Planning for a Longer (and More Expensive) Retirement

How long is retirement going to last?

Underestimating life expectancy is a problem for all older Americans, but especially for higher-income Americans, who have made significant gains in longevity after the age of 65. A longer retirement is a more expensive retirement, and financial planners need to understand how long their clients are likely to live and develop strategies for funding longer lifestyles.

Most people have a vague idea of how long they are likely to live in retirement. It’s common to think of the age our parents or grandparents died when estimating our own longevity. In reality, longevity after the age of 65 increased by about a year every decade in the 20th century, and higher-income Americans can expect to spend significantly more years in retirement.

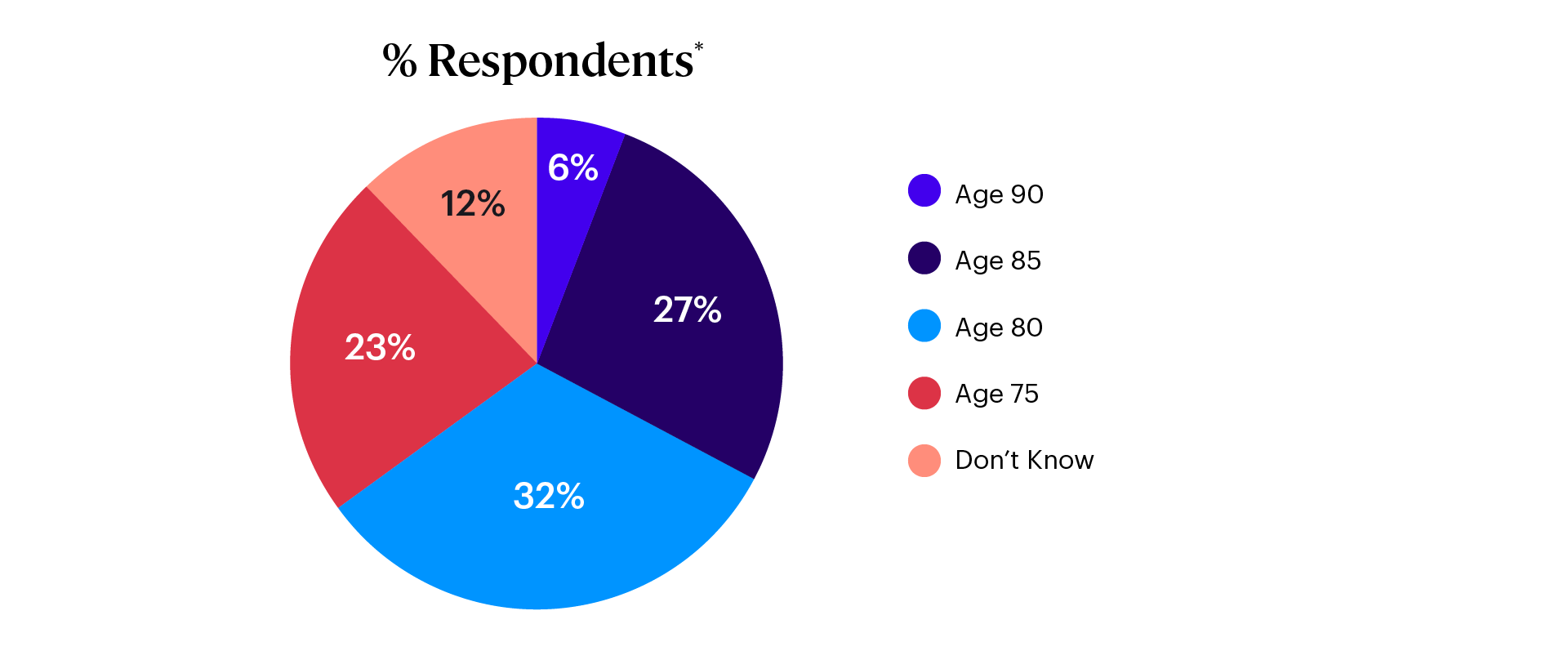

According to the Social Security Administration mortality tables, half of American men who have reached age 65 will live to at least age 85 and half of women will live to at least age 88. Respondents to the 2023 Retirement Income Literacy Study were asked how long an average 65-year-old man could expect to live. Only 27% selected the correct answer (20 years), 32% thought the average man would live to age 80 (15 more years), 23% believed only 10 more years, just 6% thought an average man would live to age 90, and 12% indicated that they didn’t know.

Respondents’ Expected Longevity of a 65-Year-Old Man

Figure 1

Most Respondents* underestimate or don't know the expected longevity of a 65-year-old man, which is about 20 years (age 85).

In other words, 55% of respondents underestimated retirement longevity and an additional 12% didn’t know. Just a third of respondents (33%) had an accurate or optimistic idea of retirement longevity.

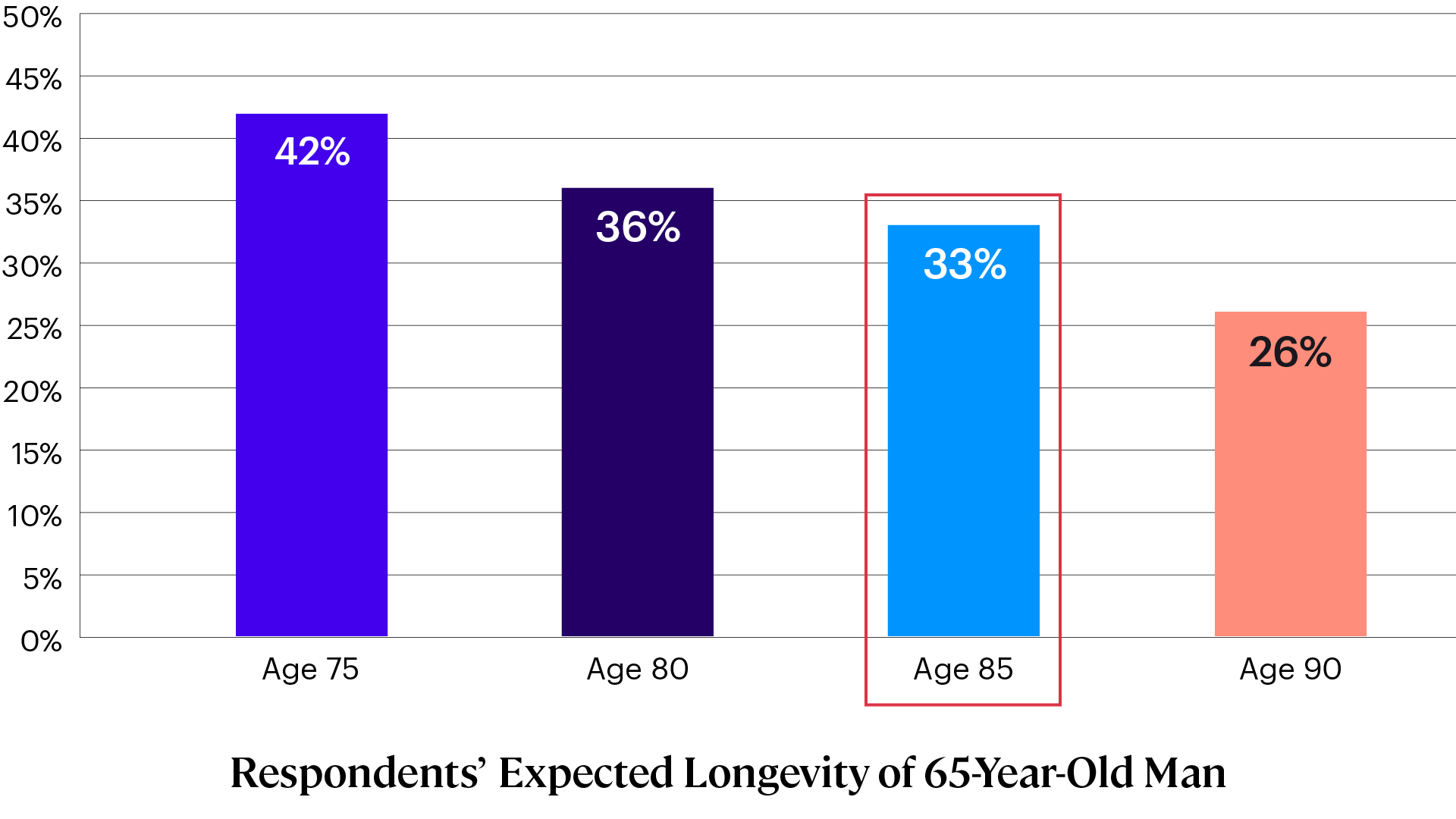

Those who had an unrealistically low expectation of retirement longevity were far more likely to indicate they plan to claim Social Security income benefits before the age of 65. Why is this important? Social Security is the only inflation-adjusted income source most retirees have. Claiming early reduces a retiree’s income for his lifetime and weakens an important source of guaranteed income for workers, many of whom no longer receive employer pensions.

While 42% of those who believed that retirement for a 65-year-old man would only last 10 years expected to claim before age 65, only 33% of those with an accurate estimate of expected longevity planned to claim Social Security early and only 26% of those who overestimated longevity planned to claim before age 65.

Percentage Planning to Claim Social Security Before Age 65 by Longevity Expectations

Figure 2

Respondents* who plan to claim Social Security before age 65 are more likely to underestimate the life expectancy of a 65-year-old man. Those who accurately estimate or overestimate a man’s life expectancy (age 85 or higher) are less likely to plan to take Social Security before age 65.

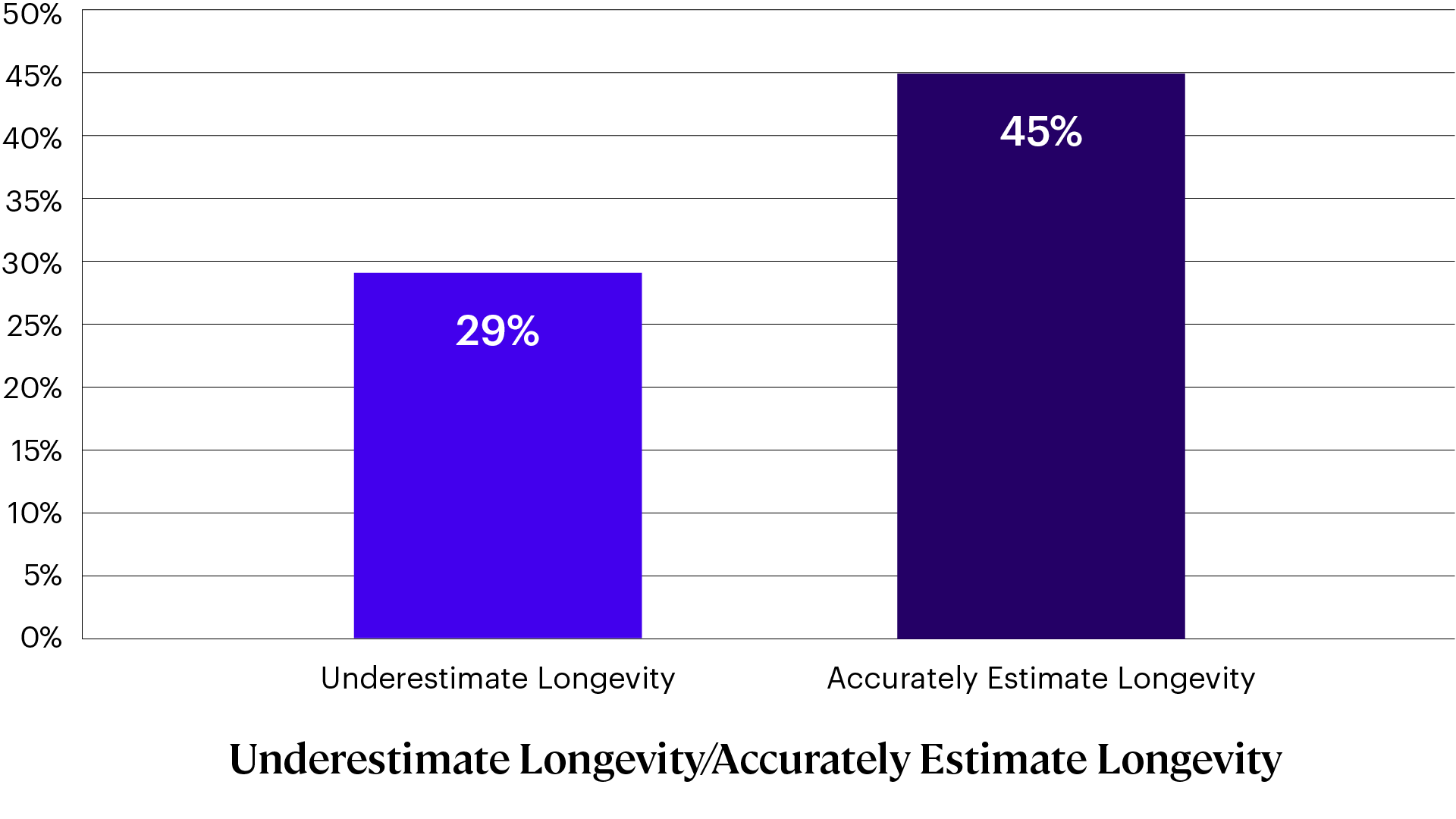

When people are asked “What is the maximum age you would plan for your savings to last in retirement before you run out of money?,” 54% more of those who had an accurate or optimistic idea of expected longevity chose a maximum planning horizon into their 90s compared to those who underestimated longevity.

Percentage Planning for Spending Into Their 90s by Longevity Expectations

Figure 3

Respondents* who plan for their spending to last into their 90s before running out of money are more likely to provide accurate estimates of the life expectancy of a 65-year-old man.

Financial Planning Clients Live Longer

The survey respondents who thought that a 65-year-old man could expect to live 25 years in retirement weren’t wrong for higher-income men. Men and women whose incomes are high enough to work with a financial advisor have made significant gains in retirement longevity in recent decades. Stanford economist Raj Chetty and his co-authors1 found that life expectancy among Americans in the top 5% of income increased 2.34 years for men and 2.91 years for women between 2001 and 2014, compared to just 0.32 years for men and 0.04 years for women in the bottom 5%.

The improvement in longevity among higher-earning Americans is largely due to differences in health-related behaviors. The most notable difference is in rates of smoking, which dropped significantly for higher-income men and women in the United States. Higher-income Americans are also more likely to exercise, eat better diets, and have access to higher-quality healthcare.

Longevity is subject to the laws of statistics. This means that the number of years you’ll spend in retirement looks like a bell curve with a left tail of unlucky retirees and a right tail of those who live into their 90s and beyond. You’re probably going to live longer than your parents. This means that the entire bell curve needs to be pushed a few more years to the right. It also means that today’s healthy retiree will have to fund more years of spending on average, and more than a few will be around into their late 90s and 100s.

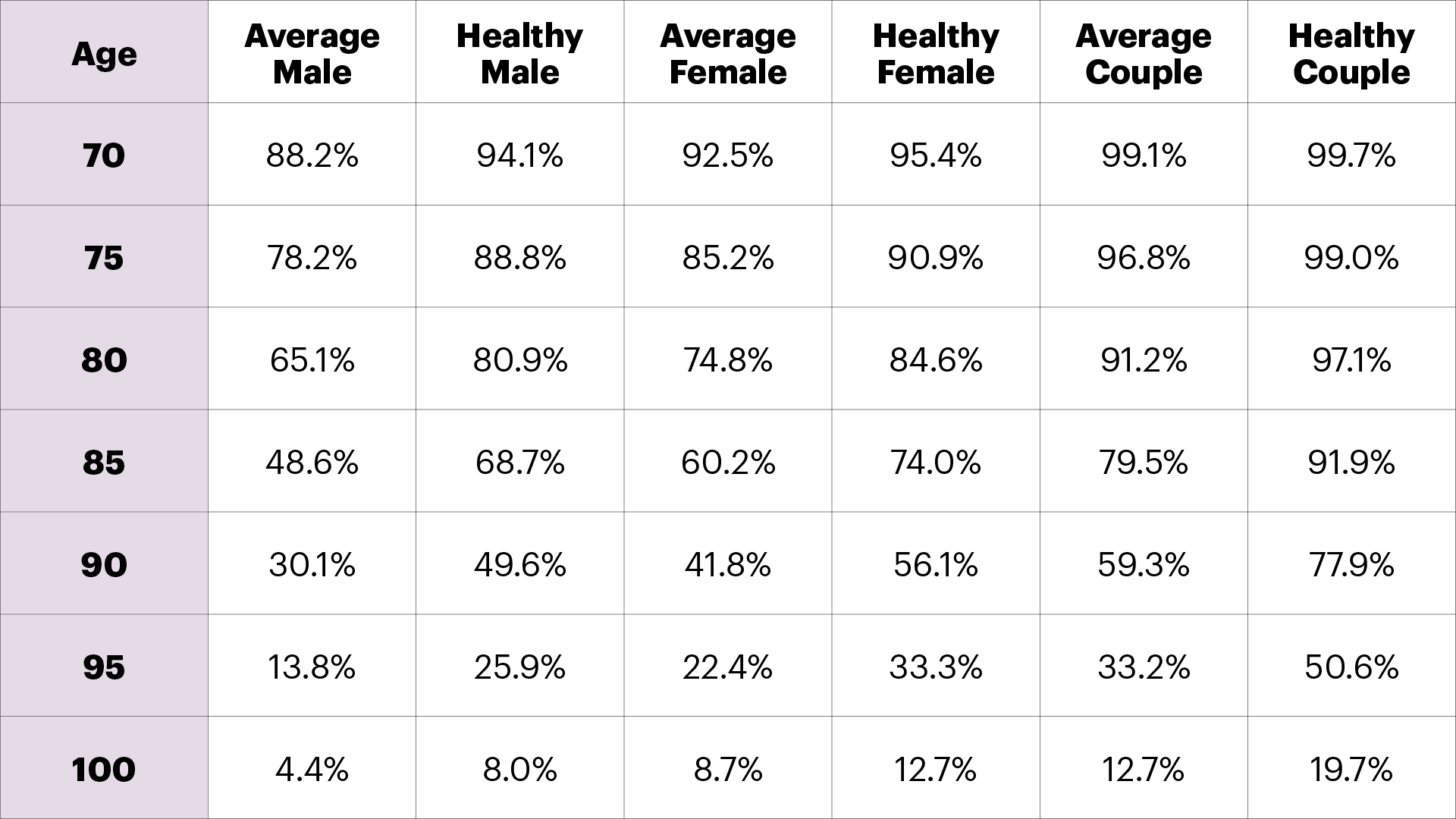

To better understand the difference in the probability of the types of higher-earning individuals (who are more likely to be financial planning clients) being alive at various ages, consider the following table that compares average Americans using the 2017 Social Security Administration mortality table and the 2012 Society of Actuaries annuity mortality table adjusted for expected improvement to the present day. Annuity buyers tend to live longer because they are in the group of higher-income, healthier Americans who have accumulated enough savings to buy a lifetime income.

Probability of Being Alive at Various Ages for 62-Year-Olds

Table 1

Americans who buy annuities tend to live significantly longer than Americans overall. For example, a healthy male is twice as likely (8%) as the average male (4%) to live to age 100.

It’s obvious from Table 1 that healthier, higher-income retirees need to plan for a longer retirement than the average American. A healthy 62-year-old man is 65% more likely to be alive at age 90 than the average American. One-third of healthy 62-year-old women can expect to live to the age of 95, and half of healthy couples will have one spouse who lives longer than 95 years.

The percentages from Table 1 can also be seen as failure rates. If financial advisors create spending plans in which their clients’ money lasts to the age of 90, then half of healthy men, 56% of healthy women, and 78% of healthy couples will outlive their savings.

The traditional failure rate methodology in financial planning considers a withdrawal rate safe if the money lasts to the age of 95. For a healthy couple retiring today, this yardstick can’t be considered safe if half of them will have at least one spouse who lives beyond the age of 95. Even if the money lasts to the age of 100, one in five healthy couples will outlive their savings.

For a healthy couple retiring today, this yardstick [of making money last through age 95] can’t be considered safe if half of them will have at least one spouse who lives beyond the age of 95. Even if the money lasts to the age of 100, one in five healthy couples will outlive their savings.

A Long Life is More Expensive

An easy way to see how much more money a retiree needs to save to fund a longer retirement is to estimate the cost of creating a base of income that lasts to various ages using safe investments. Returns on financial assets are generally variable, but it is possible to buy Treasury bonds that will mature and provide a future income that isn’t subject to investment risk.

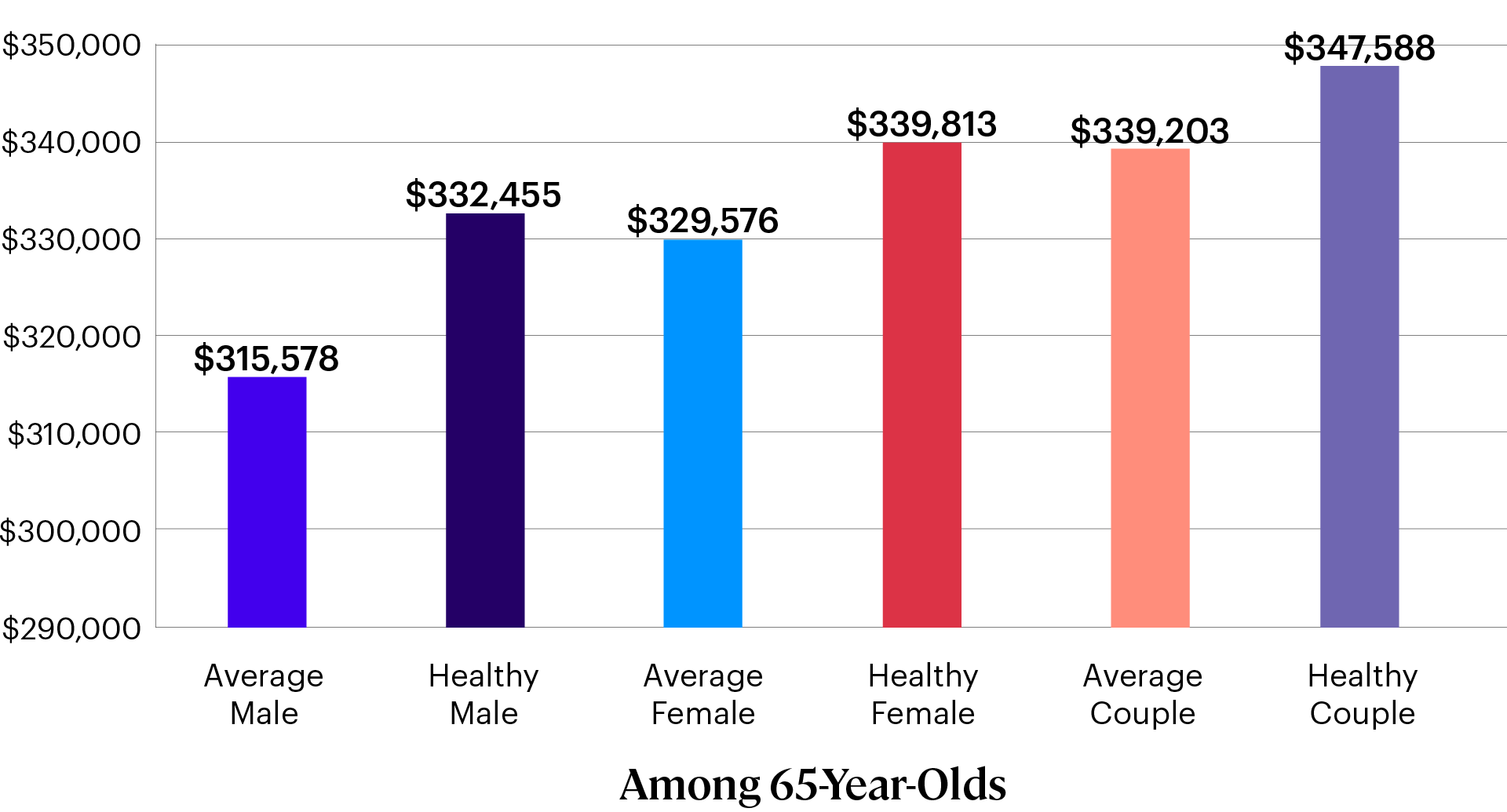

Figure 4 compares the cost of buying a safe income using Treasury bonds to the age at which a healthy man, woman, and couple has a 20% chance of outliving their savings (i.e., 80% probability of success) using yields on April 12, 2024. For example, an average 65-year-old man has a 20% chance of reaching the age of 93 years. The cost of funding $20,000 of income from Treasury bonds at today’s yields will be $315,578. A healthy man has a 20% chance of living to the age of 96 years. It will cost him $332,455 today to buy the same $20,000 of income to an age at which he has a 20% chance of “failure.”

The Cost of Funding $20,000 Treasury Bond Income*

Figure 4

As Figure 4 shows, the cost of income is higher for healthy men, women, and couples who need to plan to fund more years of spending in retirement. This means that healthier and wealthier individuals will have to save more to fund the same lifestyle with an 80% probability of success.

Healthy Americans will have to save more to fund more years of spending in retirement.

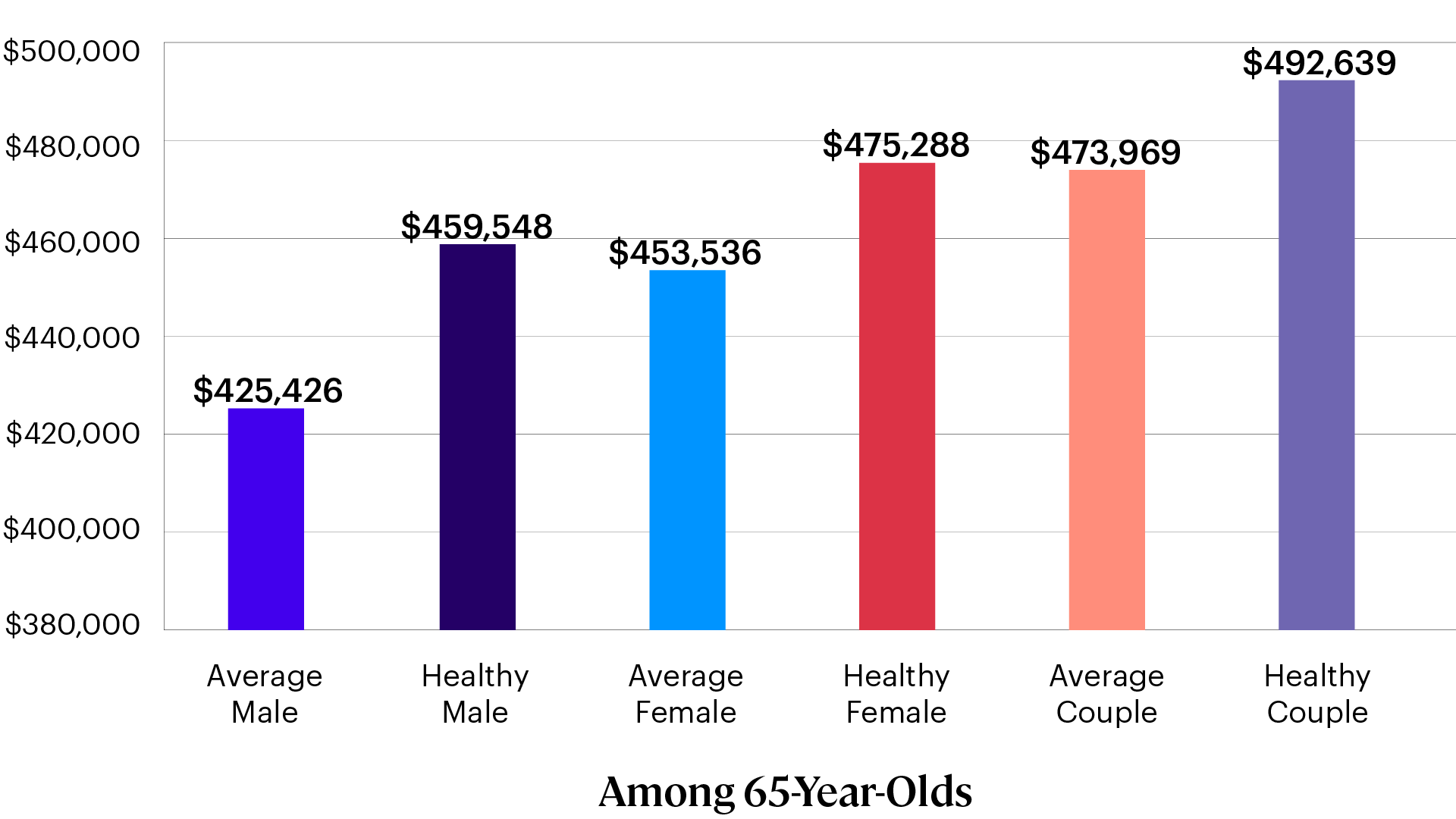

Figure 5 shows the cost of funding $20,000 of inflation-protected income using Treasury Inflation Protected Securities (TIPS). TIPS are more expensive because the amount of income received is expected to rise in the future by the rate of inflation. It would cost a healthy woman $475,288 to buy $20,000 of inflation-protected income with an 80% probability of success, but only $339,813 to buy $20,000 of nominal income each year. Inflation-adjusted income is even more valuable when a retiree can expect to live longer.

The Cost of Funding $20,000 Inflation-Protected Income*

Figure 5

Average male, female, and couple life expectancies based on the 2017 Social Security Administration mortality table. Healthy male, female, and couple life expectancies based on the 2012 Society of Actuaries annuity mortality table. *Cost estimates to achieve an 80% probability of success for a 65-year-old are based on TIPS yields on April 12, 2024.

Although inflation-protected income is more expensive, it can also be more valuable—particularly for healthy Americans who will have to fund longer retirements.

Implications for Planning

Today’s financial planning clients, who are generally healthier and wealthier than the average American, can expect to live significantly longer than their parents, and longer than the average American. Research from the Retirement Income Literacy Study shows that most Americans ages 50 to 75 underestimate the number of years an average retiree will live. Clients of financial advisors are slightly more likely (31%) than unadvised respondents (24%) to correctly answer the longevity literacy question, but 62% either still underestimate or don’t know average longevity.

Advisors can help clients establish a more appropriate planning horizon and make better choices through longevity education. This is especially importance since survey data suggest that individuals who are less longevity-literate are more likely to claim Social Security early and less likely to plan for income into their 90s.

A longer retirement is a more expensive retirement.

Improvements in longevity have several important planning implications:

- A longer retirement is a more expensive retirement. Being longevity literate means recognizing that today’s planning time horizons for healthy clients will extend into their 90s, and for couples even longer. While a longer retirement is good news, funding more years of spending creates a need for creative planning strategies that help retirees get the most out of their saving.

- Research shows that strategies such as tax-efficient distribution planning—in which advisors pay attention to spending down the least tax-efficient assets first and the most tax-efficient assets last, while taking advantage of opportunities to manage tax brackets and using strategic Roth conversions —can extend the life of a portfolio by as much as 20%.

- The higher value of inflation-protected income for healthier clients, and in particular healthier women, means that delayed Social Security claiming is almost always going to provide more retirement wealth than claiming early. Claiming strategies that focus on the expected longevity of a lower-earning spouse can provide an added boost by providing a larger lifetime spousal benefit. For healthy retirees, delayed claiming can reduce the cost of funding a retirement lifestyle by tens or even hundreds of thousands of dollars.

- Finally, retirees can also reduce the cost of funding an income goal by considering the value of transferring the risk of not knowing how long they will need to fund an income goal to an institution. Annuities allow a retiree to spend as if they will live to about an average longevity, freeing up more dollars to spend earlier in retirement and protecting against the risk of living beyond their planning horizon.

The Retirement Income Literacy Study provides actionable insights into older Americans’ financial literacy on 12 retirement topics, including longevity planning.

More From The College:

Get specialized retirement planning knowledge with our RICP® Program.

2024-2025: A Critical Window for Retirement and Estate Planning

When the closing bell rang at the end of 2023, surging stock market values left retirement accounts bulging. But supersized IRA balances are not necessarily good news.

In a recent webcast The American College of Financial Services held exclusively on its subscription-based learning platform Knowledge Hub+, IRA expert and professor of practice Ed Slott, CPA explained that a sizable IRA is little more than a ticking tax time bomb primed to explode in years to come. That’s because through the required minimum distributions (RMDs) mechanism, IRAs create a stream of taxable income – and the bigger the IRA, the bigger the income stream and its associated tax bill.

“In 2023, we had the highest end-of-year stock values of all time. Prepare your clients for larger RMDs and keep in mind that these may get taxed more heavily in the future,” Slott said. “A large IRA balance is just tax waiting to happen. I always tell consumers: your IRA is an IOU to the IRS.”

“A large IRA balance is just tax waiting to happen. I always tell consumers: your IRA is an IOU to the IRS.”

–Ed Slott, CPA

The 2017 Tax Cuts and Jobs Act (TCJA) cut tax rates to historic lows (see Figure 1); however, these favorable rates are scheduled to expire on December 31, 2025, and Slott argued that – against the backdrop of rapidly rising government debt – we’ll likely see rising tax rates soon. That means individuals taking RMDs can expect rising tax bills, and for those with bulging IRA balances, the tax bite could be particularly painful.

Figure 1: Top Federal Income Tax Rates: A Century Snapshot

Further complicating matters, SECURE Act provisions requiring heirs to empty inherited IRAs over 10 years mean those inheriting today’s large accounts may face onerous annual tax liabilities post-2025. This is especially true for heirs who may be in their highest earning years as they’re required to empty their inherited IRAs.

“In the aftermath of the SECURE Act, IRAs are a horrible wealth transfer and estate planning vehicle,” Slott said. “The whole balance of the inherited IRA is going to be taxed in a shorter window and heirs may only have two years left at today's favorable tax rates.”

“In the aftermath of the SECURE Act, IRAs are a horrible wealth transfer and estate planning vehicle.”

–Ed Slott, CPA

IRAs: A Poor Vehicle for Estate Planning

With tax rates poised to rise, tax-deferred vehicles like IRAs are looking increasingly unattractive, particularly for clients who wish to use their retirement savings accounts to benefit their heirs. Advisors must urgently find new ways to structure estates that deliver larger inheritances with lower taxes.

Fortunately, Slott had some good news for those seeking to implement fresh strategies.

Due to the combined impacts of the TCJA and inflation, 2024 and 2025 offer clients a unique opportunity to pay lower taxes as they restructure their estates. Not only are tax rates low by historical standards, but rising inflation has also inflated tax brackets. This means clients can pay lower rates on larger amounts of income (see Figure 2).

Figure 2: 2024 Tax Rates: Joint vs Single Filing

Marginal Tax Rates |

Married Filing Jointly |

Single |

|---|---|---|

10% |

$0–$23,200 |

$0–$11,600 |

12% |

$23,201–$94,300 |

$11,601–$47,150 |

22% |

$94,301–$201,050 |

$47,151–$100,525 |

24% |

$201,051–$383,900 |

$100,526–$191,950 |

32% |

$383,901–$487,450 |

$191,951–$243,725 |

35% |

$487,451–$731,200 |

$243,726–$609,350 |

37% |

Over $731,200 |

Over $609,350 |

Knowledge Hub+. Ed Slott’s Top Retirement Tax Planning Opportunities for 2024. April 2024.

“Look how much income can come out at 22%, or 24%,” Slott said. “Hundreds of thousands of dollars of taxable income can be withdrawn at these unbelievably low rates, and this is only going to go on for two more years.”

“Hundreds of thousands of dollars of taxable income can be withdrawn at these unbelievably low rates, and this is only going to go on for two more years.”

–Ed Slott, CPA

All of this makes 2024-2025 an opportune time to explore the possibility of restructuring your clients’ estates by migrating assets from tax-deferred vehicles like IRAs to tax-free vehicles such as Roth IRAs or life insurance products.

The idea, Slott says, is to pursue an aggressive, proactive IRA withdrawal strategy focused on reducing the balances held in tax deferred accounts and migrating assets to tax-free options. Instead of simply taking the RMD, clients would withdraw greater amounts and convert the proceeds into Roth IRAs, life insurance, or other vehicles depending on their needs.

Slott acknowledged clients may balk at the idea of taking large distributions and paying the associated tax bills; however, he also pointed out balances held in IRAs are inevitably going to be taxed – the only question is when and at what rate. By choosing to take bigger distributions and pay tax now, when tax rates are low and tax brackets are generous, clients can protect themselves against future tax increases. And by transferring assets to instruments like Roth IRAs or life insurance, clients can create wealth transfer vehicles that enable them to pass on larger inheritances tax-free.

Slott warned that this strategy isn’t necessarily right for every client; charitably inclined clients, for example, may find it preferable to use their IRAs as a vehicle for charitable giving either through qualified charitable distributions (QCDs) or charitable remainder trusts (CRTs). Very high net worth clients, on the other hand, may wish to avail themselves of today’s generous gifting allowances to transfer assets to heirs before their passing.

Advisors should also consider the specific circumstances of each client – clients who may need funds in the short term might not be suitable candidates for a Roth conversion, for example.

“The retirement savings tax rules are the most complex in all the tax code,” said Slott. “They affect almost every client you have. And the laws are not only complex, but they are also unforgiving. We've seen mistakes that have cost clients a fortune and cost advisors their clients. Don't let it happen to you. Be proactive. Learn what your clients need you to know to help them protect and preserve their retirement savings.”

“Retirement savings tax rules are complex and unforgiving. We’ve seen mistakes that have cost clients a fortune and cost advisors their clients. Don’t let it happen to you.”–Ed Slott, CPA

When it comes to retirement tax planning, there are many twists and turns. Want to learn more? Enroll now in Ed Slott & Company's IRA Success, an e-learning experience that helps financial professionals understand the complexities of IRA distribution planning and qualifies for up to 27.5 CE credit hours. You can also find content from Ed Slott, CPA on Knowledge Hub+, now available exclusively to members of The College’s Professional Recertification Program – and coming soon to the general public!

2023-2024 President’s Report

As we roll out this year’s report, I’m also excited to introduce Carol Parlin Prushan, our new senior vice president of advancement and alumni relations. Under her leadership, we’re renewing our focus to expand The College’s impact on our communities.

The Rule of Threes

This year’s President’s Report is a great opportunity to learn more about the impactful initiatives tied to our three strategic focus areas.

1. Specialized Knowledge:

The Innovating for Impact article shows how The College is developing new programs on sought-after topics. This includes a sneak peek at how we’re building the #1 most-requested program you’ve been asking about—plus a way to get on our waitlist for it.

“Successful, continuous improvement is the cornerstone of a strong academic institution. And that will always require assessing existing programs for relevancy and quality, and then adapting as needed. The evolution of the financial services industry also necessitates the updates of existing, and development of new programs—a process that itself benefits from recent innovation.”

2. Representation:

The Purple Walls article examines how we support new and diverse talent in the financial profession broadly–and right here at The College. You’ll see powerful demographics and equally powerful programs, with testimonials about what’s working today.

Sneak peek: Ultimately, The American College of Financial Services is seeking to shape the financial services industry into a more representative sample of the Americans served by the industry. Through scholarships, events, programs, and thought leadership, we are undertaking a mission that will benefit not only the individuals and companies that make up the financial services industry, but current and prospective clients as well.

3. Retirement Planning:

The Reimagining Retirement Planning article features The College’s latest thought leadership on a topic of growing importance to your clients. Find out how we’re helping financial professionals reach consumers with robust applied retirement planning knowledge as the Baby Boomer retirement wave rises.

“In survey after survey over the past two years, our thought leaders have consistently found financial professionals, advisors, and even the general public want more retirement planning knowledge to prepare for the challenges and changing landscapes of markets, money, and regulations.”

(Read more about our strategic priorities.)

Measurable, Memorable, and Motivating

We’ve focused on what is measurable, letting the data tell the story wherever possible. And you’ll also find other moving and memorable stories, including a tribute to a dedicated alumnus – a professional whose life reflected a commitment to financial services and whose dedication to The College made a difference for generations to follow. We hope you’ll find all of the articles motivating as you think about your relationship with The College in the years to come.

And be sure to check out the listings of all our volunteers and look for yourself, your friends, and your colleagues among the photos from past events!

On behalf of our faculty and professional staff, I invite you to get your copy, share it with your network, and expand your opportunities.

Please enjoy the report—with our thanks for your support!

Diversity, Equity & Inclusion Insights

Neeraja Rasmussen Talks About AI and the Benefits It Offers to Women

In her article, Rasmussen, who serves as a member of the Advisory Council for the Center for Women in Financial Services discusses how AI will shape the future of financial advising and better address the unique circumstances faced by women.

Rasmussen speaks about the ability of AI to create better learning environments, recruit without inherent biases, offer personalized planning strategies, and more in this article.

Read on to hear what Rasmussen has to say about AI in financial services and why its use promises a bright future for women.

Innovating for Impact

Innovation starts with great ideas. In alignment with The College’s mission, the executive leadership team identifies and vets all ideas for new initiatives and program offerings rigorously, weighing their potential to help achieve the institution’s strategic goals. A new designation program, for example, might help us:

- Enhance the education experience for learners

- Fill voids in the financial services profession and society

- Advance data-informed planning and decision-making

By adhering closely to these goals and establishing measurements to track our progress toward them, we ensure The College’s ability to deliver high-quality experiences for all our constituencies.

“It is the responsibility of The College to uphold the promises we make to our students, learners, business partners, communities, and society. Assessing and reporting on our institutional effectiveness holds us accountable and allows us to be proactive and relevant in our delivery of applied financial knowledge.”

- Katie McGowan, EdD, PMP®

Vice President of Institutional Effectiveness and Impact

What’s Old is New

Innovation occurs within long-standing programs, including the one that started it all: the Chartered Life Underwriter® (CLU®)—a designation program that is continuously improved, including most recently in 2022. During the latest reporting process to maintain its institutional accreditation, The College highlighted the reimagining of the CLU® through a collaborative effort led by Program Director David F. Pierce, MSFS, MSM, MA, AEP®, CLF®, ChFC®, CLU®.

Through the collection of student and course enrollment data, the program director and faculty identified a growing downward trend, necessitating a question and call to action: What was causing the downturn in student enrollment to CLU®?

The program team turned to corporate partners and alumni to explore the issue with a survey. As this pie chart shows, the majority (68%) agreed or strongly agreed with focusing the curriculum and shortening the program.

From this data, the program team went to The College faculty and leadership to propose a program consisting of four core courses plus one elective, using the Personal Pathway® delivery model.

The CLU® program is now tracking the impact of this change by looking at enrollment and course persistence. We see an early spark of progress in the enrollment and persistence of students from the first to the second course, as well as positive feedback from students.

“Streamlining the CLU® program from eight to five classes was a big improvement...the program [is] so well structured, [it] provides the ease of studying and understanding how various concepts apply in real life.”

- Student, 2023 CLU® End of Program Survey

Successful, continuous improvement is the cornerstone of a strong academic institution. And that will always require assessing existing programs for relevancy and quality, and then adapting as needed.

What’s New Now

The evolution of the financial services industry also necessitates the updates of existing, and development of new programs—a process that itself benefits from recent innovation.

When the time comes to develop a new program, the process involves internal teams—including Academics, the Institute for Learning Innovation (ILI), and more—and in some cases, additional experts and partners who help The College expand our resources and what we offer.

Happening now, The College is developing a first-of-its-kind Tax Planning Certified Professional (TPCP) Program, with the leadership of renowned subject matter expert and College alumnus Jeff Levine, CFP®, CPA, PFS, CWS, AIF®, RICP®, ChFC®, BFA™, MSA.

Read the full article and learn more about The College’s innovative program offerings, including the TPCP Program, in our 2023-2024 President’s Report.

Insurance & Risk Management Insights

Rest in Peace, Reggie Rabjohns, CLU®, ChFC®

Reggie Rabjohns was a member of the Board of Trustees for nine years and of the President’s Circle for 17; he was a member of The American College Foundation Board for 18 years, and he served two years on the President’s Advisory Council as well. In recognition of his “Distinguished Service to Education and Professionalism,” Rabjohns was the 2008 recipient of the Solomon Huebner Gold Medal, and he was inducted into the Alumni Hall of Fame in 2014.

Asked about his belief in the importance of education, he said: “Part of the definition of being a professional means being committed to a lifetime of continuing education… and in our industry, it’s very rare to come across someone who isn’t a graduate of The American College.” In that vein, Rabjohns exemplified The College’s mission to uplift the profession and society.

Rabjohns often spoke of the “magic of life insurance.” At The College, we also celebrate the magic of people like Reggie Rabjohns, whose investment in The College sustains us and helps us continue to evolve.

Read the full article and learn more about Reggie and how you too can support The College’s mission in our 2023-2024 President’s Report.

Diversity, Equity & Inclusion Insights

Embracing Diversity in Financial Services

Looking across key demographic segments, namely gender and race, financial services as a whole has not been representative of the American population. According to the Census Bureau, as of 2021, 69% of all financial advisors were male, and 80% of all personal financial advisors were white. Ten years ago, these numbers looked very similar, with men making up 68% of all personal financial advisors, and white advisors making up nearly 85% of the field.

In an industry dedicated to client service, these figures not only raise questions about how effectively representatives can reach diverse client bases, but they also show very little movement over the past decade toward becoming more representative of the population. This would seem to indicate that while creating an atmosphere of equality and representation is a noble goal, companies in the financial services industry are still facing challenges in this area.

It is for this reason The College has taken a number of actions in support of representation. Through ambassador programs, such as the FinServe Network, American College Centers of Excellence–including the Center for Economic Empowerment and Equality, the Center for Women in Financial Services, and the Center for Military and Veterans Affairs–and events, such as the Conference for African American Financial Professionals (CAAFP) and the Black Executive Leadership Program (BELP), we are acting on our commitment toward a more representative financial services industry.

One of these initiatives, the FinServe Network, was a new program at The College in 2023. The FinServe Network is a volunteer group of alumni and leaders who share The College’s values and help the institution amplify our benefit to the financial services profession. The ambassadors who comprise the FinServe Network have unique backgrounds and expertise, collectively representing the diverse landscape of the country that we hope to see brought to the profession.

The push for equal representation is not a passing trend at The College and has, in fact, been part of The College’s vision for some time, as demonstrated by one of its longest standing events, the CAAFP. In 2024, The College will host our 18th annual CAAFP as the industry’s premier gathering of Black and African American financial services professionals and DEI-committed professionals. This gathering brings together advisors, agents, educators, and thought leaders to discuss initiatives advancing African Americans in financial services. The CAAFP represents something far greater than a simple conference; it represents an opportunity for African American financial services professionals to come together as a community.

“The CAAFP is just one example, though significant, of how we walk the talk. The conference provides a visual symbol of how The College is working to serve underrepresented groups in our industry. ‘If I can see it, I can be it!’ is our mantra and, as a platform where we convene Black and African American financial advisors and allies at all levels, there’s nothing else like it,” says Deborah Glenn, executive director of the Center for Economic Empowerment and Equality.

Read the full article and learn more about The College’s efforts towards greater representation in the financial services profession in our 2023-2024 President’s Report.

Building Client Connections for Retirement Planning Success

Research including The College’s own 2023 Retirement Income Literacy Study suggests troubling knowledge gaps in the average American’s understanding of retirement planning, with 74% of consumers ages 50 to 75 failing a test of basic retirement knowledge. Another industry survey, the 2023 National Retirement Risk Index, predicts 51% of today’s working-age households will be unable to maintain their pre-retirement lifestyle once they leave the workforce.

To meet this moment, The College has named focusing on retirement as one of our 2024 strategic priorities: ultimately, to become the industry’s leading source of knowledge on retirement planning. There are many opportunities to do so, according to Sandy Herzlich, vice president of retirement strategy – but first, one has to challenge the notion that simply having a large nest egg is the solution.

“There are different levels of satisfaction in retirement, and different goals depending on the person,” he says. “Retiring with a lot of money alone isn’t a recipe for success. Because of this, retirement planning is going to be a much more relationship-driven business moving forward. Advisors need all the expertise, but they also need to couple that with layering in more personal aspects: understanding what their clients’ goals are and what potential roadblocks could stand in their way. They’re not just a financial manager; they’re a true partner.”

That understanding is critical to this time and place, according to Eric Ludwig, PhD, CFP®, our Retirement Income Certified Professional® (RICP®) Program director. He cites the common industry consensus that the Baby Boomer retirement wave is cresting in 2024, with roughly 12,000 Americans turning 65 every day.

“The number of Boomers retiring has been growing every year as that generation ages out of the workforce, but this year, more of them will be entering retirement than ever before or likely ever will again,” Ludwig says. “People are living longer than programs like Social Security were ever intended for, and it’s stretching resources all over the place.”

Because of this, Ludwig agrees that the psychology of retirement planning is a subject of paramount importance, and one he plans to incorporate even more into the RICP® Program curriculum over time.

“As human beings, our minds are not well-adapted to deal with uncertainty, and with all the options available and changes going on today, so much of retirement planning is fundamentally uncertain,” he says. “Advisors may think they can address these concerns with spreadsheets and calculations, but once you get started, you realize it’s more about relationships and trust than anything.”

Ludwig’s and Herzlich’s assertions follow the numbers: in The College’s 2023 Retirement Income Literacy Study, researchers found a clear correlation between lower client anxiety about retirement planning and the presence of a qualified, competent advisor. In all, nearly 11 points could be added to a respondent’s retirement knowledge score if they had working relationship with an advisor – data Ludwig calls evidence of a “significant positive benefit.”

Read the full article and learn more about The College’s impact on the retirement planning field today, as well as new initiatives in the works to address this growing need, in our 2023-2024 President’s Report.

Special Needs Planning Insights

Breaking Barriers: Celebrating Women’s Vital Roles as Disability Advocates

During Women’s History Month, we celebrate the accomplishments of women and take this opportunity to reflect on their contributions to the betterment of society. Included amongst these women working to improve the lives of others are women who advocate and care for others, specifically individuals with special needs. Caring for a family member living with disabilities can lead to several challenges, and one of the key aspects these women caregivers must consider is how to secure benefits that protect the financial future of their adult children with disabilities.

Here are some important points for women to consider when applying for Social Security benefits:

Understanding and Qualifying for the Benefits

Benefits require individuals to meet specific criteria. It’s important for women applying for these benefits to evaluate the criteria and consider whether their adult children with disabilities meet the requirements.

Application Process and Benefits

Understanding who to contact, the necessary documentation, and how to schedule an appointment are key aspects of ensuring adult children with disabilities receive the appropriate benefits.

Kaylee Ranck and Lindsey Lewis Talk Diversity in Financial Services

In their article, Ranck and Lewis discuss the importance of building an inclusive work environment and the benefits a practice can expect to incur once they have accomplished this goal.

Ranck and Lewis list several key action items, including the process of creating a safe space within your working environment, encouraging open dialogue, and recognizing and promoting diversity within the organization.

Ranck and Lewis believe firms adhering to these methods will not only grow their practices, but also find themselves better equipped to meet the needs of modern clients. Read on to hear more about how firms can grow through inclusivity!