Diversity, Equity & Inclusion News

New Research Looks To Help Women Shatter Glass Ceiling

Diversity, Equity & Inclusion News

How to Manage Remote Teams While Retaining Talent and Improving Diversity

Diversity, Equity & Inclusion Research

How Can Financial Advisory Firms Prepare for A More Diverse Future?

The Current Situation

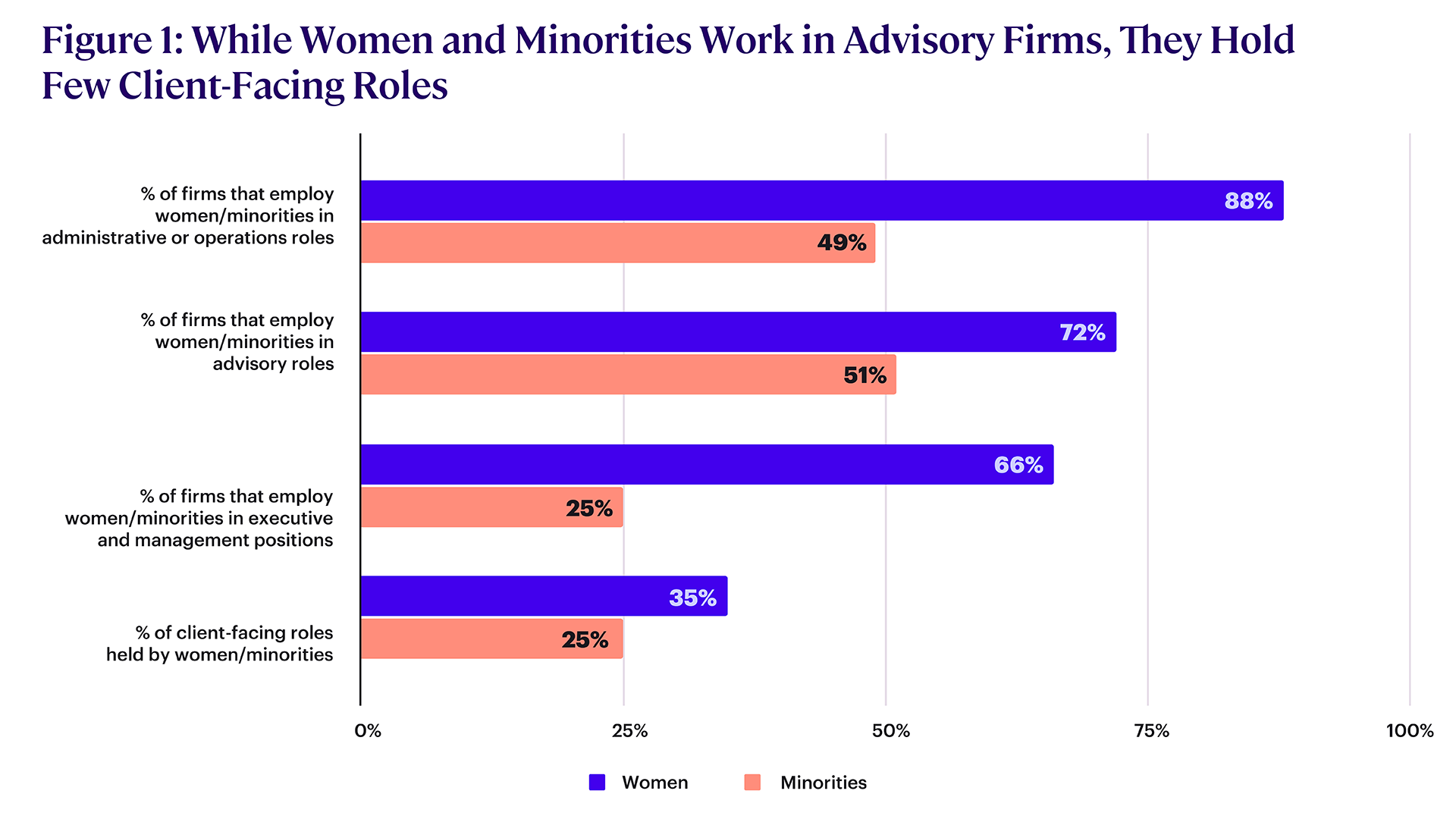

It is no secret that the financial advice industry has remained largely aging, male, and White even as America has grown more diverse, and women and minorities have gained control of a greater share of the nation’s wealth (see Figure 1).

- American women control more than $10 trillion of financial assets.

- Between 2016 and 2019, Black and Hispanic family wealth rose 33% and 65%, respectively, compared to 3% for white families.

The American College of Financial Services. Diversity & Inclusion in Financial Advice 2020. 2020.

As a result, many industry experts worry about the profession’s long-term growth and survival prospects. Unless firms can attract more minority, young, and female practitioners, there is a real risk that the industry will struggle to remain relevant in the decades ahead.

To better understand the factors driving the industry’s lack of diversity and what is needed to promote change, we conducted The American College of Financial Services Diversity & Inclusion in Financial Advice Survey. Here is what we found.

The Roadblocks

Almost 60% of respondents to the survey recognized that lack of diversity is a problem within the advice business. However, relatively few believed that their firms are working to resolve the problem:

- Only 35% said their firm tries to foster racial diversity in its staff.

- Only 36% said their firm works with suppliers committed to diversity.

Our research found that there are several structural factors standing in the way of increased diversity in financial advisory firms.

- Limited Entry Points – Less than 20% of firms used online postings to recruit new advisors, with 44% preferring to use networking. Unfortunately, by relying on networking for new talent, advisory firms tend to replicate the demographic mix of their current advisors and staff.

- Business-building Expectations – Many firms expect advisors to pay for themselves immediately or very quickly. They, therefore, tend to hire already-successful advisors who arrive with their own book of business, which results in no change in the industry’s demographics. Firms also often expect new advisors to rely on their own network of affluent investors to build a book of business and generate leads, which disadvantages candidates from less privileged backgrounds who do not have a network to tap.

- Lack of Transparency in Distributing Sales Leads – While 60% of advisors felt leads and new clients were distributed fairly at their firm, 71% of firms lack a visible process for distributing leads. With limited transparency and accountability in how leads are distributed, women and minority advisors may find themselves at a disadvantage.

The Solution

There are many actions that firms can take to accelerate their diversity efforts, including: Appoint an executive with formal responsibility for diversity. Developing mentoring programs. Implementing collaborative conflict resolution procedures. Allowing anonymous reporting of harassment. Setting formal workforce diversity goals. Offering diversity education and training. Establishing a diversity committee.

To learn more about how well these and other strategies work and how your firm can implement them, download the full survey results today.

Diversity, Equity & Inclusion Research

Black America's Financial Wellness

It takes more than information to influence people’s lives, and money alone does not result in financial health. Financial well-being is “a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life.”

Financial well-being is a holistic view of our financial lives and includes our access to financial services, our financial behaviors and decisions, and how we think and feel about money. Because financial well-being is both objective and subjective, it accommodates the realities and individualities of financial circumstances. It is the ideal measurement to evaluate the financial health of individuals and communities.

Generally, financial and economic research controls for gender, race, or ethnic heterogeneity of populations. In statistical analysis, controlling for race or gender is simple. In real life, that's not an option. Nobody gets to push the “appear as a gray avatar” button to walk into a bank, apply for a mortgage, or navigate starting a small business. We show up as we are, and our identities have real implications on how we experience life. The reality of carrying our identity with us throughout our financial and economic life experiences prompted this research.

To understand the cultural specificity of financial well-being, Timi Joy Jorgensen, Ph.D., Assistant Professor and Director of Financial Education and Wellbeing at The American College of Financial Services, conducted research that deconstructed the variables that were predicting financial well-being for different populations. This report focuses exclusively on the specific predictors of financial well-being for Black women and men in the United States. Understanding the identity-specific predictors of financial well-being is the first step for the financial services industry to engage in culturally competent and meaningful ways with Black Americans. Financial empathy and data-informed business solutions can foster a business environment of concerted economic inclusion.

To learn more about Black America’s financial well-being and how it can be improved, download Dr. Jorgensen’s white paper today.

Diversity, Equity & Inclusion Research

Black Women, Trust and the Financial Services Industry

- 60% of Black women expressed difficulty finding financial professionals they trust

- 58% of Black women believe race affects treatment more than gender

- 10% more Black women trust individual financial advisors than institutions

This inaugural study from the Center for Economic Empowerment and Equality combines quantitative and qualitative methods to create a holistic picture of Black women’s perception of financial services and money, their wants and needs, the role they play as decision-makers in their households and communities, and the opportunity the financial services industry has to better connect with them throughout their wealth journey by building a tailored and trusting relationship.

Gain insights that exemplify the Center’s collective mindset to narrow the racial wealth gap here.

Diversity, Equity & Inclusion Research

Advisors’ Perceptions of Success Study

With FINRA statistics finding that just as many advisors enter the business as enter it every year, the perception of financial services as a field that’s hard to break into and even harder to find success in has become embedded not only in the minds of the public, but also within financial services professionals themselves. Newcomers to the business comment on the competitive nature of the field and how they are sometimes encouraged to outdo, rather than collaborate with, their fellow professionals to “get ahead.”

When it comes to improving retention rates of strong talent in financial services, such focus is put on how advisors can become successful that attention is not often paid to what it takes for financial advisors to feel successful. This emotional validation is just as important as data-reinforced evidence, as multiple studies have shown employees who feel a sense of professional accomplishment and achievement in their jobs are happier at work in the long run. Because of this, the industry’s usual benchmarks for success – assets under management (AUM), increased production numbers, or higher premiums – are only a small part of the equation and insufficient to justify the challenging nature of joining the field.

In early 2022, the American College Center for Women in Financial Services surveyed over 800 financial advisors, asking them to self-evaluate their level of success based on both objective criteria and their subjective, personal definitions of success. The results showed that while most advisors consider themselves “successful,” the factors that drive that belief differ across demographics and require specialized and thoughtful approaches for recruitment, development, and retention of those advisors.

Perceptions of Success: An Overview

Encouragingly, 7 in 10 advisors surveyed by the Center for Women in Financial Services self-identified as “successful,” indicating a confident workforce mostly meeting employers’ business goals. 60% of respondents also indicated they primarily entered the financial services industry “to serve/help others,” showing a genuine desire to provide valuable guidance and benefit society.

Among the most important influences in achieving professional success, respondents cited “trust,” “individual effort,” and “specialized knowledge” – especially that gained through designation programs like The College’s – as key factors. However, the implications of these factors begin to diverge when looking at the demographic data.

The Demographic Divide

Among those surveyed by the Center for Women, major differences arose between male and female advisors' perceptions of success. Despite consistently meeting established business goals, more women than men (34% to 22%) identified as being “less successful,” demonstrating a potential lack of confidence among women in financial services as to their professional progress.

On the flip side, however, women were much more likely to view themselves as successful in the first 4-10 years of their practice than men (72% to 57%). This divergence could be explained by a greater emphasis on competition in the socialization of men compared to women, which could make men feel less successful than they really are when using their peers as a benchmark for their success.

When asked what factors were most instrumental to their success, men and women once again seemed to diverge. Men emphasized the importance of individual effort; women, meanwhile, assigned higher importance to communication, community support, and marketing.

Business Impacts and Implications

Overall, the results of the Center for Women’s survey indicated larger teams of advisors might enjoy more widespread feelings of success than smaller ones or individual advisors. This belief also varies by gender between different types of firms.

Women respondents tended to draw much of their strength from the support of smaller, more dedicated teams they could work with on a personal level, generating a sense of shared community that seemed key for women to be satisfied with their business and their own professional development. By contrast, men in financial services appear to derive a sense of success from overcoming the very challenges associated with working in larger, more competition-driven business models. With that said, however, individual women advisors testified to a much higher rate of success than their male peers (83% to 54%). This could indicate that despite their focus on the power of individual effort, men in the industry may also desire the same support systems women in the industry prize, including mentorship opportunities.

From the results of this study, it seems clear the financial services industry has room for continued growth and expansion of professional development programs for women – and their male counterparts. It will remain up to industry leaders to meet the moment and invest more time, money, and effort into making these important resources available to developing financial professionals of all demographics.

Download the research here.

Diversity, Equity & Inclusion Press

Focus Female: Study Shows Big Financial Planning Opportunities for Knowledgeable Women's Market

Yet the results reveal a staggering gap between women with an idea about retirement income options and the ones who have a formal, written retirement plan in place, which is just one in three of the women surveyed. The research also reveals nine in ten (94%) women with partners or spouses equally share or lead financial decision-making for their households, with female retirees and pre-retirees (ages 50-75) more open to financial advice than men.

This combination of decision-making power and openness to advice indicates that women are a critical audience for financial advisors. The study shows this is a clear opportunity for financial professionals to expand their business by providing guidance to women to build financial strategies and close the planning gap. Women reported retirement income planning, guaranteed lifetime income, and health and long-term care among the greatest areas of concern.

These findings are part of the third iteration of the Retirement Income Literacy Survey from The American College of Financial Services, testing consumers’ knowledge about retirement income concepts and focusing on the drawdown phase when Americans have limited or no ability to earn additional money through work. The 2020 study expanded the scope of those surveyed to include Americans ages 50-75.

“There are enough things to lose sleep over, but not having a financial plan should not be one of them,” said Hilary Fiorella, Executive Director of the Center for Women in Financial Services at The American College of Financial Services. “Advisors need to understand that women may come to the table with different approaches to retirement planning, with many thinking about finances holistically and maybe more conservatively than men. Whether that conservatism is based on fear or misinformation is an ideal place to start a conversation with an advisor. While this research suggests lower retirement literacy levels than men, women also demonstrate an awareness of their knowledge level, admitting what they don’t know and prioritizing financial education and advice – the sign of an ideal client relationship.”

Closing the Knowledge Gap: Retirement Income Planning and Finding Guaranteed Income are Key Focus Areas for Women

Retirement literacy remains low overall, with 89% of women and 72% of men receiving a failing grade on a 38-question retirement literacy quiz. The research suggests retirement income plans are less formal or not well understood for men and women alike, further underscored by consumers’ lack of confidence:

- Only one in four women (14%) feel knowledgeable about retirement income planning.

- Four in ten women (43%) feel less comfortable with investment risk because of the COVID-19 crisis.

- Only 16% of women feel very knowledgeable about investment considerations for retirement planning, though self-reported knowledge seems to increase with age and assets.

- Even fewer – 14% of women – feel knowledgeable about strategies for sustaining income in retirement.

Yet women demonstrate they are ready and willing to build a meaningful retirement plan. Six in ten women (61%) believe good advice from a financial professional is very important to satisfactory portfolio performance, more so than men who feel the same way.

Guaranteed income is also a major concern: seventy percent of women emphasize the value of guaranteed income sources, a total that is even higher among eight in ten (80%) Black women and Hispanic women (77%). Yet despite this perceived importance, women rate their own knowledge as low when it comes to the sources to build a guaranteed lifetime income:

- Only two in ten (20%) women feel highly knowledgeable about Social Security.

- Only one out of ten (10%) respondents feel educated about annuity products in retirement.

“Women are concerned about running out of money in retirement and more than half want their advisors to educate them on strategies to protect against investment risk and on how to prudently spend each year to ensure they don’t outlive their assets,” said Timi Jorgensen, PhD, Assistant Professor and Director of Financial Literacy at The American College of Financial Services. “Women and their advisors should prioritize understanding of retirement savings vehicles and how guaranteed income fits into a retirement income strategy.”

Long-Term Care Fraught with Concerns, Misconceptions: Gap Exists Between Care Need, Funding Plan

Women outscored men on the understanding of who pays for long-term care, though only three in ten women (30%) correctly stated that most expenses are paid for by Medicaid, compared to just one in five men. Still, half of women express a high level of concern about the cost of healthcare in retirement, with one-third (34%) saying they worry about paying for long-term care expenses.

Only 12% of women feel highly knowledgeable about long-term care, and the research reveals a sizable gap exists between believing long-term care is likely and having a funding plan to support it:

- 50% of women expect to require long-term care in the future, yet fewer than three in 10 (27%) have a plan to fund a long-term care need.

- Only one in four (27%) women claim they own any type of insurance that would cover long-term care needs.

- Black and Hispanic women are less likely to believe they will develop a care need, even though national studies suggest Black and Hispanic women are especially likely to be caregivers, and caregiving can negatively impact their health.

“There is a troublingly low level of self-reported and tested knowledge surrounding long-term care needs,” said Jorgensen. “Long-term care is a critical issue for this audience, and advisors can help women close the gap from theoretical to practical in terms of expected long-term care need and how it’s paid for.”

STUDY METHODOLOGY

The American College of Financial Services commissioned Greenwald & Associates for the study. Respondents were asked a number of knowledge, behavior, and attitudinal questions to assess retirement literacy among individuals who are approaching or already in retirement. Information for this study was gathered through online interviews with over 1,500 Americans, including conducted between April 29 – May 18, 2020 (821 women, 688 men). To qualify for participation in the study, respondents had to be ages 50-75 and have at least $100,000 in household assets, not including their primary residence.

ABOUT THE AMERICAN COLLEGE OF FINANCIAL SERVICES

Founded in 1927, The American College of Financial Services is the nation’s largest nonprofit educational institution devoted to financial services professionals. Holding the highest level of academic accreditation, The College has educated over 200,000 professionals across the United States through certificate, designation, and graduate degree programs. Its portfolio of applied knowledge also includes just-in-time learning and consumer financial education programs. The College’s faculty represents some of the foremost thought leaders in the financial services industry. Visit TheAmericanCollege.edu and connect with us on LinkedIn, Twitter, Instagram, Facebook, and YouTube. Discover all the ways you can expand your opportunities with us.

Diversity, Equity & Inclusion Press

Karim Hill Named Executive Director of the Center for Economic Empowerment and Equality at The American College of Financial Services

As Executive Director of The College’s newest Center of Excellence, Hill will oversee the Center’s research, thought leadership, curriculum and course development, programming, and scholarships aimed at promoting economic justice for underserved communities.

“Our exhaustive national search has come to an end and was well worth it. Karim brings a unique skillset to The College that complements our near century in financial services, having earned significant career success at some of our nation’s largest banks, representing his dedication to the industry and his ability to communicate and execute upon complex ideas to improve the lives of others,” said Nichols. “His embrace of the possibilities that could come through a collective impact approach to economic justice is what we need to start operationalizing Four Steps Forward for Black America and laying the foundation for The Center’s success.”

The Center for Economic Empowerment and Equality’s mission is to cultivate lasting relationships between the financial services sectors and all underserved groups. Under Hill’s leadership, The Center will catalyze, convene, and promote evidence-based knowledge in partnership with the financial services industry, nonprofit organizations, government agencies, and broader corporate America to drive solutions that grow businesses and uplift communities in need.

“I’m honored to lead the new Center for Economic Empowerment and Equality at The American College of Financial Services,” said Hill. “Joining The College in this inaugural position is an exceptional opportunity for me to take part in re-imagining how the financial services industry approaches diversity, equity, and inclusion. I look forward to developing and implementing a viable, actionable plan for sustainable, generational change that will help narrow the wealth gap and have a lasting effect on how the profession best serves an increasingly diverse nation.”

Hill has devoted two decades of his career to the financial services industry, spending many years at some of our nation’s biggest banks, including Wells Fargo, Bank of America, Capital One, and Citizens Bank. In September 2020, he became a Board member and Interim Executive Director of BDC Capital Community Corporation, a Consumer Development Financial Institution focused on reducing the racial wealth gap in Massachusetts by deploying capital to underrepresented groups via term loans, equity investments, mezzanine loans, and financial based technical assistance. Some 80% of the capital raised has been distributed to Black business owners.

Since 2015, Hill has led the New England Business Association as its President and Chief Executive Officer, identifying gaps and fixing processes, as well as growing the organization’s membership from 399 member companies to nearly 1,600. As Foundation Market President for northern California at Bank of America, he managed a $1.5 million philanthropic budget for the company, and in a similar role as Foundation Market President for New York State at Capital One Bank, he oversaw its philanthropic budget.

Hill is the Co-Founder of the Black Vanguard Alliance, a former Board member for the United Way of Northern California, and is a contributor for New England Blacks in Philanthropy and the New England Board of Higher Education. He earned a Bachelor of Science degree from Ohio University and a Master of Business Administration degree from Florida International University – Chapman Graduate School of Business. He is green belt certified in Six Sigma Methodology, a quality and process improvement methodology.

ABOUT THE AMERICAN COLLEGE OF FINANCIAL SERVICES

Founded in 1927, The American College of Financial Services is the nation’s largest nonprofit educational institution devoted to financial services professionals. Holding the highest level of academic accreditation, The College has educated over 200,000 professionals across the United States through certificate, designation, and graduate degree programs. Its portfolio of applied knowledge also includes just-in-time learning and consumer financial education programs. The College’s faculty represents some of the foremost thought leaders in the financial services industry. Visit TheAmericanCollege.edu and connect with us on LinkedIn, Twitter, Instagram, Facebook, and YouTube. Discover all the ways you can expand your opportunities with us.

Diversity, Equity & Inclusion Press

The American College of Financial Services and the Society for Financial Education & Professional Development Announce Partnership to Amplify Financial Literacy and Economic Mobility Programs for Underserved Communities

Underrepresented communities have faced institutional barriers to financial security and wealth for decades, leaving a significant gap between those benefiting from the current system, and those being left behind.

“It’s more important than ever for all generations in underserved communities to learn financial literacy principles so that they can effectively manage their money throughout their lifetime and act as ambassadors in closing the economic equality gap,” said Nichols. “That’s why we are pleased to partner with SFE&PD on this crucial program to equip our next generation with a roadmap for financial well-being at this important point in their financial journeys that will last for years to come.”

Through the collaboration between The College, the nation’s largest accredited, nonprofit institution devoted to applied financial knowledge and education, and SFE&PD, a national non-profit leader in the financial literacy movement, the two organizations will be able to improve financial education and wellness for underserved communities by offering access to tools and support, like HBCU scholarships, mentorship and internship opportunities, access to The College’s education programs, and peer-to-peer financial literacy programs that help students build out successful career-pathways.

“Thanks to our partnership with The American College of Financial Services, SFE&PD can expand our reach and give HBCU students access to a financial toolkit that can help them increase their economic prosperity and the communities they serve throughout their lives,” said Ted Daniels, SFE&PD Founder and President. “Collaborative partnerships like this help to level the playing field for diverse students who want to enter the field of financial services but often do not have access to information or a support system to make informed financial choices or build a career in the industry.”

“The mission of The American College Center for Economic Empowerment and Equality is to help close the wealth gap and promote economic justice with collective, community-focused solutions that last,” said Karim Hill, Executive Director of the Center for Economic Empowerment and Equality. “Empowering underserved communities and positioning them for success requires action. With our collaboration with SFE&PD, we hope to amplify their decades-long work educating Black men and women through our strong partnerships with the nation’s leading financial services companies. We are confident this program will help develop a new pipeline of well-qualified and aspiring professionals who will innovate and lead across the industry.”

ABOUT THE AMERICAN COLLEGE OF FINANCIAL SERVICES

Founded in 1927, The American College of Financial Services is the nation’s largest nonprofit educational institution devoted to financial services professionals. Holding the highest level of academic accreditation, The College has educated over 200,000 professionals across the United States through certificate, designation, and graduate degree programs. Its portfolio of applied knowledge also includes just-in-time learning and consumer financial education programs. The College’s faculty represents some of the foremost thought leaders in the financial services industry. Visit TheAmericanCollege.edu and connect with us on LinkedIn, Twitter, Instagram, Facebook, and YouTube. Discover all the ways you can expand your opportunities with us.

ABOUT THE SOCIETY FOR FINANCIAL EDUCATION AND PROFESSIONAL DEVELOPMENT

For more than 22 years, SFE&PD, based in the Washington, D.C. area, has served as an award-winning financial literacy and professional development nonprofit teaching financial skills to people of all ages and backgrounds with a focus on underserved communities and HBCU college students. SFE&PD is led by President and Founder Ted Daniels, a leader in the global financial literacy movement. Learn more at sfepd.org and connect with SFE&PD on social media: Facebook, Instagram, LinkedIn, Twitter, and YouTube.

Diversity, Equity & Inclusion Press

Economic Empowerment Day—A Philanthropic Partnership Announced Between The American College of Financial Services and the Tulsa Community

The goal of Economic Empowerment Day is to create a collective focal point for the national conversation on the racial wealth gap and the inequality in access to capital.

“The College’s commitment to Black America, and to the Greenwood District and the Tulsa community, transcends our sponsorship. We are proud to partner with and support philanthropic actions in Tulsa through The College’s Chartered Advisor in Philanthropy® (CAP®) program and the CAP® Impact Scholarship,” says George Nichols III, President and CEO at The American College of Financial Services. “The spirit of Economic Empowerment Day mirrors The College’s mission to uplift Black and underserved communities across America.”

Through the partnership with Economic Empowerment Day, The College is offering the CAP® Impact Scholarship to the Tulsa philanthropic community to support nonprofit gift planners from historically underrepresented communities in their pursuit of advanced knowledge that will enable them to better facilitate the generosity of donors for the benefit of their communities and society.

Tulsa CAP® Impact Scholarship recipients will join The College’s Advisors of Color network, created in 2021 to engage 100 advisors of color with local communities in the program this year and are currently recruiting for a Tulsa CAP® study group for a fall launch. The College has longstanding partnerships with 19 community foundations across the country who host interdisciplinary CAP® study groups to amplify the impact of philanthropy through knowledge.

“Hosting an economic empowerment conference of this caliber with a critical focus on closing the Black wealth gap is transformational,” said Phil Armstrong, Project Director of the 1921 Tulsa Race Massacre Centennial Commission. “This discussion is essential to reviving the legacy of Black Wall Street and will help set the course for Black entrepreneurs to establish a legacy of wealth for themselves and generations to come.”

The hybrid conference, held in person and online June 1, 2021, will have three tracks for different audiences focused on specific areas of wealth disparity. One track is for institutional investors, one is for entrepreneurs and business owners, and the third is for individuals and families. President Nichols and Dr. Pamela Jolly, Senior Strategist at The College and Founder and CEO of Torch Enterprises, will be participating in sessions throughout the day.

ABOUT THE AMERICAN COLLEGE OF FINANCIAL SERVICES

Founded in 1927, The American College of Financial Services is the nation’s largest nonprofit educational institution devoted to financial services professionals. Holding the highest level of academic accreditation, The College has educated over 200,000 professionals across the United States through certificate, designation, and graduate degree programs. Its portfolio of applied knowledge also includes just-in-time learning and consumer financial education programs. The College’s faculty represents some of the foremost thought leaders in the financial services industry. Visit TheAmericanCollege.edu and connect with us on LinkedIn, Twitter, Instagram, Facebook, and YouTube. Discover all the ways you can expand your opportunities with us.

The 1921 Tulsa Race Massacre Centennial Commission pays homage to the martyrs of the 1921 Tulsa Race Massacre and celebrates the resilience of the Greenwood spirit and the Black Wall Street mentality. The projects of the 1921 Tulsa Race Massacre Centennial Commission will educate Oklahomans and Americans about the Race Massacre and its impact on the state and Nation; remember its victims and survivors; and create an environment conducive to fostering sustainable entrepreneurship and heritage tourism within the Greenwood District specifically, and North Tulsa generally.