Philanthropic Planning Research

Mapping the Future of Philanthropic Advising

We will also look into the future and ask practitioners what trends they are seeing and what skill sets are needed for the next three to five years. Findings will help organizations better prepare advisors for success and provide much needed data on our changing profession.

2020 Retirement Income Literacy Survey Results

The survey, the third of its kind performed by The College, included feedback from over 1,500 people nationwide. It raised concerning questions about how well-prepared many older Americans are to leave the workforce and draw down their savings and accumulated assets, despite an increased focus on educating the general public about the importance of proper retirement planning.

To qualify for participation in the study from April 29 to May 18, 2020, during the beginning of the Covid-19 pandemic, participants had to be between 50 and 75 years old and have at least $100,000 in household assets (not including their primary residence). They were then asked to respond to a series of 78 questions assessing their financial and social status and testing their knowledge of basic financial planning and retirement planning principles. On the 38 questions that addressed retirement planning, 81% of participants received a failing grade, indicating a distressing lack of understanding regarding financial planning fundamentals or current retirement realities. In fact, the overall average score on the quiz was 42%, with only a third of consumers attesting to confidence in their retirement planning skills.

Faculty at The College expressed unease about the study's results – especially considering Covid-19 pushed many consumers toward unplanned and premature retirements.

“With a troubled economy and an acceleration of early or forced retirements, consumer understanding of retirement principles is particularly important. Yet the survey demonstrates that retirement literacy remains troublingly low,” said Steve Parrish, JD, RICP®, CLU®, ChFC®, RHU®, AEP®, Adjunct Professor of Advanced Planning in The College’s Retirement Income Certified Professional® (RICP®) Program.

The Income and Investment Knowledge Gap

The general lack of retirement knowledge among consumers who took the survey was broad in scope, covering many concepts College faculty and industry experts agree are fundamental to sound retirement planning. More than half of respondents underestimated the current life expectancy of a 65-year-old man, suggesting they may not realize how long their accumulated assets may have to last in retirement. Only 32% were aware of the limits on amounts they could safely withdraw from a retirement account each year without suffering tax penalties, and 65% didn’t know that a negative single-year return in a retirement portfolio is more impactful if it happens at the time of retirement rather than before or after, suggesting a lack of understanding in how the pre-retirement period factors into long-term planning.

“Determining how much you can spend in retirement when you don’t know how long you will live or what market returns you will experience is complicated,” said Wade Pfau, PhD, CFA, RICP®, Professor of Practice at The College. “Unfortunately, the task is even harder for Americans who do not recognize how to properly evaluate these risks in the first place. The survey demonstrates that these retirees don’t fully understand the consequences a bad market can have on their long-term retirement prospects.”

In addition, while over 60% of consumers reported on the survey they felt at least moderately knowledgeable about investment management, survey results showed that, in practice, these individuals might be overconfident in their abilities. Only 18% of those surveyed knew B-rated corporate bonds had a higher yield than AAA corporate bonds or treasury bonds. Furthermore, only 26% understood the relationship between bonds and bond funds and interest rates, demonstrating a cognitive dissonance regarding investing.

Long-Term Care Realities Leave Many Unprepared

With the public health crisis of the Covid-19 pandemic looming large over society, the survey found that considerations about long-term healthcare needs caught most consumers off-guard. Only 31% of survey respondents said they had a plan in place for how to fund long-term care needs, and only 23% said they had some kind of long-term care insurance.

The divergence between belief and reality regarding the need for such insurance was even more concerning. Only half of the respondents said they considered it even somewhat likely they would need long-term care services in the future when industry statistics state at least 70% will. More than half said they hadn’t considered long-term care a factor in their retirement plans. In addition, many consumers didn’t understand the burden the lack of such insurance could place on their loved ones: just 25% knew that family members provide the majority of long-term care services nationally, and 70% said they didn’t expect their own family to provide such care – a potentially dangerous disconnect.

“The story coming from the data suggests people underestimate their life expectancy – and what’s more, assume they will be healthy for the entirety of their life – when the truth is much different,” said Timi Joy Jorgensen, PhD, Director to Assistant Vice President of Financial Education & Well-Being at The College.

Pandemic Highlights Importance of Preparedness

Another effect of the Covid-19 pandemic on retirement planning could be felt in reactions to the market downturn it created. Surprisingly, nearly 40% of consumers reported feeling highly prepared for market turbulence, indicating an unanticipated strength of financial advice – and having a formal plan beforehand was frequently cited as a difference-maker.

While only one in three respondents reported having a written plan for retirement, those with the plan reported feeling much more prepared to deal with the downturn than those without. 54% of respondents said their financial plans are holding steady despite rough seas. However, the onset of the pandemic also shifted the mindset of many consumers, with 40% saying they now feel less comfortable taking investment risks.

“A bottom-line conclusion from this survey is that until the plan is written, it isn’t real,” said Parrish. “We are in an environment where people are coming into retirement sometimes faster than expected, without an approach to converting their pot of money into a stream of income, and yet they are looking at increased life expectancy, increased risk of a long-term care event, and decreased prospects of having their needs covered by Social Security and employer plans.”

While the stakes in the retirement planning game may be high, College thought leaders offered words of encouragement to those who may have participated in the survey and professionals in the field.

“This is a clarion call for financial advisors to help their clients increase financial literacy and, together, craft a plan for a successful retirement,” said Parrish. “Advisors should take heed of this situation and embrace the opportunity it provides to help Americans prepare for a successful retirement.”

Jorgensen agreed with his sentiments in her own statement, especially when it came to long-term care planning. “Well-prepared advisors can help with important long-term care conversations and work with clients to plan when and how to have these crucial discussions with family about the likelihood of healthcare needs,” she said.

You can see the full results of the 2020 Retirement Income Literacy Survey here.

Diversity, Equity & Inclusion Research

How Can Financial Advisory Firms Prepare for A More Diverse Future?

The Current Situation

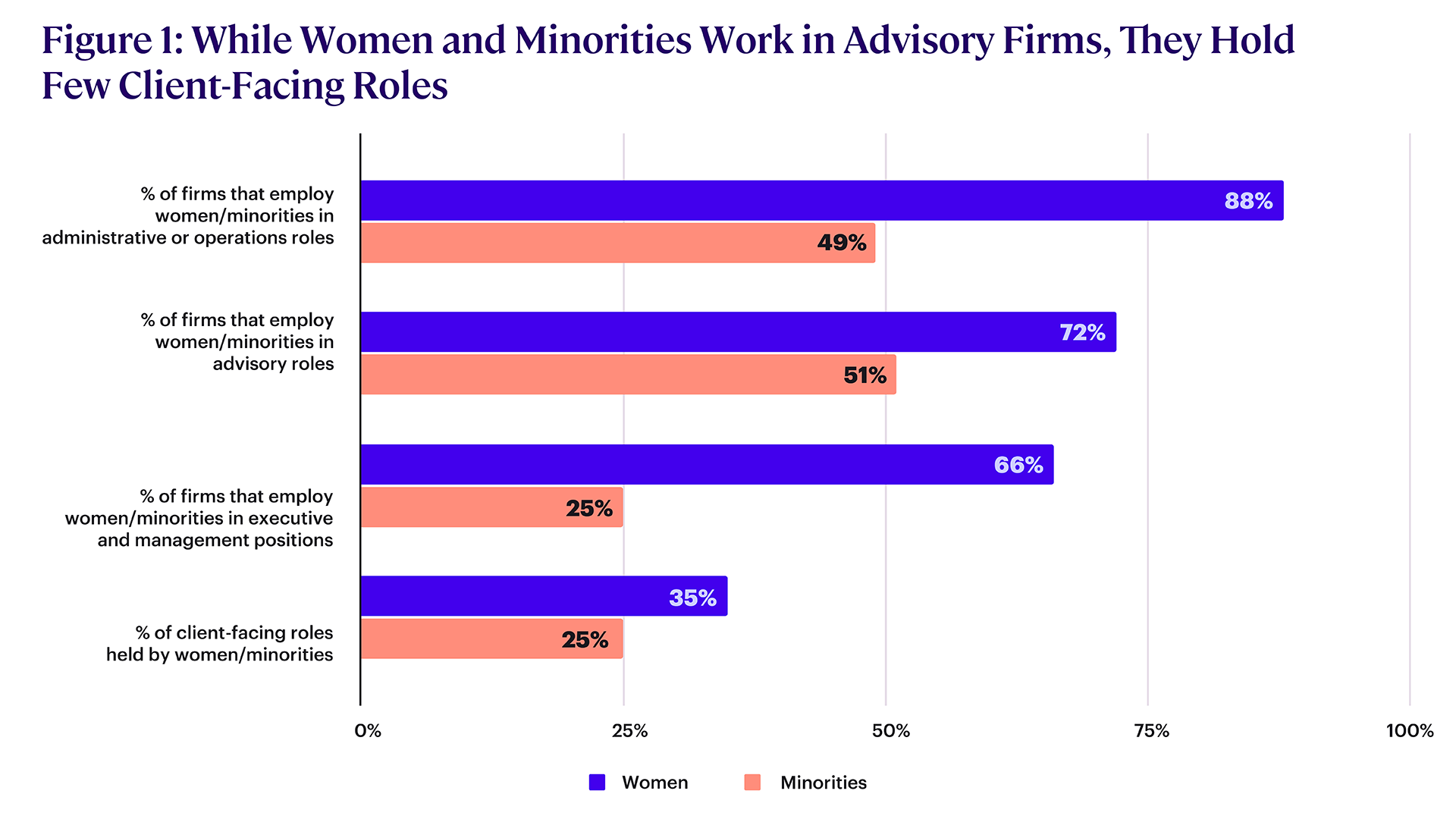

It is no secret that the financial advice industry has remained largely aging, male, and White even as America has grown more diverse, and women and minorities have gained control of a greater share of the nation’s wealth (see Figure 1).

- American women control more than $10 trillion of financial assets.

- Between 2016 and 2019, Black and Hispanic family wealth rose 33% and 65%, respectively, compared to 3% for white families.

The American College of Financial Services. Diversity & Inclusion in Financial Advice 2020. 2020.

As a result, many industry experts worry about the profession’s long-term growth and survival prospects. Unless firms can attract more minority, young, and female practitioners, there is a real risk that the industry will struggle to remain relevant in the decades ahead.

To better understand the factors driving the industry’s lack of diversity and what is needed to promote change, we conducted The American College of Financial Services Diversity & Inclusion in Financial Advice Survey. Here is what we found.

The Roadblocks

Almost 60% of respondents to the survey recognized that lack of diversity is a problem within the advice business. However, relatively few believed that their firms are working to resolve the problem:

- Only 35% said their firm tries to foster racial diversity in its staff.

- Only 36% said their firm works with suppliers committed to diversity.

Our research found that there are several structural factors standing in the way of increased diversity in financial advisory firms.

- Limited Entry Points – Less than 20% of firms used online postings to recruit new advisors, with 44% preferring to use networking. Unfortunately, by relying on networking for new talent, advisory firms tend to replicate the demographic mix of their current advisors and staff.

- Business-building Expectations – Many firms expect advisors to pay for themselves immediately or very quickly. They, therefore, tend to hire already-successful advisors who arrive with their own book of business, which results in no change in the industry’s demographics. Firms also often expect new advisors to rely on their own network of affluent investors to build a book of business and generate leads, which disadvantages candidates from less privileged backgrounds who do not have a network to tap.

- Lack of Transparency in Distributing Sales Leads – While 60% of advisors felt leads and new clients were distributed fairly at their firm, 71% of firms lack a visible process for distributing leads. With limited transparency and accountability in how leads are distributed, women and minority advisors may find themselves at a disadvantage.

The Solution

There are many actions that firms can take to accelerate their diversity efforts, including: Appoint an executive with formal responsibility for diversity. Developing mentoring programs. Implementing collaborative conflict resolution procedures. Allowing anonymous reporting of harassment. Setting formal workforce diversity goals. Offering diversity education and training. Establishing a diversity committee.

To learn more about how well these and other strategies work and how your firm can implement them, download the full survey results today.

Ethics In Financial Services Research

An Analysis of The State of Stakeholder Trust in the Financial Services Industry

Trust Deficit

In a study commissioned by The American College Cary M. Maguire Center for Ethics in Financial Services, researchers spoke to 15 senior executives at top U.S. insurance and asset management companies.

Most agreed that, in the wake of the global financial crisis, consumers lost trust in financial institutions and professionals. Looking ahead, consumers are demanding that financial institutions:

- Make meaningful contributions to societal challenges such as climate change.

- Offer transparency and open communication.

- Simplify complexity and explain products clearly.

- Deliver a strong digital experience.

Unfortunately, even firms that are committed to improving relations and being held accountable have found it hard to rebuild trust in the face of various roadblocks, including:

- Widespread bias against large financial institutions, which devalues firms’ efforts to improve.

- A tendency to lump financial institutions together irrespective of sector, which obscures individual firms’ progress.

- Short-termism and shareholder pressure to deliver growth, which threaten to undermine long-term, customer-focused initiatives.

- An inability to change the underlying structures of the industry, which leaves firms powerless to control things like independent distributors’ behavior.

Navigating a Way Forward

Despite the challenges, enhancing consumer trust is a key strategy for financial institutions and professionals that want to thrive in a changing environment (see Table 1).

Table 1: Emerging Trends Accelerating the Role of Trust as a Practice

| Key Trend | Implications |

| Generational Shift |

|

| Digital Insurgents |

|

| Serving Diverse Consumers |

|

| Artificial Intelligence |

|

| Dialogue with Regulators |

|

By focusing on building trust and delivering the types of products and services that consumers truly want, financial firms can chart a safer path through this changing environment. Greater trust will help firms attract younger consumers, adapt to diversity, deal with competition from tech-driven startups, manage the risks (and enjoy the benefits) of AI, and work more effectively with regulators.

While building trust may be challenging, for far-sighted firms, the benefits could be huge.

To learn more about how firms can tackle the roadblocks that make trust-building challenging, download the full research report now.

Diversity, Equity & Inclusion Research

Black America's Financial Wellness

It takes more than information to influence people’s lives, and money alone does not result in financial health. Financial well-being is “a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow them to enjoy life.”

Financial well-being is a holistic view of our financial lives and includes our access to financial services, our financial behaviors and decisions, and how we think and feel about money. Because financial well-being is both objective and subjective, it accommodates the realities and individualities of financial circumstances. It is the ideal measurement to evaluate the financial health of individuals and communities.

Generally, financial and economic research controls for gender, race, or ethnic heterogeneity of populations. In statistical analysis, controlling for race or gender is simple. In real life, that's not an option. Nobody gets to push the “appear as a gray avatar” button to walk into a bank, apply for a mortgage, or navigate starting a small business. We show up as we are, and our identities have real implications on how we experience life. The reality of carrying our identity with us throughout our financial and economic life experiences prompted this research.

To understand the cultural specificity of financial well-being, Timi Joy Jorgensen, Ph.D., Assistant Professor and Director of Financial Education and Wellbeing at The American College of Financial Services, conducted research that deconstructed the variables that were predicting financial well-being for different populations. This report focuses exclusively on the specific predictors of financial well-being for Black women and men in the United States. Understanding the identity-specific predictors of financial well-being is the first step for the financial services industry to engage in culturally competent and meaningful ways with Black Americans. Financial empathy and data-informed business solutions can foster a business environment of concerted economic inclusion.

To learn more about Black America’s financial well-being and how it can be improved, download Dr. Jorgensen’s white paper today.

Ethics In Financial Services Research

AI Ethics and Life Insurance: Balancing Innovation with Access

AI Can Support a Better Life Insurance Industry

In the life insurance industry, risk-based underwriting helps insurers price products properly by assessing individuals’ risk profiles and assigning them appropriate premiums. New AI-enabled underwriting tools enhance this process by integrating big data and sophisticated analysis that is beyond the reach of human underwriters.

These models have the potential to expand access to life insurance products by helping insurers understand new markets and build products tailored to their needs.

However, the opaque nature of these tools creates the risk that they may unintentionally discriminate against protected classes.

For example, an AI system may use criminal records data to support underwriting decisions. However, the criminal justice system has a history of bias, imposing harsher penalties on Black and Hispanic perpetrators compared to white offenders committing the same crimes. Thus, the AI system could inadvertently use criminal history as a proxy for race, with discriminatory outcomes.

Seizing the Benefits, Avoiding the Risks

In work commissioned by The American College Cary M. Maguire Center for Ethics in Financial Services, researchers propose three tactics to help life insurers take advantage of the benefits of AI-enabled underwriting while avoiding its potential pitfalls.

Start with Trust

Trust is crucial in life insurance, and AI-enabled underwriting can make maintaining trust more difficult. To promote trust:

- Consider the impact of AI systems on communities.

- Focus on accountability and ensuring that all stakeholders focus on the higher purpose of life insurance.

- Tackle problems with “explainability” so that consumers can better understand AI-enabled underwriting decisions.

Corporate Culture is Key

Ultimately, decisions related to technology and AI implementation are no different than other important corporate decisions, and similar processes and approaches are demanded. Corporate decisions should be made within the context of a strong, ethical culture.

Transparency and openness are key, and leadership should be receptive to feedback. Employees on data science teams should be encouraged to think about ethical issues and speak up when they see problems.

Above all, human judgment should continue to play a role in evaluating and managing AI-enabled systems.

Industry-wide Standards Can Support Ethical Outcomes

By standardizing legal and regulatory frameworks, life insurers, self-regulatory bodies, and state and federal regulators can help mitigate some of the risks associated with AI-enabled underwriting. Industry-wide standards that fill the gaps in current rules by directly addressing the use of AI would help insurers develop their internal policies and would support audits of AI systems and their outputs. Proper regulation and oversight would help enhance trust in these systems, benefiting both consumers and the life insurance industry.

To learn more about how the insurance industry can ensure that AI-enabled underwriting enhances life insurance products without increasing discrimination, download the research now.

Diversity, Equity & Inclusion Research

Black Women, Trust and the Financial Services Industry

- 60% of Black women expressed difficulty finding financial professionals they trust

- 58% of Black women believe race affects treatment more than gender

- 10% more Black women trust individual financial advisors than institutions

This inaugural study from the Center for Economic Empowerment and Equality combines quantitative and qualitative methods to create a holistic picture of Black women’s perception of financial services and money, their wants and needs, the role they play as decision-makers in their households and communities, and the opportunity the financial services industry has to better connect with them throughout their wealth journey by building a tailored and trusting relationship.

Gain insights that exemplify the Center’s collective mindset to narrow the racial wealth gap here.

Ethics In Financial Services Research

AI-Enabled Underwriting Brings New Challenges for Life Insurance

Insurers increasingly use AI tools to make underwriting decisions and regulators are struggling to keep up with the dangers this poses – especially the risk of embedding discrimination. Is there a framework that could help the industry move forward safely?

The Problem

Third-party AI systems are making many insurance decisions these days. Using both medical and non-medical information—such as credit profiles and social media activity—these systems categorize consumers and assign them risk profiles. Insurers hope these systems will yield better underwriting and boost profitability. But industry players also worry that these “black box” systems, many of which use proprietary data and algorithms, could fall afoul of the rules against discrimination in underwriting.

Many states prohibit both discrimination based on protected characteristics like race and proxy discrimination, which occurs when a neutral factor disproportionately affects a protected class. Unfortunately, ensuring that AI models do not breach these rules is difficult.

A study by Azish Filabi, JD, MA, and Sophia Duffy, JD, CPA at The American College of Financial Services notes that: AI systems can unintentionally result in unfair discrimination in insurance underwriting by using data sources that have a historical bias or act as proxies for protected characteristics, leading to discriminatory outcomes. It can be difficult to assign responsibility for decisions by AI systems—insurers may be ultimately responsible for their products, but they are not always the parties that are most knowledgeable about the technical details of the underwriting system or most able to shape system design.

Creating a measurable definition of proxy discrimination by AI-enabled underwriting is challenging because insurers can use an underwriting factor if it is related to actual or reasonably anticipated experience and existing standards do not define the threshold for effectiveness of the factor. Therefore, each insurer’s justification for the usage of a factor will be unique. Given the risks posed by AI-enabled underwriting tools and the limitations of current regulatory structures, the insurance industry could face additional regulation and reputational damage if it does not ensure these tools are used responsibly and appropriately.

The Solution

To address the challenges posed by AI-enabled underwriting, researchers at The College recommend a three-part framework: The establishment of national standards to serve as guardrails for acceptable design and behavior of AI-enabled systems. A certification system that attests that an AI-enabled system was developed in accordance with those standards. Periodic audits of the systems’ output to ensure it operated consistent with those standards. Establishing nationally accepted standards would involve developing guidelines to ensure that AI systems are designed using best practices in system design and actuarial principles. The standards should emphasize:

- Accuracy: Data used for decision-making should be evaluated for potential bias and errors.

- Significance to Risk Classification: Inputs should be assessed to determine their relevance to the risk being evaluated. If an input has a causal link to the risk, it is permissible. Otherwise, it should be excluded unless it meets an agreed threshold of actuarial significance and accuracy.

- Target Outcomes: Target outcomes should be established for algorithm calibration, such as offer rates and acceptance rates among different demographic groups. These targets could be based on a firm's target clientele or insurance rates prior to AI use or a consensus-driven, more inclusive view of insurance availability and payout rates.

Once the standards are established, both front-end and back-end audits should be used to monitor compliance. On the front end, certification would indicate algorithm developers’ compliance with standardized practices when creating an algorithm. On the back end, audits would review the system for adherence to the standards with respect to its outputs once operational.

Under the proposed framework, the National Association of Insurance Commissioners (NAIC) would develop the standards in partnership with industry. Uptake would be supported by legal mandates requiring industry players to adopt the standards and an independent self-regulatory body would oversee the certification and audit processes. The proposed framework would fill the gaps in current legislation and empower the insurance industry to self-regulate as it continues to embrace AI-enabled underwriting.

To learn more about how AI is changing insurance and how the industry should respond, download the research now.

What Do Clients Want from Financial Advisors?

To help advisors understand their clients better, the American College O. Alfred Granum Center for Financial Security in collaboration with faculty from the American College Cary M. Maguire Center for Ethics in Financial Services and the American College Center for Women in Financial Services conducted a national online survey of 1,157 individuals to answer some key questions. Understanding our findings may help you build better relationships with your clients.

What characteristics do people want from an advisor?

Respondents were asked to “rank the most important characteristics you would look for” when selecting a financial advisor. Here is what they said:

| Advisor Characteristics You Would Look For | #1 | #2 | #3 |

| Evidence of knowledge (education, certifications) | 27.2% | 11.7% | 10.4% |

| Trustworthy | 20.1% | 13.5% | 13.2% |

| Ability to listen to and understand your goals | 18.9% | 19.5% | 13.5% |

| Clearly communicates financial concepts | 10.8% | 7.6% | 9.5% |

| Positive recommendations by people you know | 8.0% | 12.8% | 12.9% |

| Online reviews | 4.4% | 6.8% | 7.5% |

| Values my input | 2.2% | 9.3% | 12.2% |

These results show that clients value education and certifications, as well as trustworthiness and advisors’ ability to engage with and understand clients’ goals.

What services are consumers looking for when they seek out professional advice?

Advisors need to understand the specific services that clients need. As the chart below shows, they are most interested in getting help preparing for retirement and managing investments.

We also asked if consumers seek out advisors who can evaluate investments and make portfolio recommendations, or are primarily interested in an advisor who develops a plan to meet various financial goals.

Interestingly, 52.5% primarily sought help meeting financial goals, while 47.5% felt that investment evaluation was a more valuable service. This indicates that more consumers are looking for goal-based planning services than traditional investment advice.

How important are environmental, social, and governance (ESG) factors?

We asked our respondents, “How important is it that your advisor considers the environmental and social performance of the companies you will invest in?” The answers surprised us.

Clearly, clients care about ESG. They also care about their advisors’ personal values – 53.8% said an advisor’s personal values influence their decision to do business with the financial advisor.

Did COVID change the importance of in-person advice?

The pandemic had a major impact on how advisors deliver services and many wonder how clients feel about the changes. Our findings suggest that most clients prefer a balance of online and in-person services.

When we asked our respondents, “What is your preferred form of contact with a financial advisor?” we found that:

- 52.3% prefer an initial in-person meeting followed by subsequent Zoom or telephone meetings

- 38.9% prefer in-person only

In terms of meeting frequency, a plurality of respondents felt that every 6 months was the sweet spot – although some disagreed.

Are young investors overconfident?

As advisors try to recruit new young clients, they may need to better understand how consumers’ confidence and financial knowledge levels change with age.

Financial literacy scores – measured by how many correct answers respondents provide for questions about financial concepts – increase with age. The percentage of correct answers is:

- 38.6% for those under age 30

- 42% for those in their 30s

- 45.8% for those in their 40s

- 58% for those in their 50

- 65.8% for those in their 60s

- 71.2% for those 70 and older

Despite the increase in knowledge with age, however, the percentage who indicated that they were “very confident” choosing investments fell from 40% for those under 40 to 10.2% for respondents in their 60s and just 5.3% for respondents in their 70s and older.

Bottom Line

In summary:

- Consumers want advisors who are knowledgeable, trustworthy, and good listeners.

- Saving for retirement in defined contribution plans has created a strong desire for knowledge of retirement income planning.

- Investors want their advisor to consider their ESG preferences when building an investment strategy.

- More consumers prefer to attend regular meetings with their advisor either through Zoom or a phone call, but a strong majority still prefers to be physically present for initial meetings with an advisor.

- Young investors are confident in their ability to choose investments, but also score poorly on financial literacy. This may suggest that younger investors are vulnerable to overconfidence.

Download the 2022 Granum Center for Financial Security Consumer Survey results here.

Ethics In Financial Services Research

The State of Trust in Financial Services

In fact, according to industry metrics like the Edelman Trust Barometer, financial services consistently appears as one of the least-trusted sectors in business.

However, that perception may be changing. As part of its ongoing work to measure the state of public trust in the financial services industry, the American College Cary M. Maguire Center for Ethics in Financial Services used a combination of surveys, focus group discussions, and individual interviews to gather insights from nearly 2,000 consumers about their beliefs and behaviors regarding the financial services industry in early 2021. The results point toward a more encouraging picture of the future than many might think, but one that must be managed for continued success.

In September 2023, the Center for Ethics' Trust in Financial Services Study was also named a finalist at the 2023 WealthManagement.com Wealthies Awards for Industry Research Provider!

View our insights on the State of Trust in Financial Services.

Trust in Financial Services: An Overview

Despite well-chronicled dynamics and practices that cratered public trust over a decade ago, the Center for Ethics in Financial Services’ research shows that trust in financial services is moderate compared to other service industries: the industry ranked third in a listing of consumers’ seven most-trusted service fields behind healthcare and education, and above such groups as government, telecommunications, and media.

This improving picture may be reason for optimism, but results showed lingering trust issues remain among certain demographic groups. For example, those with low trust in financial services tend toward the older and younger ends of the age spectrum, including more women than men, are less educated, and have a lower household income. Many of these groups are those who would benefit most from the services the industry can provide. Furthermore, data suggests those with low trust are more likely to have no loans or debt, indicating avoidance of the financial system altogether – another hurdle to overcome.

Despite this, trust has the potential to be a key enabler of industry change, provided financial companies can understand the feelings and motivations among low-trust demographics and make inroads based on their individual priorities.

Aligning Values

The Center for Ethics in Financial Services’ survey results suggest today’s consumers of financial services are stuck between a rock and a hard place. They are frustrated in their search for unbiased, trusted information they can use to determine whether they fit with a financial company. They do their homework, but they are often overwhelmed and don’t always know where to turn for education.

Consumers indicated reasons that drive them to engage with a financial services company. These include a company’s product and service transparency, good customer service, and community involvement. Many consumers also said a company’s treatment of employees and contributions to social justice and diversity, as well as commitment to keeping their personal information private, could influence their decision.

Additionally, more than half of consumers said they preferred financial products that are easy to use and understand. This preference was so strong it outweighed fees associated with a product or service, the level of risk involved, or guarantees offered by a company. Because of this, firms offering simpler, streamlined products that help consumers consolidate their relationships could help build consumers' confidence about the quality of advice they receive.

Meeting Consumers Where They Are

The Center’s study showed trust levels also varied among different methods of accessing financial products and services in financial services. In-person access appeared more important to low-trust consumers; for high-trust consumers, the importance of in-person access usually depended on the financial product or amount of money held.

Using a composite measure called the Demographics of Trust Index™, the Center found survey respondents largely preferred doing business with community banks and credit unions, even though they were the least widely-utilized options in a list along with national banks, investment brokerage firms, and online banking. The results again emphasized the importance many consumers place on having a personal relationship with their financial advisors or institutions from the community level, suggesting a new model the industry at large would be well-served to consider.