to women pursuing degrees or careers in financial services, and helps operate Utah Valley University’s Women of the Woodbury Polished mini-conference—an event dedicated to women and girls pursuing careers in financial services.

Congratulations, Lindsey! We’re proud to have you as part of our team.

What Juneteenth Means

Instead of turning this note into a history lesson (here’s a great recitation), let me talk briefly about what the day signifies for us as The American College of Financial Services, and for our nation, moving forward.

First, it is a day to remember. As we frame our work through the Center for Economic Empowerment and Equality, we always reflect on the days of slavery and freedom from that enslavement, but also on the fleeting change in the time since.

Second, it is a day to re-engage. Take some time to listen to public figures and community leaders “…celebrate, educate, and agitate,” in the words of historian Mitch Kachun. Find a personal or professional thread that you can latch onto to help create lasting change in Black communities.

Third, it is a day to re-affirm. The College, through Four Steps Forward, must re-affirm our commitment to the cause. While many have called Juneteenth “America’s second Independence Day,” that independence has not yet equaled justice, opportunity, and equity. That must change, and our work, with partnerships across the financial services industry, will push us closer to those goals.

As Martin Luther King Jr. said, “Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” So, we remember, re-engage, re-affirm, and move forward not with the belief that true equality is preordained, but that it comes through continuous struggle.

A True Celebration

While we haven’t always lived up to those ideals, we’ve never walked away from them. The American College of Financial Services continues to do its part by providing financial knowledge and education to financial and nonprofit leaders, and through our Centers of Excellence, by promoting financial well-being and supporting initiatives that help uplift underrepresented and underserved communities.

As former President Harry S. Truman once said, “America was built on courage, on imagination, and on an unbeatable determination to do the job at hand.”

We, as Americans, have shown our resolve and collective might throughout the COVID-19 pandemic, and we demonstrate that same mettle and might each day to uplift all Americans.

We are a nation of dreamers and pragmatists, imperfect and yet still embarking on the never-ending pursuit of that perfect union.

Enjoy your holiday with freedom, family, and friends.