Diversity, Equity & Inclusion Insights

Celebrating Women's History Month: Inspiring Inclusion in Financial Services

International Women's Day serves as a poignant reminder of the strides made towards gender equality while highlighting the ongoing journey to break down barriers and foster a more inclusive society. The theme of “Inspire Inclusion” resonates deeply within the financial services industry, emphasizing the significance of diversity and empowerment in all facets of our work.

In the realm of financial services, inspiring inclusion means celebrating the diverse perspectives, talents, and contributions of women from all backgrounds. It means recognizing and valuing the unique experiences and insights they bring to the table, enriching our industry and driving innovation forward.

At the heart of inspiring inclusion lies a commitment to challenging stereotypes and dismantling barriers that hinder the progress of women in financial services. It involves creating environments where all women feel supported, empowered, and encouraged to reach their full potential, regardless of their race, ethnicity, sexual orientation, or socioeconomic background.

As advocates for gender equality, it is incumbent upon us to not only celebrate the achievements of women but also to actively work towards creating a more inclusive and equitable financial services industry. This entails implementing policies and practices that promote diversity and inclusion at all levels of leadership, ensuring women have equal opportunities for advancement and representation.

Moreover, inspiring inclusion requires us to amplify the voices of women from marginalized communities, recognizing their unique challenges and advocating for meaningful change. By fostering a culture of inclusivity and belonging, we can create a more vibrant and resilient financial services industry that reflects the rich tapestry of human experience.

As we honor Women's History Month and International Women's Day 2024, let us reaffirm our commitment to inspiring inclusion in financial services and beyond. Together, let us celebrate the diversity, resilience, and strength of women, recognizing that true progress towards gender equality is only possible when we embrace and uplift all women, without exception.

Diversity, Equity & Inclusion Insights

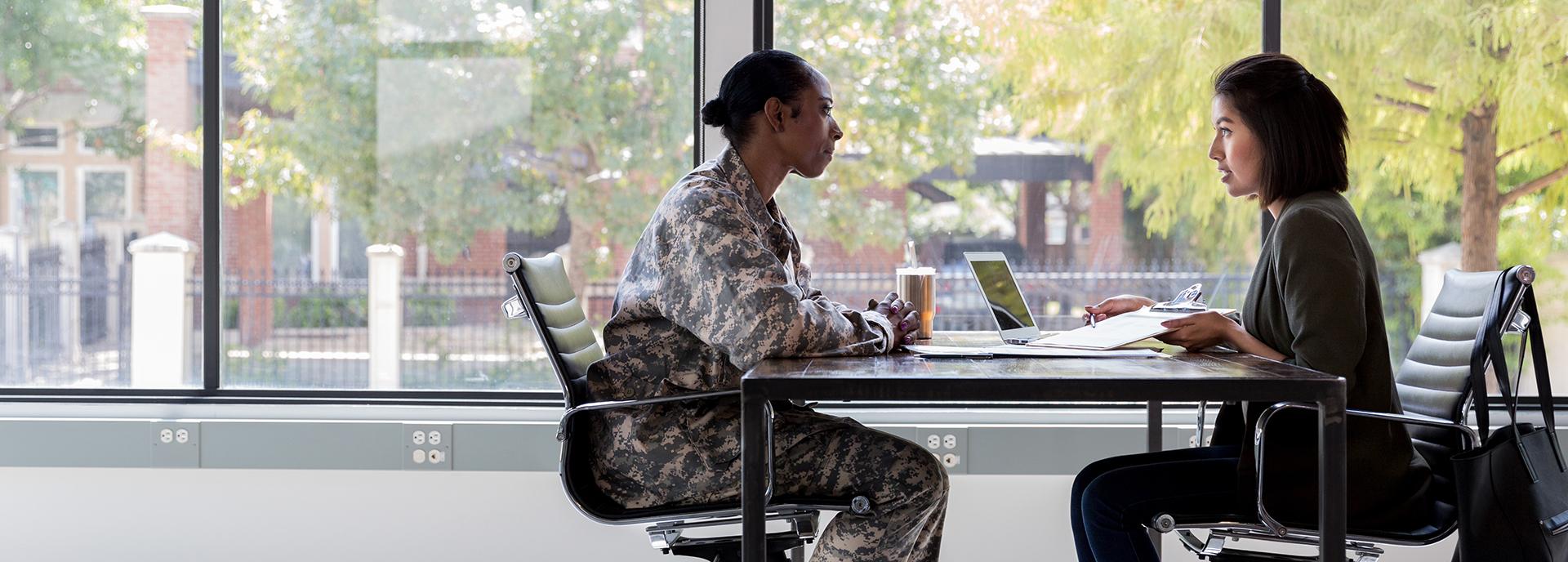

Kickoff Military Resource Group Consortium Lunch and Learn

In 2023, the Center for Military and Veterans Affairs partnered with The American College of Financial Services’ Career Services Office and Nationwide’s Military Affiliated Resource Group, led by President, Director of Broker Dealer Licensing, and Advisory Council Member Melvin Smith, USMC (Vet.), to develop a Military Resource Group (MRG) strategy mission and vision:

Mission Statement: “Building Bridges to Success”

Our mission is to bridge the gap between transitioning military scholars who are pursuing careers in the financial services industry through awareness, education, professional development opportunities, and networking with and between esteemed financial services companies.

Vision Statement:

We envision a future where the unique skills and experiences of our military scholars are recognized and harnessed, contributing to a more diverse, resilient, and innovative financial services sector. As a catalyst, we connect scholars with industry professionals, raise awareness for The College, and strengthen Military Resource Groups to shape the future of finance

On February 6th, the Center hosted its first virtual MRG Consortium Lunch and Learn collaborating with multiple financial services companies to discuss several topics key to the military and financial services communities, including:

- Military members transitioning into the financial services industry

- Best practices to foster and grow successful industry MRGs

- Methods to effectively support our military communities

The consortium will support the Center in organizing quarterly webinars to introduce Center scholars to the MRGs and provide educational and professional development opportunities at the 2024 Military Summit.

Diversity, Equity & Inclusion Insights

Center News

On January 17th, Admiral Michael Mullen, USN (Ret.), 2023 recipient of the Soldier-Citizen Award and Former Chairman of the Joint Chiefs of Staff, joined the Center for Military and Veterans Affairs to discuss how he believes military members, veterans, and their spouses provide value to the financial services industry.

Admiral Mullen expressed his gratitude as the award recipient and how special the 2023 Clambake was: “One of the thrills was to see the number of people there who were in financial services who were either veterans themselves or who were employers bringing veterans into the space. This area is a particularly challenging one because it is not well-known to us in the military.”

Admiral Mullen discussed the challenges the military community faces when transitioning during his experience as the 17th Chairman of the Joint Chiefs of Staff. His experience led him and his staff to develop a paper called “A Sea of Goodwill,” which connects the goodwill of the American people to support those who serve as they transition through the pillars of education, employment, and health.

“The key for anyone in transition is you need to have a network. There are many things tied to a good transition, but to me that is key, recognizing how hard it is, going somewhere and connecting with those who have done it, and going somewhere you really want to go,” Mullen stated.

He recommended for those in transition to list what they do and do not want in their next career to help identify a purpose, find a company with leadership who supports hiring military members, veterans, and their spouses, and effectively communicate your myriad of skills.

Mullen stated “one of the hardest things is how do you create the right vocabulary for your skillset that would match the vocabulary in the civilian sector. We in the military, right down to the most junior person, bring skills that are really valued in the private sector.”

He emphasized that for those interested in transitioning into the financial services industry, education is key.

To financial service companies looking to hire military members, veterans, and their spouses, Mullen stated, “it is a really good bet for your company, you will find individuals who are proud and young, they are loyal, they are team-oriented, disciplined, selfless, they lead, they perform really well under pressure and in a crisis, they are responsible and accountable individuals, and they can handle change. If you want to hire someone who wants to make a difference in your outfit, go to our community. I have heard it from leaders who have hired vets, and it is one of the best things they have ever done.”

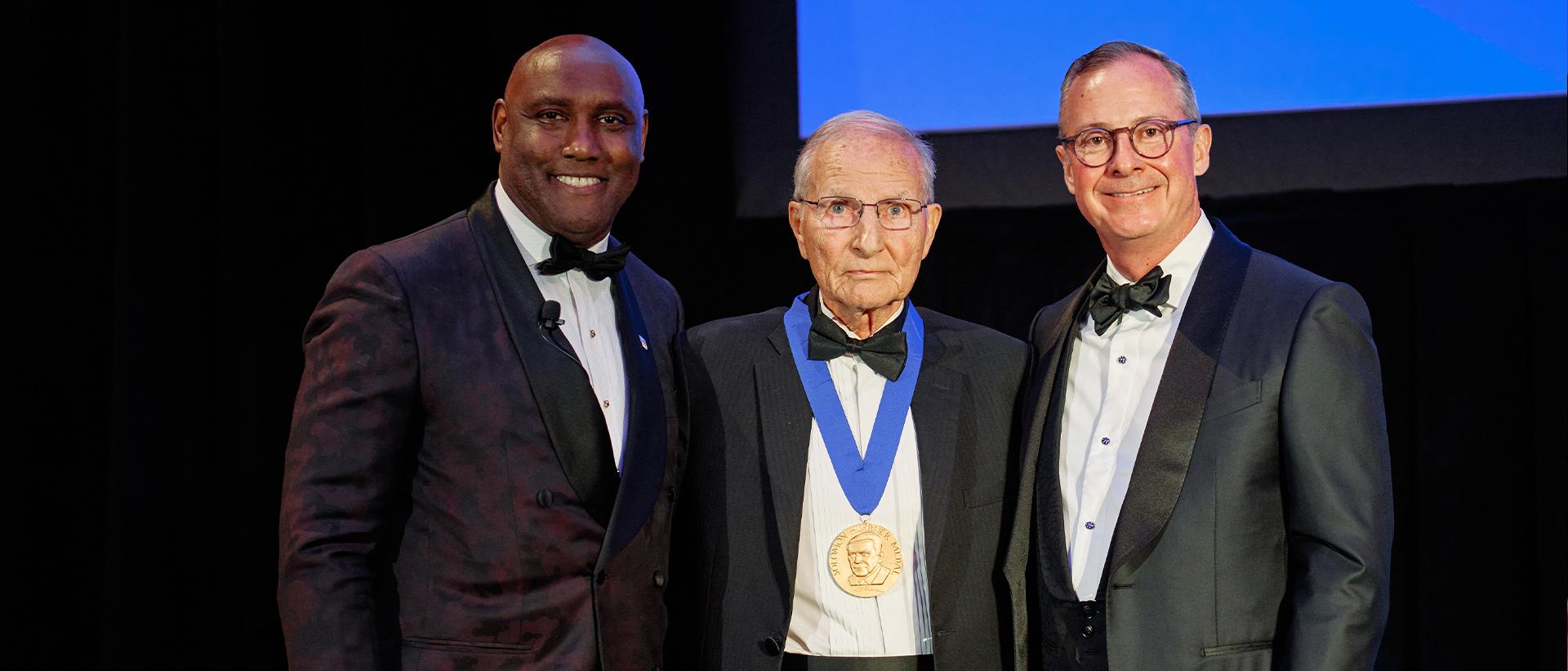

Honoring 2023 Hall of Fame Inductee, Paul Vignone

Alumni Hall of Fame: Paul E. Vignone, CLU®, ChFC®, JD, LLM

The American College of Financial Services’ Alumni Hall of Fame was established in 2005 to recognize graduates of The College's designation, certification, and degree programs who have made extraordinary contributions in time, treasure, effort, and energy to the institution, their community, and the financial services industry as a whole. The College is proud to announce Paul Vignone as the 2023 inductee.

Paul is an estate and business planning consultant for The Gaber Group. He spent much of his career with Penn Mutual as a managing partner and then an executive consultant. Throughout his distinguished career, he earned many of Penn Mutual’s employee awards, including its most prestigious, the National Chairman’s Award. In addition, the General Agents’ and Managers’ Association has consistently recognized his contributions to the industry, including honoring him with its coveted First-in-Class Award and 13 Master Agency Awards.

Prior to his work with Penn Mutual, Paul served as general manager for Phoenix Home Life and general manager for Prudential, and from 1974 to 1977, he was a trial attorney for the U.S. Department of Treasury.

Active in the industry, Paul is a member of the FINSECA Board of Directors. He is a past president of the New York City Chapter of Financial Service Professionals and served as a past president of the New York City General Agents’ and Managers’ Association, as well as the Northern New Jersey General Agents’ and Managers’ Association.

A past 1st Lieutenant in the U.S. Army, Paul is a Vietnam veteran and earned a Bronze Star for Valor during his service. He graduated from LaSalle University with a bachelor’s degree in political science. He earned his Juris Doctorate from Seton Hall University Law School and was awarded a master’s degree in tax law from New York University.

With this honor, Paul joins a distinguished group of The College’s alumni and partners, and it is an honor for The College to grant him this recognition.

Hear What Experts Say About the New Retirement Income Literacy Study

The American College of Financial Services released the findings of the fourth wave of the Retirement Income Literacy Study at a New York City premiere event attended by invited guests from the media and institutional partners of The College on February 13, 2024.

Based on a 38-question financial literacy quiz, the research aims to assess older Americans’ level of knowledge on topics they need to understand for effective retirement planning. The questions cover various aspects of retirement planning, such as the ideal age for filing for Social Security and the impact of interest rates on bond prices. The results reveal that in the decade since the first wave of research began in 2014, the needle has not moved. On average, respondents only answered 31% of the questions correctly, indicating a lack of financial literacy on topics related to retirement income.

At the premiere event, top academics from The College shared their initial insights and “aha” moments sparked by the new research. Here's a look at highlights from the panel discussion led by Steve Parrish JD, RICP®, CLU®, CHFC®, AEP®, featuring researchers Michael Finke, PhD, CFP®, Kaylee Ranck, PhD, Chet R. Bennetts, CFP®, CHFC®, CLU®, RICP®, CLF®, and Eric Ludwig, PhD, CFP®—in their own words:

Parrish: Call it financial literacy, you could call it knowledge, you can call it understanding—but whatever it is, we know that these are important pieces of information [individuals must know] in order to make smart decisions about their own retirement…It's very important because it affects millions of people and affects their well-being. Think about things like the fact that so few of us have defined benefit contracts anymore, right? It's defined contributions and IRAs, and that means that in accumulating you have to figure out how to do it yourself. In distribution and decumulating, you have to figure out how to do it. You don't have your employer doing it. Key decisions like Medicare and Social Security, those are decisions that have to be made fairly early in retirement, but they stick for the rest of your life.

Finke: Target-date funds have been a success in the accumulation stage, but it's actually divorced people from having to make decisions about their own retirement. And what ends up happening is that when people start to see the end zone approaching, once they hit their fifties, they start realizing that they have no idea how much money they've saved, how they've invested, what their options are for generating income in retirement, and they have no idea what sort of risks they're exposed to…There is a general social phenomenon, especially for these generations like the younger Baby Boomer generation and Gen Xers who are approaching retirement, who have been in this sort of soft bubble-wrapped environment of accumulation. Now what do we do with them once they start decumulating? It's no wonder that they're experiencing anxiety.

Ranck: What we find through a lot of the research is that individuals [score better] when they have to experience something. For example, when they get closer to being Medicare-eligible in age, their knowledge score around Medicare increases because it's an experience that they have and the knowledge that they need in order to get through that particular transition. We see that with several of the scores.

Bennetts: I specifically looked at some of the retirement concerns [and] the two that had the highest average across the board were Social Security cuts and inflation. Those were two of the bigger ones. And that's something I think we can all agree that even the best financial advisor, best financial planner in the world is not going to be able to wave a magic wand and help someone with. Rightfully so, maybe that's a higher level of concern from the consumer with or without an advisor. However, when you added an advisor, there was an impact and those concerns did decrease. And in part, I'm sure, because of the preparation and the conversations [between financial advisors and clients about] “How do we handle…?” or “How do we anticipate those things?” from the psychosocial and behavioral side of it. [What] I thought was cool was the fact that when we have professionals—professionals whom, as an institution, we're charged with training and giving the most relevant information—that dramatically decreased [respondents’ answers] to the tune of 20% on the anxiety side and 25% on the stress side.

Ludwig: If you ask people how they viewed the stock market over the next 12 months, that was a significant predictor [of what they would do with their portfolio]. Basically for each level of optimism, that led to another 10% higher likelihood that they didn't do anything with their portfolio. Those who had an advisor [were] twice as likely to maintain [their] portfolio during the market volatility of 2022 as opposed to those who did not… From a practical aspect [what we recommend to advisors is] having them check in with their clients and asking them, “How do you view the stock market over the next 12 months, what is your market outlook?” [That may] be a significant predictor of what they're going to actually do with their portfolio.

The research underscores the need for better education about retirement planning geared toward those who are approaching or in retirement age. With robust results from surveying more than 3,765 Americans aged 50 to 75, the Retirement Income Literacy Study research team plans to release additional cuts of the data to provide deeper analysis into topics highlighted here—plus additional topics yet to be revealed.

To learn more about the findings and what the research reveals about the educational role of financial advisors, read the study here.

Recognizing the 2023 NextGen Financial Services Award Recipients

NextGen Financial Services Professional Award

The NextGen Financial Services Professional Award honors young professionals under the age of 40 who made a significant impact in the financial services industry and have shown outstanding performance and leadership in their careers, with a desire to give back to the community.

The winners from 2023 include:

Michael Acosta, CFP®, CSLP, ChFC®

Michael is a Certified Financial Planner® (CFP®) at Genesis Wealth Planning, LLC in Charlotte, North Carolina. A first-generation Colombian-American, he attended Wingate University on a lacrosse scholarship and graduated with a Bachelor of Science in Accounting and a minor in Economics. Michael spent the first four years of his career working for a wealth management platform before transitioning into his current role as a financial advisor.

Kay Blunck, CFP®, ChFC®, CAP®, CRPC®

Kay is a wealth advisor with Inspired Wealth Advisors at Thrivent Financial. She enjoys creating holistic and individualized financial plans for each client’s unique circumstances. Kay also serves on the board of a local nonprofit, Military Missions. She finds joy in meeting with nonprofits and teaching their board members about different gifting strategies her clients are adopting and how they can incorporate these strategies into their fundraising efforts. She is a graduate of the University of Kentucky.

Akeiva Ellis, MSFP, CPA/PFS, CFP®, ChSNC®

Akeiva is a CFP® Board Ambassador whose financial expertise has been quoted in numerous media outlets, including Refinery 29, NPR, Business Insider, and CNBC. As the co-founder of The Bemused (with her husband), she has helped tens of thousands of young adults improve their finances through online video content and coaching programs. She has been recognized by the AICPA with a Standing Ovation Award in Personal Financial Planning, been named an industry Rising Star by Financial Planning magazine, been identified as a Luminary in Diversity and Inclusion by ThinkAdvisor, and she is the youngest person to be named to Investment News’ prestigious 40 under 40.

Hannah Kanstroom, CAP®, MSW

Hannah is a Senior Vice President and philanthropic strategist for the National Consulting and Advisory Practice at Bank of America Private Bank, based in Boston, Massachusetts. In her role, Hannah delivers customized consulting and advisory services to nonprofit clients’ boards of directors, investment committees and senior leaders. Her areas of focus include strategic planning, mission advancement, next gen engagement, nonprofit governance, and board dynamics. She holds a Bachelor of Arts in Psychology from Boston College and a Master’s in Social Work with a focus on Corporate Social Responsibility and Nonprofit Management from Columbia University.

Padric H.B. Scott, AEP®, CFP®, CAP®, ChFC®, CLU®, WMCP®, CCFC

Padric graduated from Florida A&M University (FAMU) with a Bachelor of Science in Molecular Cell Biology. He then began his Master's at FAMU, until he stopped to accept a contract to play in the

NFL for the Arizona Cardinals. Padric's professional football career spanned five years, with stops in the Arena Football League and the Canadian Football League. Today, Padric serves as both CEO and Founder of Crossroad Capital Partners, a full-service equity and estate planning practice founded in 2018 that serves as an umbrella organization for his consulting engagements, partnered with Northwestern Mutual. Based out of Tallahassee, Florida, Crossroad is currently licensed in 43 states.

From the looks of these five accomplished professionals, the next generation is here now, and the industry is in good hands.

Honoring the 2023 President’s Award Recipient, Mary Wright

President's Award: Mary M. Wright, CAP®

Conferred by The American College of Financial Services’ President and CEO, the President’s Award recognizes the leadership and generosity of select benefactors and volunteers. The College is proud to announce the 2023 winner: Mary Wright.

Mary Wright attended Yankton College in Yankton, South Dakota, where she met and married Charles R. Wright, known to many at The College and elsewhere as Chuck. Together, they were leading donors to the Center for Women in Financial Services and helped to establish the State Farm Women’s Chair. Mary’s years of service through philanthropy led her to complete her Chartered Advisor in Philanthropy® designation at The College, so she could explore more ways of helping others engage in philanthropic work, as well. Mary was honored to work with The College in not only funding but in creating the scope and direction for the work that became the Wright Fellowship in the Center for Women in Financial Services.

Mary is a special example of the enduring relationships The College has been fortunate to develop, and we are so pleased to be able to recognize what that relationship has meant and continues to mean to us and everything we do here.

Honoring the 2023 Huebner Gold Medal Recipients

In 1975, as The American College of Financial Services approached its 50th anniversary, the Board of Trustees decided to honor those whose role in the development of the institution was of special significance. The Huebner Gold Medal, named for The College's founder, Solomon S. Huebner, is The College’s most prestigious honor and is awarded to people who, through support and dedication to The College and its programs, have moved the institution forward in its mission.

The College awards the Huebner Gold Medal each year at its annual President’s Dinner. The 2023 President’s Dinner was held this past November at the Barnes Foundation, located in the heart of Philadelphia’s beautiful museum district.

Margaret I. Bradshaw, CLU® (posthumously)

This year, we celebrated two recipients. First, we remembered and paid tribute to the late Margaret I. Bradshaw, CLU®. Margaret was a trailblazer, a successful businesswoman, an exemplary advocate of ethics in the insurance industry, and so much more. In 1931, she became the first woman in the United States to earn the Chartered Life Underwriter® (CLU®) designation. At that time, in the early days of The College, few agents recognized the CLU® —and fewer understood the value of applied knowledge in the insurance industry, or the significance of the designation. Over a relationship with The College that spanned seven decades until her passing at the age of 106 in 2011, Margaret often credited the CLU® for professionalizing the industry and elevating its practitioners in the eyes of the public.

Margaret broke down barriers and paved the way for other women to succeed in the insurance industry. At The College, she was known for the Margaret Bradshaw Lecture Series and generous investment in the Center for Ethics in Financial Services. She was a tireless advocate for ethics and professionalism. She believed that financial services professionals have a responsibility to put the needs of their clients first and she always led by example. She saw the potential of The College to make a difference in the industry—and the world.

Phillip C. Richards, CLU®, RHU®

We also recognized Philip C. Richards, CLU®, RHU®. Phil is the Executive Chairman and Founder of the North Star Resource Group and a member of The College’s Alumni Hall of Fame. Among his many contributions, he has helped drive The College’s growth as an alumnus, a board member, and a champion of our shared mission. In honor of his own mentor and a prior recipient of the Solomon S. Huebner Gold Medal, Phil helped create the annual endowed Maurice “Maury” L. Stewart Lectureship program. He also supported the One Person and Invest in the Future capital campaigns.

Phil embodies The College’s belief in the value of lifelong learning. North Star represents a fully integrated array of financial services and products for individuals and businesses of all sizes and has over 140,000 clients with offices in 22 states with client assets under administration exceeding $10 billion. In addition, he is an adjunct professor emeritus for the Carlson School of Management at the University of Minnesota and former adjunct professor at Central University of Finance and Economics in Beijing.

Ethics In Financial Services Insights

AI Ethics in Financial Services Summit to Examine Challenges of Artificial Intelligence

On April 2, the American College Cary M. Maguire Center for Ethics in Financial Services will host an AI Ethics in Financial Services Summit in New York City examining governance and ethics challenges of AI use in financial services.

Crafted as an immersive and educational meeting of financial experts spanning diverse corporate roles, the event aims to assist leaders frame governance and ethics considerations relating to the use of AI. The discussions will center around crucial aspects, some of which include:

- The ethical risks of AI in finance: From fairness concerns to biased algorithms, we'll explore the potential pitfalls and how to mitigate them.

- Restoring trust through responsible AI: Learn best practices for developing, deploying, and governing AI ethically and transparently.

- The future of AI in insurance underwriting: Gain insights into the latest regulatory updates and ethical considerations in this critical area.

As the financial services industry grapples with the ever-expanding role of AI, this summit stands as a beacon for forward-thinking professionals. It provides a unique opportunity to engage with industry leaders, share insights, and collectively shape the narrative around responsible AI integration.

Amidst the complex challenges faced by global leaders, the recent World Economic Forum annual meeting in Davos assumed a pivotal role in addressing the pressing need for rebuilding trust between business and society. As governments navigate increased societal division and armed conflicts worldwide, CEOs expressed mixed sentiments regarding how to best navigate instability and the escalating influence of AI. This highlights the critical importance of acknowledging and navigating the intricate landscape of AI while concurrently working towards restoring trust in the global community.

This summit will showcase eminent speakers encompassing regulators, researchers, and industry leaders. Notable among them is Kathleen A. Birrane, currently serving as the Insurance Commissioner at the Maryland Insurance Administration. Additionally, Jillian Froment will be sharing her expertise in her role as the Executive Vice President and General Counsel at the American Council of Life Insurers (ACLI), while Arezu Moghadam will contribute valuable insights as the Managing Director and Global Head of Data Science at J.P. Morgan Asset Management. Furthermore, Reva Schwartz will bring valuable perspectives to the discussion as a Research Scientist at the National Institute of Standards and Technology.

Explore our AI Ethics Summit details and additional speakers. If you are interested in attending and would like an invite, email us at ethics@theamericancollege.edu.

To learn more about artificial intelligence in financial services, you can explore further with research findings from the Center for Ethics in Financial Services.

How Financial Advisors Can Effectively Leverage AI Tools in Practice

According to surveys from the World Economic Forum and the Cambridge Centre for Alternative Finance, as of late 2023 85% of financial organizations globally were using AI tools in some form, and 52% have already created at least some AI-driven products and services. Additionally, 77% of firms believe generative AI platforms such as ChatGPT, Bard, and Microsoft Copilot will become essential to the industry in the next two years.

While lawmakers, technologists, philosophers, and everyone in between may continue to debate the ramifications of developing AI and potential guardrails that should be placed on new innovations, it’s clear these platforms are not going anywhere and have already become indispensable to many businesses for one simple reason: efficiency. ChatGPT, for example, can scour the entirety of the internet and return comprehensive, conversational answers to queries in a matter of seconds, dramatically faster than a human being could reach the same conclusion. And as one of the industries most directly impacting everyday people and their livelihoods, the financial services profession has found itself at the heart of this technological revolution.

This examination of how financial professionals can use AI effectively and responsibly was the subject of a recent webcast from The American College of Financial Services, held exclusively on its subscription-based learning platform Knowledge Hub+. Eric Ludwig, PhD, CFP®, director of The College’s Retirement Income Certified Professional® (RICP®) Program, and Chet Bennetts, CFP®, ChFC®, CLU®, RICP®, CLF®, director of the Chartered Financial Consultant® (ChFC®) and CFP® Certification Education Programs, hosted the discussion based on their deep experience with testing and using AI systems: specifically, the evolving field of prompt engineering.

“Almost everyone who uses ChatGPT for the first time is blown away–but not always for the right reasons,” Ludwig says. “Its job is to respond and give you answers, but in doing so it’s not immune to ‘hallucinating’ or making up information. The question we’re trying to address is how to get the tool to do what you want it to do, and the answer is making clearer requests.”

"The question we’re trying to address is how to get [AI] to do what you want it to do, and the answer is making clearer requests.”

- Eric Ludwig, PhD, CFP®

Uses of AI in Financial Services

As Ludwig and Bennetts point out, even before the launch of ChatGPT, almost everyone was using AI in their lives in some form or another, whether it be through voice assistants like Siri or recommendations in your Netflix queue. The differences between these algorithm-driven services and something like ChatGPT are functionality, level of interactivity, and real-time updates—something that substantially changes the game.

“Consider this: when Netflix and Facebook were first introduced to the world, it took nearly 10 years for them to become universally adopted and accepted,” Ludwig says. “With ChatGPT, it took only two months. Financial professionals can’t afford to overlook these technologies.”

So, should your financial services practice start using AI in everyday work? Ludwig and Bennetts say the answer largely depends on the kind of work advisors want AI to do for them. As Bennetts explains it, there are three big questions every financial professional looking to leverage AI tools should ask themselves:

- Does it matter if the AI tool’s output is true to your practice?

- Do you or other advisors have the expertise to verify what the AI tool is telling you?

- Are you or your organization willing to take responsibility for inaccuracies that may occur based on AI-generated knowledge?

Depending on the answers to these questions, Bennetts suggests financial professionals think long and hard about how they can use AI to its maximum potential and with minimal risk to themselves and their reputations.

“Time savings from using AI tools depends on what you’re using them for,” he says. “Obviously ChatGPT isn’t going to be able to run a meeting with a client for you. But it can be great for service-level jobs, preparation for client meetings, and portfolio- or proposal-building.”

“Obviously ChatGPT isn’t going to be able to run a meeting with a client for you. But it can be great for service-level jobs, preparation for client meetings, and portfolio- or proposal-building.”

- Chet Bennetts, CFP®, ChFC®, CLU®, RICP®, CLF®

How Advisors Can Use AI Responsibly

While ChatGPT and other AI tools are powerful, Ludwig and Bennetts stress they are not infallible: ChatGPT is notoriously bad at translating written descriptions into visual images, for example, and at times even basic math appears to be difficult for it. For this reason, the thought leaders strongly advise against taking the information AI provides as gospel—at least, not without checking it first.

Bennetts says he recommends financial professionals use AI tools as a starting point for research or drafting, reviewing its output and saving the most salient points for personalization and fact-checking before use. Because of this, he says he’s skeptical AI will ever fully replace human workers.

“We generally find consumers still get their financial advice more from social media than from AI,” he says. “The medical community probably felt the same way when WebMD was first created, but WebMD didn’t stop people from going to their doctor. It’s a supplement, not a substitution.”

"[AI] is a supplement [to professional guidance], not a substitution.”

- Chet Bennetts, CFP®, ChFC®, CLU®, RICP®, CLF®

Ludwig and Bennetts also say advisors using ChatGPT and similar systems shouldn’t be afraid to get specific about what they want and how they want it when using AI: advisors can use the technology to provide output to a multitude of formats, specifications, and voices—as long as they know how to ask the right questions and keep their intended audience in mind.

Want to learn more? You can watch Bennetts and Ludwig’s full conversation, including a live demonstration of how financial professionals can use ChatGPT, as well as their AI 101 course, on Knowledge Hub+, now available exclusively to members of The College’s Professional Recertification Program–and coming soon as an open subscription model!

More From The College:

Get specialized retirement planning knowledge with our RICP® Program.

Get the details of our ChFC® Program.

See our CFP® Certification Education Program.