Diversity, Equity & Inclusion Insights

The College Celebrates at InvestmentNews’ DE&I Summit and Awards

InvestmentNews' See It, Be It Role Model is awarded to those who have demonstrated leadership and achievements in financial services while actively seeking to inspire those from diverse backgrounds to pursue financial services careers.

As the first Black President and CEO of The American College of Financial Services, Nichols has recognized the opportunity for The College to further expand on its goals and efforts to address economic injustice in America. Nichols has been acclaimed for his efforts to drive transformative change in diversity, equity, and inclusion in the financial services industry and elsewhere. Under his leadership, The College has prioritized diversifying the profession.

Upon accepting the award, Nichols spoke about his experiences embarking on his career journey. "Many times throughout my career, I've been the first, the only, or one of the few,” he said. “I know what it feels like to be the lone wolf, assimilating and integrating myself into the existing culture."

He also spoke about the importance of having diverse role models to help others grow in confidence and belonging. "Two things happen when we can SEE IT AND BE IT. When we SEE IT, our confidence grows. What we aspire to achieve and the goals we've set for ourselves appear closer; we know our dreams are attainable,” he said.

Nichols added, "And as more of us BECOME IT, the space in which we are free to celebrate our individuality expands. We no longer feel pressured to assimilate, but are free to celebrate our shared history, challenges, and culture. With this celebration of self, biases begin to break down, perspectives widen, and true belonging is born in our corporate cultures."

InvestmentNews Names The College as a Finalist for Diversity Champion

Each year, InvestmentNews also recognizes firms and industry partners that foster diversity, equity, and inclusion within their organization or across financial services. With a strategic focus on diversifying the profession and as a steadfast champion of advancing DE&I initiatives, The College was named as a finalist for this year's Diversity Champion award.

Multiple initiatives led by The College's Centers of Excellence, including the Center for Economic Empowerment and Equality, the Center for Women in Financial Services, the Center for Military and Veterans Affairs, and the Center for Special Needs advance DE&I in the financial services industry and beyond.

President Nichols, Vice President and Chief Marketing Officer Jared Trexler, Vice President of Administration and Chief Human Resources Officer Deborah Eskridge Glenn, MA, MSM, SPHR, SHRM-SCP and Executive Director of the Center for Women in Financial Services Hilary Fiorella attended the event to connect with others leading in DE&I and celebrate The College’s recognition.

The College Leads Panel Discussion on Countering Pushback and Addressing Anti-DE&I Sentiments

President Nichols was joined by Vice President and Chief Diversity and Inclusion Officer of Commonwealth Financial Network Scarlett Abraham Clarke for a discussion on how to counter DE&I pushback moderated by the Executive Director for the American College Center for Women in Financial Services, Hilary Fiorella.

The discussion focused on the benefits realized from DE&I initiatives, why some employees are resistant, and proven strategies to counter anti-DE&I sentiment. Nichols pointed to political pressures and economic uncertainty over the past year as why some executives have started "falling back to what's 'worked' in the past." Nichols cautioned leaders to continue with DE&I strategic plans and initiatives "even if the business is stressed."

"Executives need to be realistic in setting expectations and solving the bigger issues. Coming out and saying you're going to increase diverse hires by five percent in a tight environment sets up a false dichotomy where someone feels threatened by personal loss," he said. "We must re-frame so everyone wins with the focus on diversity as a growth engine for everyone."

FinServe Network Advisors On Retirement Planning Challenges and Opportunities

With recession fears constantly looming, inflation soaring, and new regulations, including the SECURE 2.0 Act, clients frequently name retirement security as their top financial priority – putting the onus on advisors to be prepared for these important conversations.

Retirement Income Certified Professional® (RICP®) Program Director Eric Ludwig, CFP® hosted the panel discussion on retirement planning along with four members of The College’s FinServe Network who work primarily with clients in this area. Subjects ranged from inflation and taxation to shifts in banking systems, financial literacy, and more.

Preparation Means Greater Security

Ludwig started off the conversation by noting the two biggest disruptors for retirement planning today – recession fears and inflation – and how these combined worries can cause anxiety about retirement security for many clients.

FinServe Network advisors said that while they have seen an increase in concern from clients, they also see current turbulence as an opportunity to encourage clients to engage more with them. “I think fear typically comes from not knowing, so if you’ve talked with clients beforehand and prepared for different situations, you can create momentum like in football planning,” said Padric Scott, AEP®, CFP®, CAP®, ChFC®, CLU®, WMCP®, CCFC, President and CEO of Crossroad Capital Partners. “Seeing the excitement in them to get to planning and stick with the plan all comes from setting expectations early on.”

Jason Austell, CFP®, MSFS, ChFC®, CLU®, CASL®, RICP®, AEP®, CAP®, a financial planner at MassMutual Carolinas, agreed, saying that advisors need to equip themselves with a toolbox of knowledge and strategies and be prepared to alter their planning depending on shifts in the financial landscape. “What we use today may not be exactly what we need next week, next year, and so forth,” he said. “It helps to have a baseline of confidence in a portion of a client’s money and know they’re not going to lose that, so they can take more but appropriate risks with what they have left and try to build up assets that will support their needs long-term.”

Keeping Clients in the Loop

Ludwig also noted that since the stock market crash of 2008, various types of assets and planning strategies have experienced ups and downs in effectiveness that have forced advisors to rethink how they approach retirement planning – including the relatively recent end to a long period of low interest rates due to rising inflation. Several of the advisors present shared stories of clients they’d worked with who were caught by surprise when unexpected situations disrupted their planning and emphasized the value of preparing for any eventuality – and educating clients while doing it.

“One of my clients and her husband are in their late 70s and believed they didn’t need any help with their retirement planning,” said Nancy Du, MBA RICP®, CFP®, a financial advisor at Ashford Advisors. “But then in 2022 the stock market tanked and her husband was diagnosed with dementia. She panicked and sold everything they owned in the market, thinking it was the right thing to do, before coming to me for help. Since then we’ve ensured they have a good portfolio, pension plan, and annuities to support their retirement lifestyle and care, but it reinforces the idea that people need to be aware of their situation and their goals.”

The power of working with informed clients was a recurring theme and one that Terry Parham, CFP®, ChFC®, CLU®, RICP®, WMCP®, a financial planner and co-founder of Innovative Wealth Building, elaborated on, pointing out the power of resources like RISA profiles and retirement styles. “It’s a natural human tendency to see people going a certain direction from social media or the news and go that direction too,” he said. “It’s like Costco on a Saturday: long lines everywhere, and as soon as a new one opens, everyone jumps in that line and makes it long again. We need to look at the specifics of each client’s situation and help them realize that we live in a dynamic world where truths about money are always changing.”

Getting Ahead of Retirement Planning

Overall, the panel of advisors agreed that one of the keys to sound retirement planning is to work more closely with clients and form a relationship founded on both business and personal levels. The panelists repeatedly returned to the themes of proper planning made well in advance of crisis situations to help reduce the risk of running out of money in retirement and being proactive rather than reactive.

“I always ask people, would you rather be punching someone in the mouth or getting punched in the mouth?” said Scott. “Allowing your money to be wasted with unnecessary taxes when you could have planned against it is like allowing Uncle Sam to punch you in the mouth. Why not get ahead of all that? If you’re delaying Social Security for a lower income base, front-run some of those dollars so you can then think long-term. If you end up in a situation where you have a lot of extra income, you’re not going to be using it anyway, and you’re setting yourself up for failure. It’s so important to get the lay of the land, find the mines you need to navigate with your clients and adjust accordingly.”

FinServe Network Advisors Talk RIA Strategy

These included the challenges independent advisors face in maintaining stability and consistent organic growth during times of market volatility. According to a 2022 benchmarking study by Charles Schwab, many RIAs’ target of 4% growth in 2021 failed to account for rising inflation, leaving many firms at a net negative and starving for organic growth.

Wealth Management Certified Professional® (WMCP®) Program Director Michael Finke, PhD, CFP® hosted one such discussion: a panel focused on Registered Investment Advisor (RIA) firms. Along with four members of The College’s FinServe Network from thriving RIAs, Finke led a meaningful conversation that ranged from what to do when markets go south to managing charitable giving, helping clients plan for their eventual retirement, and more.

Steady Hands Amid Shaky Markets

One of the primary subjects involved recent changes in interest rates and market declines, which have put many clients on edge. Finke and the panelists acknowledged that it would be objectively foolish to believe markets would only go up, but also that many younger investors who may not have experienced high-interest rate environments or market volatility don’t always properly understand the risks of investing.

“There's a lot of anxiety,” said Scott Winslow, MSFS, ChFC®, CLU®, RICP®, AEP®, CCFC, managing partner at Nabell Winslow Investments & Wealth Management. “We’re getting a lot of calls from people who thought every advisor was doing a great job until we suddenly hit this market turbulence, and they want to know what went wrong. We focus mainly on educating clients upfront on possible outcomes so that when downturns happen, they’re prepared for them.”

Chief Wealth Coach at Alchemist Wealth Andrew Tudor, CFP®, CAP®, agreed that advisors must better convey to clients that risk is an accepted part of the game when investing. “Like Mike Tyson once said, ‘Everyone has a plan until they get punched in the face,’” he said. “A lot of people got punched in the face this year, and I think we’ve gotten into a space where people in our industry want to sell certainty. We need to be more upfront that certainty isn't a given. Positive charts and graphs are great, but we need to uncover what their fears are, see the questions behind the questions, and make sure we give investors a feeling of control over their outcomes while still steering them toward the best ones.”

Angela Ribuffo, CFP®, RICP®, ChFC®, CDFA, CLTC, WMCP®, president and financial advisor at Raion Financial Strategies LLC, added that one way of protecting against client panic in market downturns is to talk about the potential downsides to investing first. “A lot of advisors focus on the gains so that when the losses come, they have to walk things back a little,” she said. “My philosophy is that if we protect against the downside, the upside will come eventually – that’s natural market recovery. So let’s focus on the downside: what are you willing to give up? What are you willing to do differently? What’s your Plan B? That way, when the downside comes, there’s no fear factor with clients because they can sit back and say, ‘We planned for this; we’re going to be okay.’”

Turning Lemons into Lemonade

Turning away from the pure downside aspects of the current market, Finke encouraged panelists to talk about what opportunities might exist in a high-interest rate, high-yield environment. Several of the panelists spoke about how there could be hidden benefits in the form of new planning strategies.

Heather Welsh, CFP®, AEP®, MSFS, vice president of wealth planning at Sequoia Financial Group, brought up how to reduce the pain of taxation through Roth conversions. “Down markets can really be an opportune time to do those conversions and then capture the appreciation in a tax-free environment on the upside,” she said. “You can turn that low into an opportunity for somebody to continue progressing toward their goals. At its core, financial planning is about establishing that pathway to financial success for clients regardless of the variables outside our control.”

Finke and Winslow had a discussion about how many advisors who stretched investment strategies for yield in the low-interest environment of the past 10 years were punished, along with their clients, when rates shot up in 2022. Winslow said it had forced his firm to rethink how they approach working with high-net-worth clients.

“We were really trying to use some hedging strategies before, but now that you can build a portfolio of treasuries or less risky assets in the short term, we can get back to old, academic portfolio management,” he said. “What I’ve been doing more now than I have in almost my entire career is buying up a lot of three-month to two-year treasuries just to fund short-term needs.”

Tudor added that there are now also increased opportunities in the charitable giving space. “A lot of our financially-savvy and income-based clients are still often the charitable ones in their communities,” he said. “We have our definitions of high-income and high-net-worth, but they aren’t always the same inside a community. I’ve found that at certain levels they’re still giving at a higher percentage, so we can approach charitable giving in a really impactful way. $10,000 may not seem like a big deal to some, but if it’s from one of the largest donors in a local church, for example, it can be. And there are many strategies we can use to offset taxes or increase their yields to give them a nice experience around safe money.”

Assets to Clients in Need

Finke also asked the group whether asset location, rather than asset selection, might be the primary value proposition of a financial advisor. The group generally agreed that products and asset types are not the end-all, be-all of an advisor’s role with clients.

“Working with clients is an education process, not just an action process,” Ribuffo said. “It’s not us telling them what to do but helping them understand the why of it. If they understand the why of it, they’re more likely to execute it and keep on the path versus getting distracted by outside noise. This is the perfect opportunity for advisors to say to clients, ‘This is why you have me.’”

Winslow said this collaboration with clients and across the profession has become even more important with new SECURE 2.0 Act regulations on the books. “We’re using this opportunity to go out and talk to CPAs and attorneys, particularly in the qualified plan market, on the changes that are coming up,” he said. “There's a lot of unique little provisions in there, and decisions have to be made. So we spend more time with clients and go out to the other centers of influence to discuss those things.”

The group also reflected on changing attitudes between generations to money management: they noted that while the post-World War II generation was driven by a desire to leave their children better off than they were in their lifetime, the later Baby Boomers are simply trying to navigate not running out of money in retirement. But many, they said, are still looking to give back to their communities with what they have left.

“Conversations start to shift toward ‘I would really like to see my impact while I’m still alive. How can I start giving these dollars away now?’” said Tudor. “People want to know how they can be an active member of their community with their money and not just leave it behind, hoping their kids will take care of it.”

Juneteenth and Reclaiming Black Wealth

Juneteenth is a time to celebrate our progress in advancing racial equity and harmony while also being mindful of the work that still needs to be done to eradicate systemic inequities in America.

Here, at The American College of Financial Services, we recognize the impact of economic inequality on communities and are working to narrow the wealth gap by championing diversity in financial services. This August, we will host the 17th annual Conference of African American Financial Professionals (CAAFP), with this year's theme being "Reclaiming Black Wealth." With the passing of the 13th amendment in 1865, African Americans achieved political freedom. Yet, financial freedom remains unobtainable for many Black families leaving nearly 3.5 million Black households with negative net worth and 4.3 million more with a net worth under $10,000.1

The racial wealth gap in America has not continuously widened. In the decades immediately following the end of slavery, the wealth gap was diminishing rapidly.2 In the early 20th century, Black communities were thriving across the country, including the Greenwood District of Tulsa, Oklahoma, Harlem, New York, the "Sweet Auburn" District of Atlanta, and the neighborhood of Christian Street and Black Doctors Row in Philadelphia, which was home to the largest percentage of Black professionals in Pennsylvania.3 However, since the 1980s, the racial wealth gap in America has continued to expand due to unequal pay, limited access to capital, and other discriminatory laws and practices.4

Reclaiming Black wealth in America calls for our Black communities to redefine what "wealth" means holistically, in terms of financial prosperity and beyond, and provide new avenues of access to achieve this wealth. Recognizing the need for relatable, digestible financial education, we launched Know Yourself, Grow Your Wealth® a little over a year ago. Since then, our empowering financial e-learning platform has been instituted at 36 HBCU campuses and enrolled over 3,000 people. Here's a summary of our impact to date:

- 95% of learners are Black and African American, with 70% of completers being Black and African American women under the age of 30

- 90% of participants reported a significant increase in their subjective financial knowledge

- 63% demonstrated an increase in financial skills based on questions in the pre- and post-survey

- 53.8% said they had saved more since starting Know Yourself, Grow Your Wealth®

On Monday, we will celebrate the thousands of people who have increased their financial wellness with Know Yourself, Grow Your Wealth®, the 1,000+ attendees who will be joining us in Chicago at the upcoming CAAFP, the 64 fellows who have graduated from our Black Executive Leadership Program, the 330 advisors of color who have graduated from our Chartered Advisor in Philanthropy® (CAP®) Program, the new strategic partners who are supporting our mission to diversify the profession, and our community which continues to grow in initiative and impact.

Together, this Juneteenth, let's celebrate progress marching on!

1CBS News. 3.5 Million Black American Households Have A Negative Net Worth, New Study Finds. June 2021.

2,4National Bureau of Economic Research. Exploring 160 Years of the Black-White Wealth Gap. August 2022

3NBC News. Philadelphia designates the city’s first Black historic district after yearlong push. July 2022.

Five Questions with Eric Ludwig, CFP®

Ludwig is a financial planner, researcher, and educator with a Master of Science in finance and a PhD in personal financial planning. He also has a wide array of professional experience in the financial services industry, including as a wealth management advisor for U.S. Bank, a researcher at the Investor Behavior Lab, and a peer review board member for the Journal of Financial Planning and the Financial Planning Association (FPA), as well as teaching at various institutions in several capacities.

We asked Ludwig five questions about his career, his path to the financial services profession, and what he hopes to accomplish as a faculty member at The College.

How did you decide on financial services as your career path, particularly retirement planning education and research?

When I was growing up, my dad, who was the CFO of a company, had a hobby of personal investing, and I thought it was normal for parents to talk about the Wall Street Journal with their kids. I also had crazy timing with my career journey. I was halfway through flight training when 9/11 happened. After that, I worked as an airline pilot from 2003 to 2007, but the industry was struggling then, and the pay and schedules were pretty bad. During that period, I loved reading everything and anything about personal finance, and I enjoyed helping people as a flight instructor. Eventually, I realized there was a job that combined both those passions – becoming a financial advisor.

In September of 2007, I made the switch – right before the Great Recession. The market dropped 50% during my first 18 months on the job, greatly impacting me. Despite my best efforts, some clients bailed to preserve their cash during the crisis and didn't get back in until several years later, negatively impacting their retirement plans. That experience sparked my interest in learning more about how to apply the psychology of retirement planning, eventually leading to my pursuit of a PhD specializing in that area of research. Because of my practical experience as a client-facing advisor, I view research through the lens of how advisors can use this information to improve client outcomes.

How has retirement planning changed since the Covid-19 pandemic, and what are the next big disruptions professionals must look out for?

One of the most noticeable changes in the financial planning industry is the shift in how services are delivered to clients. In-person meetings at the advisor's office have been augmented, if not replaced, by a significant increase in online platforms such as Zoom. This has opened various new opportunities for advisors to serve their clients online, such as sharing timely information through blogs and podcasts and utilizing online financial planning tools.

Another trend that has gained momentum is using artificial intelligence (AI) as a tool for advisors to serve clients; however, AI is not expected to replace advisors but rather complement their services. The industry will likely see further advancements in AI, which will continue to enhance how advisors serve their clients.

What are the most important questions consumers need to be asked—or be asking themselves—about retirement in today’s environment?

Planning for retirement, and in retirement, is complex and stressful for many people. Pension programs continue to be phased out, and the responsibility is being shifted to individuals to save for their own retirement. Tax laws also change, and, let's face it, the economy is in constant flux. Individuals should ask themselves to what extent they have the knowledge, interest, and time to do it on their own or whether they would benefit from the help of a well-educated advisor.

Results from previous retirement income literacy surveys show general overconfidence regarding what people think they know about retirement planning versus how much they actually know. The results of The College’s 2023 survey will highlight areas where advisors can help clients with their financial outcomes, retirement income planning, and how to help increase their retirement confidence.

What do you think The College’s Retirement Income Certified Professional® (RICP®) Program program does well, and how will it have to evolve?

I may be biased, but I think the RICP® program should be the go-to choice for advisors specializing in retirement planning. RICP® goes deep into the weeds with three advanced courses that provide specialized training. One of the program's key advantages is its ability to bring in leading subject matter experts from the retirement planning world, such as Michael Kitces and David Blanchett, PhD, MSFS, CFA, CLU®, ChFC®, CFP®. These experts provide cutting-edge, modernized education not found in other financial planning programs. Additionally, the RICP® program focuses on the behavioral side of retirement planning, giving its graduates the technical and soft skills necessary to help clients navigate the complexities of retirement with confidence.

For advisors who are serious about specializing in retirement planning and providing the best possible service to their clients, the RICP® program is an excellent choice.

Do you have any pieces of advice for today’s up-and-coming financial professionals?

I think it goes back to what I’ve been saying throughout this conversation: being a financial professional requires both technical skills and interpersonal skills.

Take something like building a retirement portfolio and distribution plan for a client that aligns with their wants and needs. That obviously requires a certain amount of technical skill. Now think about what happens during a market downturn or an unexpected health issue pops up. The advisor will also need soft skills like empathy and active listening.

Ultimately it comes down to the Golden Rule: treat your clients how you would want to be treated.

Learn more about our extensive, intensive retirement incoming planning education with the RICP® Program.

As Military Appreciation Month Concludes…

Also observed in May is Military Spouse Appreciation Day, celebrated the Friday before Mother's Day, and Armed Forces Day, which honors all those actively serving each year on the third Saturday of May.

As we go about our pursuits and enjoy our liberties, nearly 1.4 million active duty service members and their spouses stand sentry to ensure our country is ready at a minute's notice. Like our health, our military community, including our guard and reserve service members, is often taken for granted daily. More often than not, when we hear of an overseas conflict, become alerted to a national threat, or require disaster recovery assistance, we acknowledge and admire just how critical they are to our security, safety, and well-being.

At The College, our military community, veterans and their spouses are a daily priority. Helping them pursue new careers in financial services as they transition to civilian life is part of our mission instituted through our Center for Military and Veterans Affairs.

I was beyond proud to see a picture of our Center for Military and Veterans Affairs Executive Director Jim Roy, PMP, appear on my screen while watching a segment before Armed Forces Day on the CBS Evening News with Norah O'Donnell last Thursday. O'Donnell discussed the rank of Chief Master Sergeant of the Air Force, the highest enlisted rank in the United States Air Force and a position only held by 19 people to date. Jim is the 16th Chief Master Sergeant of the Air Force.

I appreciate Jim immensely every day as I do all of our faculty, staff, leadership volunteers, students, and alumni who have served and all the women and men who are serving today for their sacrifices in service to our country. I hope you enjoy this Memorial Day with those you love, doing what you love in remembrance and honor of those who paid the ultimate sacrifice so that we could be free.

FinServe Summit Heralds Increased Amplification of The College’s Mission

A group of 16 financial professionals with diverse backgrounds, fields of expertise, and positions in the industry, the FinServe Network is a new initiative by The College to utilize those in its network to amplify The College’s mission within their spheres of influence. Membership in the FinServe Network is an exclusive invitation extended to practitioners who embody lifelong learning and are passionate about advancing the profession to be more diverse and inclusive.

With 14 of the 16 members of the FinServe Network’s inaugural class represented at the Summit, held in-person at The College’s offices, faculty, staff, and influencers engaged in two days of team-building, panel discussions, coffee talks, and more designed to bring them together, inspire them, and equip them with the tools they need to spread the word about The College to their communities.

A Powerful Introduction

The FinServe Network ambassadors arrived at The College on Monday from hometowns all across the country–some even from as far away as Alaska and California. They joined in the excitement felt by The College’s professional staff as Chief Marketing Officer Jared Trexler led the unveiling of The College’s reimagined brand, a sneak peek at its new website, and an overview of the “Your Life’s Work” campaign meant to introduce diverse communities to the multitude of opportunities available to them at The College.

Trexler and other members of The College’s Marketing and Communications team emphasized how this trifecta of changes would enhance the ability of those present to share The College’s story with others and communicate the value of its programs, not just as a leader in financial services education, but as a difference-maker that seeks to better the profession and society through financial knowledge.

To that end, faculty members Timi Joy Jorgensen, PhD, and Valencia Gabbay presented the latest iteration of Know Yourself, Grow Your Wealth: The College’s consumer financial education program designed to help those in underserved communities to grow in personal finance knowledge. Jorgensen and Gabbay highlighted the program's benefits to advisors, encouraging them to share the news of its availability to their networks.

Breaking the Ice and Building Community

Following the informational sessions, Senior Director of Marketing and Media Relations Lindsey Allumbaugh sought to grow the group’s team spirit by having the FinServe ambassadors engage in a few fun activities. In the first game, ambassadors were given a choice between two opposing sides–coffee or tea, vacations at the beach or in the mountains, etc.–to lighten the mood of the gathering and allow them to get to know a bit more about each other. In the second, the ambassadors were encouraged to speak about their “superpower”: not a power they would like to have, but one they already possessed.

Many ambassadors spoke about their power to connect disparate ideas and different people to foster growth through community and connections, especially ones that might not be expected or commonplace. A few testified to their powerful personalities, from sunny optimism to grounded realism, as what helps them to sway clients and convince them to consider alternatives to their preconceived notions about financial planning. Still others referred to their backgrounds from diverse communities as a force that drives them to serve others or a passion for giving back.

These talents were the focus of the day’s last activity, an inspirational conversation with Deirdre Van Nest of Crazy Good Talks®. In her session, Van Nest testified to the power of personal stories and emotional connection as the key to effective speaking. Rather than simply trying to convince or sell their clients on ideas by presenting facts, Van Nest shared her own highly affecting story of losing her mother in a car accident to prove the point that emotional appeals are at the core of creating relationships based on trust–an especially important skill for FinServe ambassadors to have.

A Meeting of the Minds

The FinServe ambassadors reconvened Tuesday morning for coffee and a discussion session with College President and CEO George Nichols III, CAP®. President Nichols painted a picture of how far The College has come in its nearly 100-year history and how far he envisions it going as it works to fulfill current strategic initiatives designed to set a new standard in the industry. While candid, President Nichols was full of enthusiasm and hope for the future–and his sentiments were shared by the ambassadors, who excitedly peppered him with questions about what they could do to help The College move forward in its mission.

Afterward, the ambassadors heard from The College’s leading faculty in a panel discussion distilling recent research initiatives and their results. Faculty members represented included: Michael Finke, PhD, CFP®, Wealth Management Certified Professional® (WMCP®) Program Director; Eric Ludwig, CFP®, Retirement Income Certified Professional® (RICP®) Program Director; Chet Bennetts, CFP®, ChFC®, CLU®, RICP®, CLF®, director of the CFP® Certification Education Program and Chartered Financial Consultant® (ChFC®) Program; Keith Gatto, PhD, Assistant Professor; Sophia Duffy, JD, CPA, Associate Professor of Business Planning; and David Pierce, MSFS, MSM, MA, AEP®, CLF®, ChFC®, CLU®, Certified Financial Fiduciary®, Chartered Life Underwriter® (CLU®) Program Director.

Ambassadors once again freely engaged throughout the presentation session and asked many impactful questions about the implications of the findings and how they saw The College’s programming evolving in the years to come.

Conversations and Connections

The late morning and the early afternoon saw ambassadors being split into smaller groups for the final activities of their visit: panel discussions.

Ambassadors were grouped by specialty and area of focus for several discussions capturing insights into retirement planning today, DEI in practice, and opportunities and challenges in philanthropic advising. A member of The College’s faculty or leadership team led and moderated each discussion.

In the first panel on retirement planning, Ludwig led a discussion with ambassadors Jason Austell, CFP®, MSFS, ChFC®, CLU®, CASL®, RICP®, AEP®, CAP®, Nancy Du, RICP®, CFP®, Padric Scott, AEP®, CFP®, ChFC®, CLU®, WMCP®, CCFC, and Terry Parham, Jr., CFP®, ChFC®, CLU®, RICP®, WMCP®. Ludwig pointed out the two biggest disruptors in current retirement planning–inflation and market volatility–and asked the ambassadors about their strategies for handling them.

For the second panel, Finke headed a conversation focused on challenges facing independent advisors from RIA firms featuring ambassadors Andrew Tudor, CFP®, CAP®, Angie Ribuffo, CFP®, RICP®, ChFC®, CDFA®, CLTC®, WMCP®, Heather Welsh, CFP®, AEP®, MSFS, and Scott Winslow, MSFS, ChFC®, CLU®, RICP®, AEP®, CCFC. Finke pointed out that 2022 was an interesting year for advisors, especially those going independent, due to fluctuations in investment products and a rising number of clients needing retirement planning services.

The third panel, including and moderated by President Nichols, looked at diversity, equity, and inclusion in the financial services industry. Ambassadors Fatima Williams, FSCP®, Alanah Phillips, Centario Grier, and Marco Williams talked about their experiences as women and people of color getting started in the industry and advancing in the profession. They emphasized leaning into what makes you unique despite a culture that often browbeats people into fitting a mold.

Finally, the last panel on philanthropic advising included recent Chartered Advisor in Philanthropy® graduate President Nichols and two ambassadors specializing in giving back: Rick Peck, CAP®, and Mary Fischer-Nassib, CAP®. Peck, a gift planner with a charitable foundation, and Fischer-Nassib, founder of her own organization focusing on making an impact through athletic programs, talked about current challenges, trends, and opportunities in philanthropic advising.

A Celebratory Conclusion

A final address from Trexler and Nichols and a champagne toast tied a bow on the inaugural FinServe Summit and sent the ambassadors on their way with inspirational words and the promise of an impactful collaboration to come–as well as new bonds of friendship and fellowship formed.

We thank all the members of our first FinServe Network class for their service to The College and dedication to advancing our mission to benefit society! Check out the recap reel below to view the Summit’s video highlights.

Ethics In Financial Services Insights

How Personal Relationships Affect Trust in Financial Services

The results showed that while the industry has come a long way since public trust in financial services cratered in the wake of the 2008 financial crisis, there is still a long way to go when it comes to earning the confidence of diverse groups of clients and those outside the system of traditional financial services companies.

In a new report released in April 2023, the Center for Ethics in Financial Services continued to highlight the sources of consumer anxiety when dealing with financial services companies and which companies were more likely to earn the public’s trust.

In the report, experts from the Center write that consumer trust in financial services comes with some latitude for mistakes but is also easily lost when consumers have negative experiences that question whether it was wise to trust in the first place. In addition, there is significant complexity around the factors that drive whether individuals trust an organization. These include three general domains of trust factors: psychological, experience, and demographics.

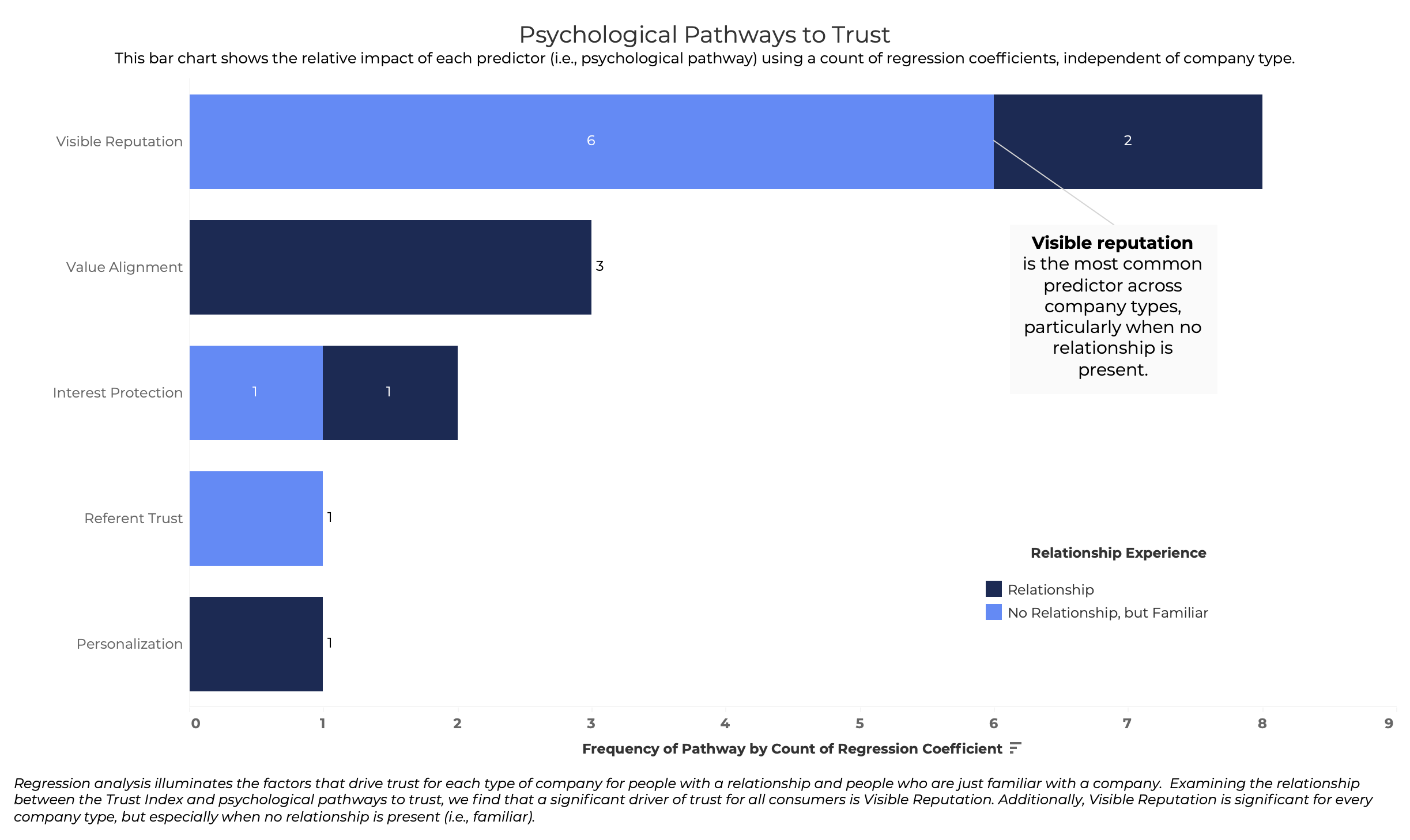

Among the psychological factors that drive trust for consumers, the Center’s research identified five key points: company behavior and values; what consumers hear about experiences with a company from others; levels of personalization and individualized service; how organizations protect their clients from fraud and act transparently toward them; and what kinds of reviews a company has from reputable sources. All can play a significant role and, when taken together, provide a potential blueprint for how financial services companies can approach consumers who may tend toward lower levels of trust.

The Center found that more often than not, personal relationships formed due to experience with a financial services professional or company matter significantly. In addition, an important marker of an organization consumers feel they can trust is the consistency with which they are present in the community: are employees treated well? Is the community treated well?

Organizations, such as investment app companies and online-only or mobile banks, tend to have fewer opportunities for direct engagement or to form personal relationships. In this study, they also trended lower on trust indexes – proving the “experience gap” is a real and enduring factor the industry must consider.

Access our research brief offering pathways to trust in financial services.

Diversity, Equity & Inclusion Insights

ESG Investing Takes Center Stage

ESG is an acronym for the use of environmental, social and governance considerations in investing.

ESG is important when seeking to connect with women as clients because women are more likely than men to be interested in ESG impacts through their financial portfolios. The topic has become politicized because it may affect the allocation of investments across various sources of energy, such as coal, renewables, oil, or gas. Such shifts could create winners and losers among energy companies, and the states where they do business. Moreover, the Biden veto protects a Department of Labor (DOL) amendment to the ERISA fiduciary duty rules, which regulate financial professionals advising on pension plans, 401(k)s and other retirement and endowment funds.

Implications Of The Biden Veto

The DOL under Biden released its final amendment to the ERISA rule on November 22, 2022, just before the Republicans won control of the House. The Republican-led Congress, however, opposes the Biden administration’s approach to ESG and voted to kill the rule by using a mechanism called the Congressional Review Act, which enables Congress to overturn actions taken during the end of a prior Congressional term.

Biden’s veto secured the 2022 DOL rule, which became effective on January 30 of this year. Whereas the Trump administration had a restrictive view of the type of data a fiduciary could consider, the current rule enables fiduciaries to consider ESG factors so long as they are relevant to the financial analysis.

Admiral Michael G. Mullen Named as the 2023 Soldier-Citizen Award Recipient

A distinguished service member and former Chairman of the Joint Chiefs of Staff for Presidents Bush and Obama from 2007 to 2011, Admiral Mullen embodies sacrifice, service, and selflessness.

“Admiral Mike Mullen truly exemplifies the values of a soldier and a citizen. As a soldier, he has given over 40 years of military service to our nation at the highest levels of leadership. As a citizen, he has done significant work in the financial services industry, held numerous board positions with both for-profit and nonprofit organizations, taught national security decision-making policy as well as ethics and leadership, and has received a long list of distinguished awards. Much of his work with nonprofit organizations is related to assisting military veterans and their families. It was an honor to nominate Admiral Mullen for this award in recognition of his sacrifice, success, and service.”

~John M. Howard, Chairperson of the Board of Trustees of The American College of Financial Services

Admiral Mullen served as the 28th Chief of Naval Operations from 2005–2007 and the 17th Chairman of the U.S. Joint Chiefs of Staff for Presidents Bush and Obama from 2007 to 2011. He led the military during a critical time of change and transition, advancing the rapid fielding of innovative technologies, championing emerging and enduring global partnerships, and promoting new methods for countering terrorism. He spearheaded eliminating the “Don’t Ask, Don’t Tell” policy, ushering for the first time in U.S. military history the open service of gay and lesbian men and women.

After his retirement from the United States Navy in November 2011 after 43 years of honorable service, Admiral Mullen joined the corporate boards of General Motors from 2013–2018 and Sprint from 2013–2019. He continues to serve on numerous boards, including Bloomberg Philanthropies, Naval Academy Foundation, Naval Postgraduate School Foundation, Harvard Business School, and a wide array of nonprofit organizations dedicated to improving the growth, development, recovery, and transition of military veterans and their families.

Additionally, he taught National Security Decision-Making and Policy at the Woodrow Wilson School of International and Public Affairs at Princeton University from 2012– 2018 and continues to teach advanced ethics and leadership at the U.S. Naval Academy.

Currently, Admiral Mullen is president of MGM Consulting, which provides counsel to global clients on issues related to geo-political developments, national security interests, and strategic leadership. Admiral Mullen is a distinguished graduate of the U.S. Naval Academy and a distinguished graduate of the Naval Postgraduate School, a distinguished alumnus of Harvard Business School, a member of the National Academy of Engineering and served as a trustee at Caltech.