Ethics In Financial Services Philanthropic Planning Insights

Ethics Through the Lens of Philanthropic Planning

Managing director of the American College Cary M. Maguire Center for Ethics in Financial Services, Azish Filabi, JD, MA sits down with The College’s Chartered Advisor in Philanthropy® (CAP®) Program director and assistant professor of philanthropy Jennifer Lehman PhD, JD, CFP®, CAP® to discuss the ethical considerations advisors and other financial professionals must make when offering philanthropic planning services in a new continuing education (CE) opportunity available on Knowledge Hub+.

Filabi kicks off the discussion by reflecting on her history as a professional, stating that she has always worked to ensure organizations have the right governance structures in place and the right tools in place so they can consider ethics in their own personal decision-making as well as the impact they’re having on society.

She goes on to discuss the work performed at the Center for Ethics in Financial Services, stating the importance of the group’s research mission and outreach. In reference to this research, Filabi explains the purpose as “learning about the challenges that leaders and individuals are facing with respect to ethics so that can reflect back on the work that we do.” By completing this research, Filabi believes that the Center for Ethics will be able to provide the industry with valuable lessons relating to ethical concerns in the field.

Trust in Financial Services

One of these key lessons focuses on the topic of trust in financial services. Filabi shares that “Everyone I talk to highlighted trust as being a key factor in effective work that we do because it's essentially the glue that brings it all together. Some people went as far as to say that they're not in the business of selling financial products. They're selling trust because people have to trust us as professionals to be able to have their money in our good hands. Because trust is so important to financial services, the Center offers a certificate program on Advanced Strategies for Building Trust to help leaders access tools and frameworks to address this challenge.”

Lehman ties this back to the mission of The American College of Financial Services as a whole, stating a goal of providing applied financial knowledge and education, promoting lifelong learning, and advocating for ethical standards to benefit society. As Lehman points out, philanthropy is a key part of the profession tied to social impact.

Filabi weighs in on this, providing a description of ethics in the industry. She emphasizes the importance of doing no harm and acting in accordance with legal requirements while navigating opportunities. However, she points out that this is a more simplistic view on ethics. When providing her perspective, she states, “We at the center like to think about ethics, not only about the compliance and legal challenges that people face in their day to day, but about the gap between these minimum standards that are expected of us and the day to day challenges that people face in their work…what is the standard that clients expect from you so that they can trust you that might not already be codified in the law?”

How Do We View Ethics in the Context of Philanthropy?

Filabi continues by tying this to the field of philanthropy, discussing concepts such as conflicts of interest, duty of care, and loyalty. She admits this to be a challenging balancing act that also requires financial professionals to consider social impact as part of the equation.

Filabi contends that the importance of social impact is especially critical for the philanthropic sector in recent years. She supports this assertion by stating, “Government budgets are really crunched, and so that means that the philanthropic sector is playing a huge role in addressing some of the business and (societal) challenges that we face in the economy, and I think that should be part of an understanding of ethical duties and obligations as we think about social impact.”

“Government budgets are really crunched, and so that means that the philanthropic sector is playing a huge role in addressing some of the business and (societal) challenges that we face in the economy, and I think that should be part of an understanding of ethical duties and obligations as we think about social impact.”

Lehman and Filabi go on to discuss several additional topics relating to ethics in the philanthropic sector including the Donor Bill of Rights, what an organization should do if a donor’s values don’t align with the organization’s values, key items to consider when weighing the ethical implications of our choices, and more in this discussion, available exclusively on Knowledge Hub+!

To access this learning opportunity and other valuable CE, visit Knowledge Hub+.

More From The College:

- Gain philanthropic and legacy planning knowledge with our CAP® Program.

- Learn about the American College Center for Philanthropy and Social Impact.

- Join the waitlist to be notified when enrollment opens for the TPCP™ Program.

- Learn about the American College Cary M. Maguire Center for Ethics in Financial Services.

Ethics In Financial Services Insights

Drivers of Trust in Consumer Financial Services

The article uses the Center for Ethics’ Trust in Financial Services Study (2021 Consumer Survey) to explore the drivers of trust in consumer financial services. By contextualizing the Center’s research within existing academic research, the study highlights how both corporate reputation and a consumer’s personal values play a critical role in establishing and maintaining trust in the financial services sector.

The Importance of Building Trust

The research, based on responses from nearly 1,700 U.S. consumers, examines trust levels associated with seven types of financial service providers including national banks, credit unions, and online-only financial institutions. One of the key findings is the stark contrast in how trust is built among "familiar non-customers" and "customers." For familiar non-customers – respondents who don’t have a relationship with a firm but are familiar with the services provided – trust tends to be influenced by external indicators such as reviews, third-party recommendations, and the overall reputation of the institution.

This dynamic is especially important for digital-only providers, who are newer to financial services; trust is often built through indirect experiences for such firms. In contrast, for customers who already have established relationships with a provider, trust is more deeply rooted in personal interactions. These customers value shared ethics, protection of their interests, and personalized services, particularly from institutions like credit unions, national banks, and investment firms.

Values Associated with Trust

The study underscores the need for financial institutions to differentiate their trust-building strategies for these two groups. For institutions aiming to attract familiar non-customers, focusing on reputation management and enhancing their public image is critical. By prioritizing transparency, aligning operations with core values, and offering tailored customer experiences, financial service providers can strengthen trust with clients. Conversely, when maintaining existing customer relationships, reinforcing trust through personalized, value-aligned services are key. In addition, these customers consider whether firms are actively protecting their interests.

These findings offer valuable insights for financial institutions looking to navigate the competitive and increasingly digital marketplace. Moreover, the research offers practical guidance for building, maintaining, and repairing trust differentiated by the type of financial entity and the type of customer in the relationship.

More From The College

For further details on the research findings, you can access the full report in the Financial Planning Review.

Pattit, J. M., & Pattit, K. G. (2024). An empirical exploration of the drivers of trust in consumer financial services.

Financial Planning Review, e1190.

For more information on the Center’s research on trust's role in financial services, get our full report.

Financial Planning Retirement Planning Insights

2024 Advisory Services Survey

The new 2024 Advisory Services Survey explores key similarities and differences in service offerings and client needs among three types of financial professionals: dually registered advisors (Duals), investment advisor representatives (IARs), and those who are either insurance agents (IAs) or registered representatives (RRs). The results reveal opportunities for independent advisors to differentiate their practices, as well as areas in which captive advisors have clear advantages.

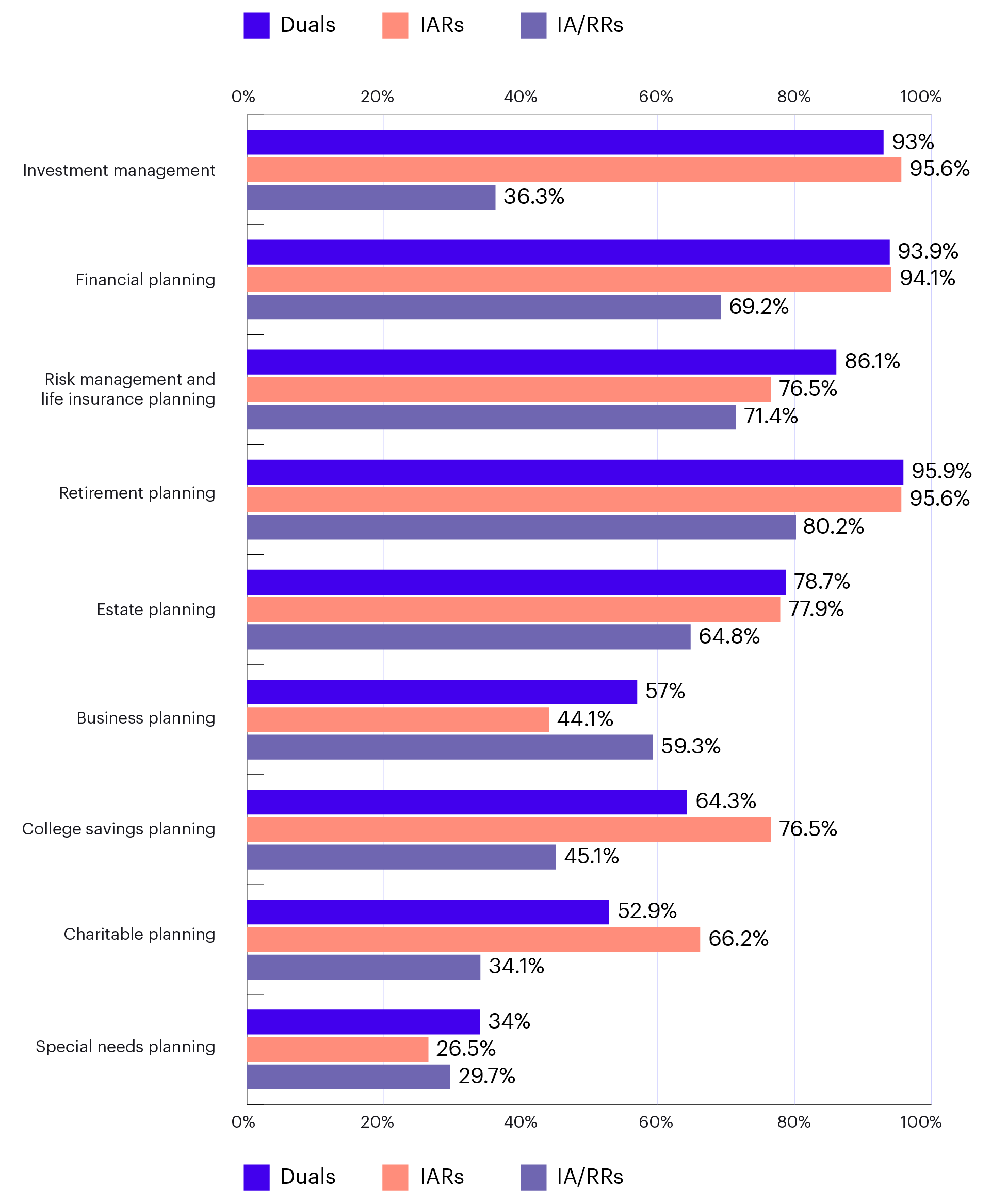

What Services Do Advisors Offer?

The survey began by asking advisors about the services they are currently offering to clients. Across all three advisor types, the data shows independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients, including: charitable planning, college savings planning, estate planning, retirement planning, risk management, financial planning, and investment management.

“Independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients.”

However, IARs are less likely to offer special needs planning and both IARs and Duals fall short in offering business planning services – with only 57% of dually registered advisors and a mere 44% of IARs offering such services.

Services Currently Offered

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

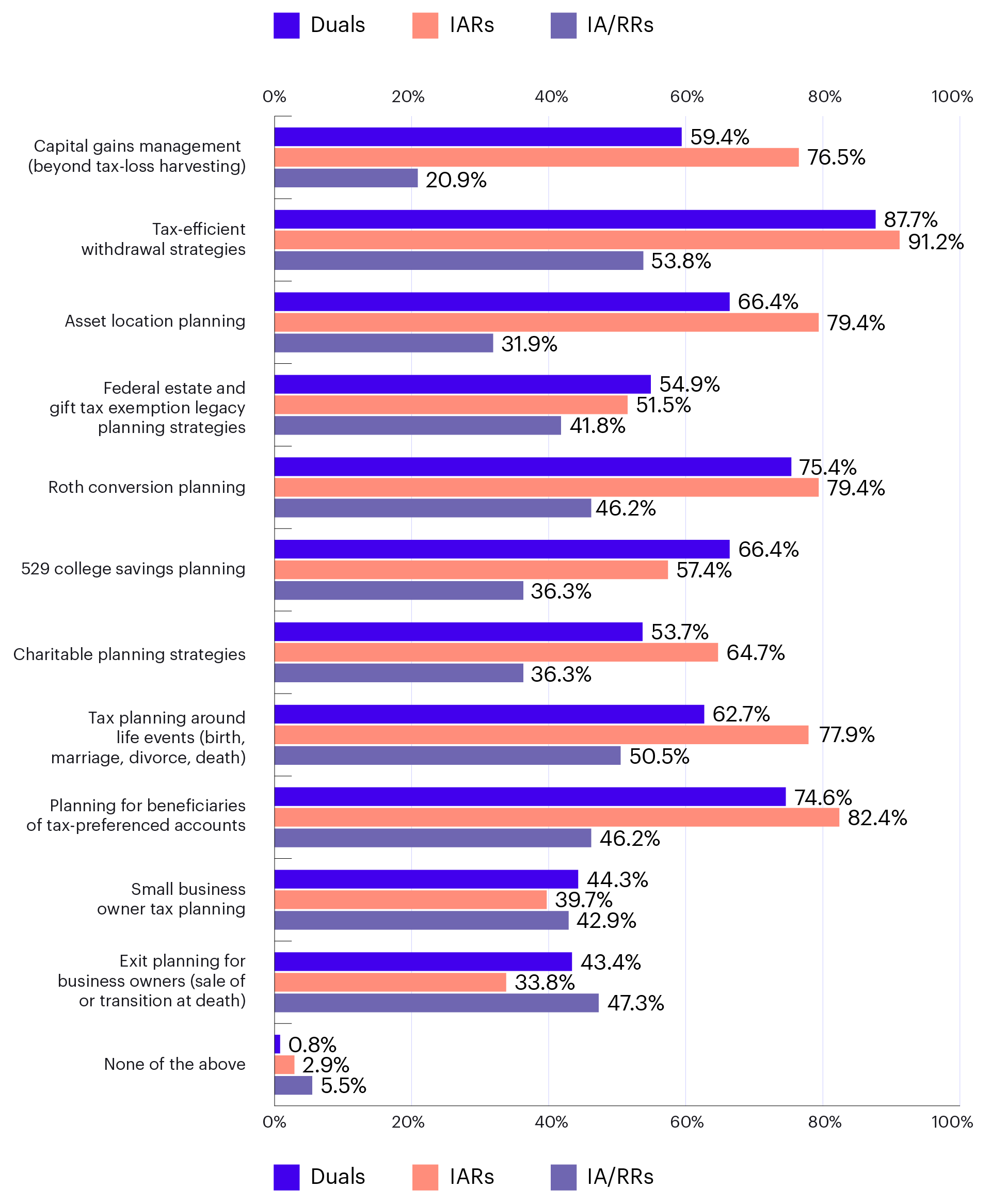

What Strategies Do Advisors Use?

The data further suggests that independent advisors are leading the way in using various strategies – especially tax-informed planning strategies – to deliver the many services they offer clients. Financial professionals who are dually registered or IARs have a competitive advantage in delivering tax-informed planning strategies to differentiate their practices.

In contrast, insurance agents and registered representatives are often required to comply with the restrictions of their home office in regard to tax planning services. However, our research suggests that over half of these insurance agent and registered representative respondents employ tax-efficient withdrawal strategies (54%) and conduct tax planning around life events with their clients (51%).

Strategies Currently Used

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

Unfortunately, with many home offices not offering a comprehensive education on tax planning services, it would seem that the respondents currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.

“[Advisors] currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.”

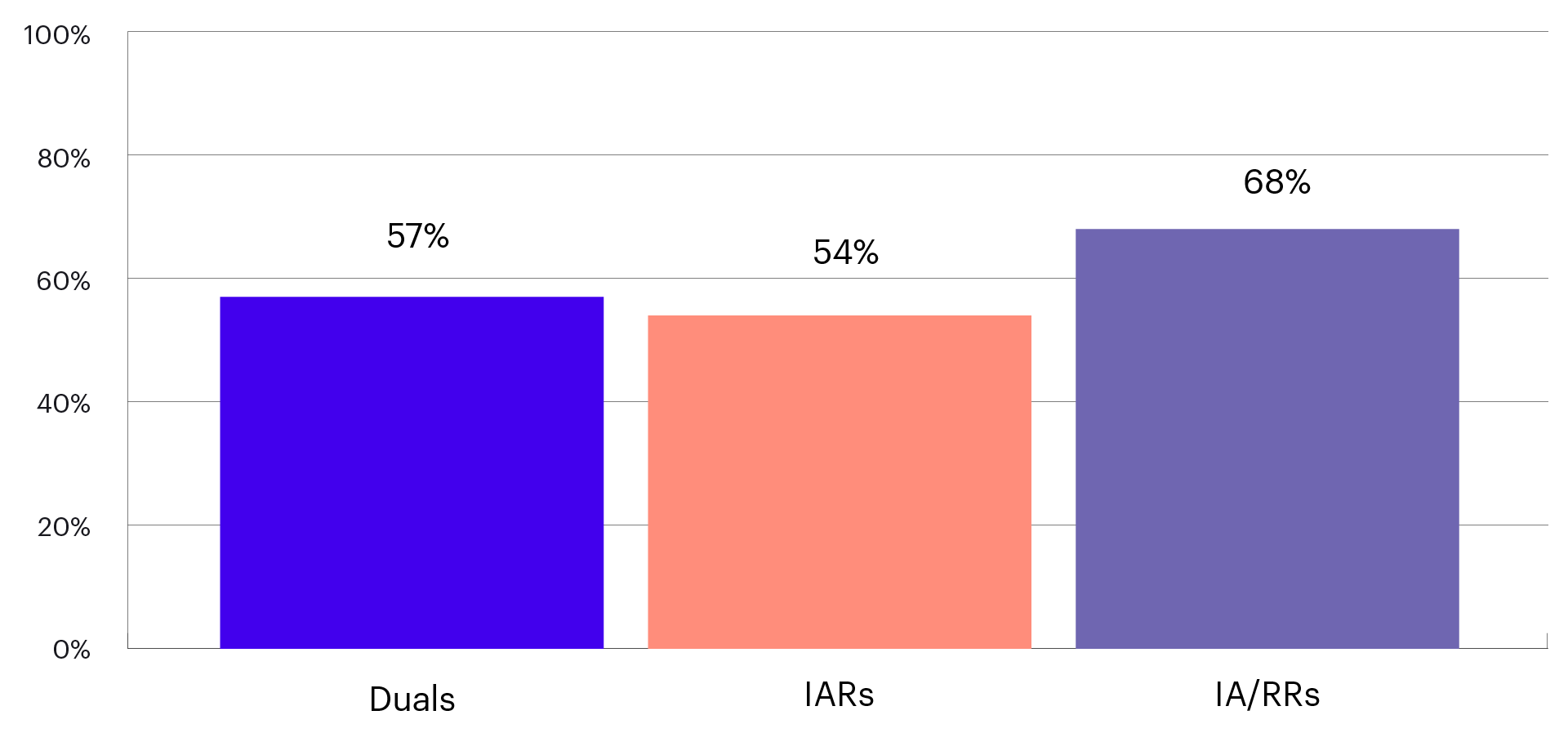

What Services Are Not Being Offered?

Finally, the survey asked advisors about the services their clients frequently request – to reveal any gaps in their current offerings. When reviewing this data, one significant outlier emerges. More than 68% of insurance agents and registered representatives, 54% of IARs, and 57% of dually registered advisors reported small business owner tax planning as the most frequently requested service among those they are not currently providing.

This represents a sizable unmet need that could prove to be a differentiator for any advisors willing to add these services to their menu. Yet, without comprehensive education on tax planning services or robust tax planning resources, how can we ensure that financial professionals across the financial services ecosystem do tax planning well?

Strategies Not Used But “Always” or “Often” Requested

Small Business Owner Tax Planning:

The American College of Financial Services. Advisory Services Survey. 2024.

Financial Planning Is Tax Planning

When reviewing the results of this survey in totality, an interesting trend emerges. Many advisors partake in some form of tax-informed financial planning. Independent advisors are more likely to say they engage in tax planning than others – but more than half of all types of advisors are currently employing tax-advantaged strategies. However, across all categories, advisors are not meeting the needs of their clients when it comes to small business tax planning, a valuable service that many advisors could benefit from offering to their clients.

Fortunately, financial advisors can address this gap through a new designation at The College. The Tax Planning Certified Professional™ (TPCP™) program is The College’s latest offering to the financial services industry and addresses this need. As advisors look to implement advanced tax strategies in their own practices, the TPCP™ program can help them by equipping participants with the skills to identify and evaluate these strategies for individuals and small businesses with a focus on maximizing tax benefits while ensuring compliance with current legislation.

The program covers a number of different topics including tax planning during the accumulation phase and the less frequently covered topic of tax planning during retirement (or the decumulation phase).

Enrollment for this powerful new designation launches in November and, with advisors already lining up to be among the first to call themselves a Tax Planning Certified Professional™, the time is perfect to seize this opportunity and join them as you look to grow your practice by improving your ability to meet the needs of your clients.

More From The College

About The College Diversity, Equity & Inclusion Insights

2024 Military Summit Highlights

Formerly known as the Clambake, the inaugural Military Summit melded several traditions of The College and its Center for Military and Veterans Affairs, including the Maury Stewart Lecture Series and the Leadership Symposium into a full day of programming spread between the W Hotel Philadelphia and the National Constitution Center. With over 140 financial professionals, service members, veterans, military spouses, and scholars in attendance, it was an inspiring, educational, and empowering event in the best tradition of the Center’s mission: providing educational support and career development opportunities to active duty, guard and reserve members, veterans, and their spouses.

An Examination of Knowledge and Leadership

The Military Summit kicked off with Center managing director Phil Easton, CMSgt, USAF (Ret.), welcoming the attendees and recognizing the solemn nature of the day chosen for the Summit with a moment of silence.

“This event is a celebration of the military community, but it’s also an occasion to remember, as we always do, those who have given their lives in service to their country, both in and out of uniform,” he said.

The annual Maury Stewart Lecture was up next, delivered by Michelle Caruso-Cabrera: a CNBC contributor, former chief international correspondent, and the network’s first Latina anchor. Caruso-Cabrera spoke about her experiences transitioning from a local journalism to the national stage when CNBC was still a young network and many of her colleagues felt she was making a career mistake. She went on, however, to become a major force that drove CNBC’s growth over 15 years, including traveling the world to interview important politicians and leaders – while also unwittingly becoming a leader in the newsroom herself.

“You know leadership when you see it, and you feel it when it’s missing,” she said. “I was surprised some of my colleagues looked at me as a leader because I’d never thought of myself as ‘the boss.’ But you don’t have to be the boss to be a leader. It’s all about little interactions, giving credit where it’s due, and thinking small, not just big.”

“You don’t have to be the boss to be a leader. It’s all about little interactions, giving credit where it’s due, and thinking small, not just big.”

–Michelle Caruso-Cabrera, veteran journalist

The session on leadership was followed by a talk from Jamie Hopkins, Esq., LLM, CFP®, ChFC®, CLU®, RICP® of Bryn Mawr Capital on adaptive retirement planning. Throughout the presentation, Hopkins used data from The College’s 2023 Retirement Income Literacy Study and other sources to drive home the point that retirement plans need to be flexible enough to account for variables in markets and individual lifestyles – there is no one-size-fits-all solution.

“Americans are being told as long as you put money into your 401(k) and save rather than spend, you’re going to be okay. That’s an oversimplification,” he said. “We also have to do a better job guiding clients through the decumulation stage: they’ve spent their entire lives saving, and if they’re afraid to see their balances go down during retirement, it kind of defeats the purpose.”

Technology and Opportunity in Financial Services

Further programming at the Military Summit included a panel discussion on the impact of artificial intelligence (AI) on financial services led by Kevin Crawford of Northwestern Mutual, including College faculty members Chet Bennetts, CFP®, ChFC®, CLU®, RICP®, CLF®, Azish Filabi, JD, MA, and Eric Ludwig, PhD, CFP®. The panelists took the opportunity to note the pitfalls and promise of AI technology; while it has the potential to enhance consumer education and build trust in the industry, when used for nefarious purposes it can also threaten to undermine privacy protections and perpetuate many of the discriminatory practices that have plagued the profession in the past.

“When AI is impacted by faulty data or human biases, it can continue those biases,” Filabi said. “What happens when an insurance company’s AI system uses private data to arbitrarily strip coverage from people it thinks don’t qualify for it? There’s a lot of good it can do, but only if it’s managed ethically and transparently.”

“When AI is impacted by faulty data or human biases, it can continue those biases. There’s a lot of good it can do, but only if it’s managed ethically and transparently.”

–Azish Filabi, JD, MA

Attendees got a sneak preview of the evening’s festivities with a fireside chat featuring College board of trustees member Lieutenant General Michelle Johnson, USAF (Ret.) and 2024 Soldier-Citizen Award recipient Major General Suzanne Vautrinot, USAF (Ret.). The two discussed General Vautrinot’s path through the service, from her early Air Force days to her introduction to cyber operations that eventually led her to help found the military’s Cyber Command in defense of sensitive information worldwide.

Among the many things that make an effective leader, General Vautrinot said, the most important is creating a culture of trust and respect where people feel their ideas are heard and their peers are accountable for their actions.

“In the Air Force, there’s a tradition we call the ‘hot wash,’” she said. “After any kind of operation, before any more discussion happens, the senior officer who was leading the operation will be the first to share their analysis of how it went and what they could have done better as a leader. How you recover from any kind of internal crisis is just as important as how you handle it.”

Finally, attendees were invited to network and socialize in a Military Resource Group Networking Lounge featuring informational booths from event sponsors on resources and partnerships available to military members, veterans, and spouses: these included USAA, NFP, Thrivent, Nationwide, and F&G.

A Patriotic Culmination

After the Military Summit concluded, attendees migrated over to Philadelphia’s National Constitution Center for the main event of the day: the Soldier-Citizen Award and Scholarship Fund Dinner, which raises money for the Center to provide scholarship opportunities to members of the military community who want to transition into the financial services profession and pursue a designation or certification with The College.

Easton read off an impressive list of achievements for the Center in 2024, including:

- 1,700 scholarships granted by the Center since 2014

- 49 master’s degrees and 245 designations awarded to military community members in 2024

- $460,000 in funds raised for 67 scholarships and Center initiatives in 2024

In addition, Easton noted 20% of The College’s military scholarships go to military spouses, and that 19 scholars were in attendance for the evening’s event. Attendees heard from three of them – Tia Nichole McMillen, Kyle Packard, CFP®, ChFC®, and Rachael Smith, MBA – who are now successful professionals in the financial services industry as they shared their stories and thanked the Center and The College for the opportunities they received.

“Successful transition is possible through this powerful, thriving, and supportive community. We here, all of us, have your six,” said McMillen in her remarks, referring to the military phrase meaning “to have someone’s back.”

“Successful transition is possible through this powerful, thriving, and supportive community. We here, all of us, have your six.”

–Tia Nichole McMillen, military scholar

The evening’s crowning moment, of course, was the official presentation of the Soldier-Citizen Award – a bust of Pericles, the Greek soldier, philosopher, and leader – to Major General Vautrinot. In her acceptance speech, she brought the conversation back to the solemn meaning of 9/11, as well as what it means to be a member of the military and serve others. Recalling an incident involving colliding planes years earlier during an air show at a German base, she remembered what happened after everyone present got over their shock.

“In the moments afterward, you didn’t see people running away from the wreck – they ran to help,” she said, asking all the military veterans, service members, and families present to stand and be recognized once again. “That is service: the scholars and signers of the Constitution framed around us remind us of that, and so does everyone in this room. Because of you, we will always move forward together. Thank you.”

Thanks to all who attended the 2024 Military Summit! Check out all of the event's highlights below:

More From The College

About The College Diversity, Equity & Inclusion Insights

Steps to Strengthen Our Alumni Network

Our regional alumni receptions unite alumni and students with a variety of designations and offer a social setting where they can connect. These events are a testament to our commitment to cultivating a dynamic, supportive, and thriving alumni network.

At the heart of these events is the desire to strengthen our alumni network. We believe in the power of connection and collaboration, so we want to facilitate just that. By coming together, we create opportunities for professional growth and support.

Our goal is to forge stronger ties among alumni, fostering a sense of unity and shared purpose. Each reception will be an opportunity to exchange ideas, discuss common interests, and build relationships that could lead to new ventures and collaborations.

Cultivating Connections

We held our first two Regional Alumni Receptions last month in Atlanta, GA following The College’s annual Conference of African American Financial Professionals (CAAFP). Looking around the room, we witnessed College alumni sharing experiences which highlighted their diverse career paths while also finding commonalities in their journeys.

In the words of one of our alumni, some who attended “took a walk down memory lane” while recounting fond memories of studying with classmates. Other alumni and students were just beginning to launch their careers in the financial services industry, having just received their first designation only two short months ago. College president and CEO George Nichols III, CAP® and our advancement and alumni relations team listened intently to the valuable insights shared by our talented alumni.

We raised a glass to honor the successes of individuals who have made a significant impact in financial services and in their communities. These celebrations are not just about recognizing past accomplishments, but also inspiring future greatness.

A Warm Invitation for Future Gatherings

We encourage you to look out for future alumni receptions coming to your area or planned with our upcoming College events. Whether you are a recent graduate, student, or a long-standing member of our alumni family, your presence will add to the richness of our gatherings. We are eager to celebrate with you, hear your stories, and build connections that will last a lifetime.

Stay tuned for details on the dates and locations of our regional alumni receptions. We hope to meet you in person soon! Let’s come together to celebrate collective achievements, nurture our connections, and embark on new journeys as one united alumni community.

Connect with our manager of alumni relations and volunteer management Meagan C. Ryer at Alumni@TheAmericanCollege.edu for more details on upcoming regional alumni receptions coming to a city near you.

More From The College

Practice Management Wealth Management Insights

Personal Relationships and Financial Services

“I was the oldest grandchild on both sides of my family, and a lot of expectations fell on me to give good advice – and money was one of the most important parts of that,” he said.

Acting on that impetus, Williams started in financial services as an advisor, often going door to door to solicit new clients and work with existing ones. These days, he’s a vice president and regional practice management consultant within JPMorgan’s practice management division, consulting with financial advisors across the Southeast, Mid-Atlantic and New England regions. He says his career journey has been an evolutionary one in many ways.

“It’s given me a lot of insight into how to not just be a better advisor, but also how to run a successful business,” he said. “When you start out in this industry, you often have to wear a lot of different hats: sales, operations, compliance, managing and planning, and more. It can really weigh on you sometimes, but it teaches you a lot about who you are.”

“When you start out in this industry, you often have to wear a lot of different hats…it can really weigh on you sometimes, but it teaches you a lot about who you are.”

Sculpting Skills to Succeed

Williams says many elements of his more than 15 years of experience in wealth management and financial services made him aware of the power of knowledge and leadership – among them his stint in The College’s Black Executive Leadership Program.

“The College brings financial knowledge, education, and acumen to the table in a way that’s just phenomenal,” he said. “So, when my then-managing director reached out to tell me about this new program The College was starting up, it was kind of a no-brainer for me.”

The Black Executive Leadership Program offers high-potential Black and DEI-committed professionals ready to advance in corporate leadership the resources to power their next career steps. With its hybrid online and in-person program and its model of executive sponsors and student fellows collaborating in both settings, it’s helped set many rising leaders up for success, and Williams praised the culturally relevant insights of the curriculum.

“You can only learn so much in a textbook; it makes you aware of the issues, but not always how to navigate them,” he said.

When it comes to practice-building advice, Williams offered four key points for advisors to consider:

- Look for people who are looking for you. “Many of us are looking to improve and advance ourselves in the business, and the Black Executive Leadership Program reminds us of a lot of cultural and social issues at play and business dynamics that can have an impact on growth,” Williams said. He further explained that it’s important to find a workplace where professionals believe they belong and will be heard.

- Preparation is key. “You have to be detail-oriented, understanding the nuts and bolts of the business,” Williams said. Only then, he says, can professionals continue moving in the direction they want successfully – and hopefully have fun while they’re doing it.

- Develop your emotional intelligence. Often in business and in life, things won’t turn out the way you want them to; the defining factor is how you respond to it. Williams emphasized that it’s important to separate the ego from the professional workplace. “If a client or potential client says no, that’s okay, and there’s usually a reason for it,” he said. “Instead of getting offended, take a minute to ask them questions and try to find that reason. They may respond with something you hadn’t considered that can help you get them to yes.”

- Understand how your business model operates. “Before we even sit down with clients to have investment or other conversations, we have to understand exactly how our business is set up so we can help our clients understand, too,” Williams said. He says programs like the Black Executive Leadership Program and other learning opportunities exist to assist professionals in crafting these business models and developing their communication skills.

“The College brings financial knowledge, education, and acumen to the table in a way that’s just phenomenal…it was kind of a no-brainer for me.”

Building Client Relationships

Financial professionals are often told about the need for building strong client relationships – but Williams says his experience shows it’s even more important than some may think.

“Financial advice often has very little to do with finance,” he said. “It’s been a long time since I’ve had a Series 7-related question. Alpha, asset management strategies – these are table stakes. Relationships are the selling point of your business.”

Williams emphasized that his interactions with clients often border on life counseling in addition to financial planning and investment management – and it’s important advisors get comfortable with and be prepared to take on that role.

“Personal finance truly is personal: you’ll find yourself talking to your clients about things that have nothing to do with money. When feelings are tied into money, it becomes a highly emotional situation. It’s a sensitive subject, and you’ll become part of all kinds of conversations you never expected.”

So, how does an advisor build the kind of trust-based relationships it takes to make these connections possible? Williams advises a sound knowledge of yourself, your business, and your values – which, in turn, will give you confidence.

“There are a lot of options out there for financial planning these days, and people are often hesitant. You have to make them believers in what you’re offering,” he said. “Clients pay close attention to your attitude and your process while working with them – so you need to focus on strong communication and adding value in each interaction you have with them.”

“Financial advice often has very little to do with finance…relationships are the selling point of your business.”

It’s also often cited that financial services is a high turnover industry, with many new advisors lasting less than five years before transferring out of the business: according to Advisorpedia, 90% of advisors quit the profession within three years. Williams, however, says the ingredients for success are there as long as professionals are willing to look for them – and prepare themselves for the long haul.

“My father used to tell me about how his experience with success in law happened almost overnight. It’s not that way for most business owners, including those in financial services,” he said. “Stamina is critical. Discipline, emotional intelligence, and consistency are all things I learned along the way. The key to making it is modeling your business to run efficiently and give your clients confidence. That way, you have the confidence you need to sleep at night and spend time with your family.”

Learn More From The College

Meet Our FinServe Network.

CFP® Certification Education Program.

Philanthropic Planning Insights

Making a Tax Plan for Planned Giving

Join The College’s Chartered Advisor in Philanthropy® (CAP®) Program Director and Assistant Professor of Philanthropy Jennifer Lehman PhD, JD, CFP®, CAP®, as she discusses how to account for tax consequences when assisting clients in making charitable contributions and other forms of planned giving in this new continuing education (CE) opportunity available on Knowledge Hub+!

Whether you’re a financial advisor or a professional representing any other area of the philanthropic advising ecosystem, you should be familiar with tax regulations in order to assist clients as they devise their strategies for planned giving. The College and charitable giving expert, Jennifer Lehman provide key details in Planned Giving: Fun with Taxes and Probate.

What is Probate?

Lehman begins this discussion by explaining the concept of probate to listeners. “Probate is a legal process … that transfers property after somebody’s passing.” Probate is meant to re-title assets that are not already re-titled through some other method (such as a valid beneficiary or automatic survivorship).

However, not all cases in which the transfer of property occurs involve the process of probate. Some smaller families without significant assets may simply agree on how to divide an individual member’s wealth after their passing.

Probate can also differ on a case-by-case basis. Lehman goes on to discuss how probate looks when an individual dies with a will in place and compares the differences in the process when an individual dies without one. She also describes what parts make up this process and what participants can expect.

Lehman goes on to share her major takeaway that provides a high-level understanding of people’s relationship with probate. According to Lehman, probate is an expensive and onerous process. “It is a process that people like to avoid. So, the way to avoid probate is to plan during life for what will happen to your things when you pass.”

Giving During Life vs. After Death

Lehman discusses several methods of planned giving that clients may want to consider, starting with giving to individuals, such as a family member, and the differences between giving during life and giving after death. She emphasizes several important factors to consider, including step-s up in basis, long-term holdings, and annual gift tax exclusions, among others.

However, one key factor cannot be optimized for the best tax situation. Lehman reminds advisors, “The downside in waiting until death is you don’t get to see the benefit to the individuals or the charity as far as how they use the money and what they do with it.” This can be a major deciding factor for some clients, as they may like to see the benefits of their giving before passing away.

Gifts Your Clients May Want to Consider

Lehman highlights several forms a client’s gift may take, including gifts that can take effect during life such as cash, donor advised funds (DAFs), stocks and bonds, real estate, and qualified charitable distributions (QCDs). She continues by comparing these types of gifts to gifts that can be planned in life, but do not take effect until death, such as retirement assets, life insurance, life estate, DAFs, and individual retirement accounts (IRAs).

For continued giving, clients may also want to consider gifts that generate income such as annuities, remainder trusts, and lead trusts. These allow clients to impact their recipient of choice for years to come rather than as a single transaction.

All of these gifts have various factors to consider, and the best choice may not be the same from one client to another. By mastering the principles Lehman shares in this discussion and following her guidance when offering clients recommendations, advisors can help their clients achieve all of their gift-giving goals and more. She elaborates on these in greater detail in Planned Giving: Fun with Taxes and Probate on Knowledge Hub+.

To access this learning opportunity and other valuable CE, visit Knowledge Hub+.

More From The College

Gain philanthropic and legacy planning knowledge with our CAP® Program.

Learn about the American College Center for Philanthropy and Social Impact.

Join the waitlist to be notified when enrollment opens for the TPCP™ Program.

About The College Diversity, Equity & Inclusion Insights

CAAFP 2024 Recap

For three days from August 12-14, 2024, attendees of the 18th annual event focused on empowering, educating, and advocating for the role of Black, African American, and DEI-committed professionals in the financial services industry experienced informative and inspirational workshops and coaching sessions plus invaluable networking opportunities.

The conference was truly transformational for all involved as it focused on the theme of Expanding Our Collective Impact: building solutions to the racial opportunity and wealth gaps that still persist in America today.

The Power of Insurance Planning

The first day of CAAFP 2024 opened with an insightful conversation between two financial services industry leaders: Salene Hitchcock-Gear, president of individual life insurance at Prudential; and Kam Harris, vice president of actuarial and risk at Atlanta Life Insurance. In their discussion, they focused on their diverse roles within the insurance planning space – one of The College’s foundational pillars thanks to the Chartered Life Underwriter® (CLU®) designation program – and how insurance can shape the futures of diverse communities.

Hitchcock-Gear and Harris also talked about the relationship between insurance and legacy planning, and how Black and African Americans have been left out of conversations about building generational wealth.

Along with a welcome dinner filled with fun and fellowship, attendees went to bed excited for the next day’s main events.

Financial Services Policy and Prosperity

The second day of CAAFP 2024 kicked off with a keynote address from Donna Brazile, a veteran political strategist and author. Brazile drew on her extensive history with Washington, DC and legislating to examine the current state of the country – and what can be done to narrow wealth gaps between diverse communities.

“Leadership comes in all kinds of flavors, shapes, sizes and colors,” she said. “We are not going back. We are going to celebrate who we are, and we are not afraid to claim diversity, equity and inclusion.”

After getting a chance to attend a series of workshops and coaching sessions and check out The College’s Networking Lounge – filled with information booths and activities, as well as shopping opportunities from local merchants – attendees enjoyed lunch and a conversation between two more industry movers: George Nichols III, CAP®, president and CEO of The College; and Raphael Bostic, president and CEO of the Federal Reserve Bank of Atlanta.

In their discussion, Nichols and Bostic took a look at the role of the Federal Reserve, bankers, and the financial services industry in unlocking new opportunities for communities of color.

“Information is power, and we want to get that information into the hands of the public,” Bostic said. “Our job is to create certainty and an economy for everyone. If we’re doing our job, people will feel optimistic about the future.”

Finally, the evening was capped off with a celebratory White Party, where all attendees were invited to wear their best white outfits and dance to the beats of DJ Shakim and Dee-1. It was the perfect ending to an eventful day!

Empowering Future Generations Through Finance

While no one wanted CAAFP 2024 to end, day three of the event wasn’t short on excitement and insight. To kick off the day, Nichols hosted a fireside chat featuring Virgil Miller, president of insurance giant Aflac U.S.

Following that session, the CAAFP crowd heard a powerful address from Michelle Singletary, author and award-winning personal finance columnist for The Washington Post. Singletary stressed the importance of legacy-building for Black communities and families, returning to the themes of day one while adding her own ideas on how a change in mindset is necessary to close the racial wealth gap.

The College recognized the excellence of African American financial professionals with its annual presentation of the Lang Dixon Leadership and Excellence in Achieving Diversity (LEAD) Award. This year, two award recipients – Maceo A. Sloan, CLU® and Calvin F. Vismale, CLU® – were recognized posthumously as two of The College’s first Black alumni in the CLU® Program and among those who paved the way toward increasing diversity in the insurance business.

Finally, the entire event was capped off by a talk from Dawn Staley, a legendary figure in women's basketball. Staley is renowned both as a former player and as the current head coach of the South Carolina Gamecocks, leading the team to multiple national championships, SEC titles, and Final Four appearances. She played eight seasons in the WNBA as a stellar point guard for the University of Virginia, and was a three-time Olympic gold medalist with the U.S. women’s basketball team. In her address, Staley focused on critical elements of leadership needed to expand collective impact.

“I hope CAAFP attendees do three things after this great event: expand their knowledge, expand their network, and stay connected—both with The College and with each other. That’s how we’ll deliver on the promise of the conference and Expand Our Collective Impact.”

George Nichols III, CAP®

President and CEO

Thanks to all who attended CAAFP 2024! We look forward to seeing even more financial professionals and continuing to expand our collective impact in 2025.

Get an inside look in this year’s recap video.

More From CAAFP:

Learn About the Event.

Visit the Center for Economic Empowerment and Equality.

Ethics In Financial Services Insights

AI Governance in Life Insurance

The afternoon panel on unfair discrimination in insurance underwriting was a presentation by Azish Filabi, JD, MA, managing director of the Center for Ethics in Financial Services, and Sophia Duffy, JD, CPA, AEP®, associate professor of business planning at the American College of Financial Services, about the ethical and governance challenges of artificial intelligence (AI) in the life insurance industry.

The panel highlighted the ethical and regulatory challenges of AI in the life insurance industry, drawing insights from a 2022 academic paper with the National Association of Insurance Commissioners (NAIC), "AI-Enabled Underwriting Brings New Challenges for Life Insurance: Policy and Regulatory Considerations," and a 2021 white paper, "AI Ethics and Life Insurance: Balancing Innovation with Access."

The panelists emphasized that AI differs from traditional algorithms because complex machine learning systems can obscure the decision-making rationales in underwriting, which creates new legal and ethical challenges. Moreover, once AI systems are embedded within a process, their operations become difficult to disentangle. The opacity of these systems, often referred to as "black box" systems, poses significant technical challenges, necessitating increased technical literacy and education. The proprietary nature of many AI systems adds another layer of complexity. This opacity and complexity make it difficult to ensure that these systems comply with anti-discrimination laws, particularly those that prohibit discrimination based on legally protected characteristics, like race.

AI systems can inadvertently result in unfair discrimination by using data sources that have a historical bias or serve as proxies for protected characteristics, the panelists shared. This can lead to outcomes that are not just unfair, but also potentially illegal. However, determining who is responsible for these decisions is not straightforward. The chain of data ownership involves big data aggregators, algorithm developers, and insurers/lenders. While insurers are ultimately accountable for their products, they may lack the technical expertise to fully understand the intricacies of the AI systems they use. This creates a disconnect where insurers may not have the ability to shape or even fully comprehend the systems they deploy.

Another issue presented was the difficulty in defining and measuring proxy discrimination when it comes to AI-enabled underwriting. Insurers are permitted to use an underwriting factor if it’s related to actual or reasonably anticipated experience, but there’s no clear-cut standard for how effective that factor needs to be. This ambiguity means each insurer’s justification for using a particular factor can be unique, making regulation even more challenging.

Ensuring insurers' systems align with regulations while integrating various external consumer data points is crucial. A major concern is consumers may remain unaware of which data is used, such as credit scores, credit history, and social media data, raising questions about fairness and the ability to correct inaccuracies. The use of irrelevant and incorrect data can lead to mistakes that get embedded in data chains earlier in the process. Embedded mistakes could be particularly pernicious in complex AI systems that use proxy factors to render decisions. In such systems, it's possible the mistaken data input will render an answer false.

To mitigate these risks, researchers at The College recommend a three-part framework: establishing national standards to set boundaries for acceptable design and behavior, implementing a certification system to verify that systems are developed in accordance with these standards, and conducting periodic audits of system outputs to ensure ongoing compliance.

Developing nationally accepted standards would involve the creation of guidelines to ensure AI systems adhere to best practices in system design and actuarial principles. This process requires collaborative research and careful consideration of who should define these standards. Key areas to address include: behavioral validity, or ensuring that data accurately reflects the behavior of interest; actuarial significance, assessing how inputs contribute to risk evaluation; and social welfare outcomes, defining a financially inclusive marketplace.

As the panel discussion ended, the conversation turned to the importance of testing for unfair discrimination in AI-enabled underwriting. Emerging rules suggest both objective and subjective approaches. For instance, an objective method might involve a 5% threshold for evaluating disparate impact on race, while a subjective approach would permit insurers to develop their own AI testing methodologies.

Critical questions remain. Should there be a unified approach to testing for unfair discrimination resulting from insurance underwriting? Who should have the authority to determine this approach? And how transparent should insurers be with consumers about data usage and privacy rights? These considerations are essential as we navigate the complexities of AI-enabled underwriting and strive for a fair and equitable system.

The future of insurance underwriting is undoubtedly tied to AI, and regulators and industry can together make sure that future is fair and equitable. We hope our study sparks a necessary conversation within the industry and among regulators.

To learn more about AI in financial services, you can explore further with research from the Center for Ethics in Financial Services.

About The College Diversity, Equity & Inclusion Insights

Lang Dixon and the Origins of CAAFP

Established in 2018, The College’s Lang Dixon Leadership and Excellence in Achieving Diversity (LEAD) Award is given annually at CAAFP to an African American financial services professional who has significantly impacted the financial services profession. For 2024, two men received the Lang Dixon Award posthumously: Maceo A. Sloan, CLU®, and Calvin F. Vismale, CLU®, two of The College’s first Black alumni in the Chartered Life Underwriter® (CLU®) Program.

Along with recognizing Sloan and Vismale, those offering tributes to them at CAAFP 2024 took time to reflect on the man who provided the inspiration for the award in the first place. Lang Dixon was a successful life insurance agent and mentor who believed in giving back to his profession, and was part of The College’s inaugural African American Advisory Committee dedicated to increasing diversity and inclusion in financial services.

When Dixon passed away in 1994, the members of the still-active committee decided to commemorate his legacy with a Lang Dixon Education Day – and, thanks to the backing of some generous corporate sponsors, the idea evolved into the first CAAFP event held in 2001!

See the full story in this year’s tribute video.