Subscribe to Newsletter

Related Posts

The Best of Both Worlds

From the privacy issues raised by listening systems like Amazon’s Alexa to the growing discussion of Facebook, Twitter, and other platforms’ role in spreading disinformation, society at large is starting to recognize that technology in general, and artificial intelligence (AI) systems in particular, need to be better monitored and integrated into our lives. The financial services sector, for its part, faces a similar reckoning with the rise of robo-advisors: however, choosing to work with AI rather than against it may offer both sides of the financial planning divide a chance to benefit.

Since the earliest days of automation, there has been concern about machines eventually supplanting the jobs humans currently do, leading to not only economic instability but social concerns about surrendering control of our lives. Naturally, this leads to animosity and the sense that machines everywhere are “taking our jobs” and that they must be prevented from doing so. During the 2008 financial crisis, when confidence in the financial services system was severely shaken, several companies arose on the basis of using what they called “robo-advisors”—in actuality, collections of computerized programs and algorithms—that would quickly, efficiently, and dispassionately offer portfolio building to a wide array of clients. The appeal of machine-based advising was attractive to many investors who no longer trusted human advisors to manage their money responsibly, as well as to clients who didn’t have enough assets to attract human advisors looking for high-net-worth clients; in this way, robo-advisors helped democratize portfolio building. But many in financial services attacked the robo-advising model as an overly simplistic system that couldn’t possibly match the nuance, experience, and intuition that make real people so valuable long term. They saw robo-advising as direct competition that was seeking to replace them, and robo-advising firms, for their part, did nothing to dissuade them.

Since then, however, the attitude in the financial services industry toward robo-advisors has markedly changed, based on a realization that is occurring among professionals in various fields: while machines may be able to do certain things better and faster than people, they often lack a “human quality” needed to make wise decisions that may for one reason or another buck traditional logic. Machines just can’t think outside the box like we can (yet); therefore, even though they can and should be used to perform jobs humans can’t accomplish on their own, they require guidance and a human touch to work to their full potential.

The fact is, robo-advisors undeniably provide many advantages to savvy financial planners. They can sort through and process vast amounts of data to make decisions that are more timely and more informed than any human financial advisor could hope to produce. Robo-advisors can also be tailored to specific tasks, from risk management to client goals or investment outcomes, to provide specialized and laser-focused advice in fields like estate planning, life insurance, retirement planning, and portfolio allocation. Above all, they can lower costs to firms that utilize them by offering a cheap and efficient service of high quality that is an asset to any business, as well as cut down on the possibility of human error. It seems many in financial services are beginning to recognize this: according to a 2018 poll, almost 90% of wealth managers surveyed said they viewed robo-advisors positively. A growing number of firms use their in-house robo advisors to perform various tasks like assessing new clients and making financial wealth management recommendations based on a variety of potential situations and factors.

As humans, we’re notoriously slow to accept large-scale change, and this is true both of the robo-advising trend and in the financial services industry. Robo-advisors can help with this by giving wealth management professionals the hard data they need to adapt more quickly to changing financial environments and ensure continued profitability for firms.

AI and Wealth Management: A Mutually Beneficial Partnership

While it’s true that AI technology like robo-advisors may not always be able to offer the flexibility and imagination of human wealth managers, it’s equally true that robo-advisors offer enormous benefits to firms committed to harnessing their computing power. Therefore, the most obvious solution to the robo- vs. human advisor dilemma would seem to be a partnership: just as a human miner could find a new line of work in guiding a mechanical drill, robo-advisors don’t need to compete against traditional wealth management firms when they could instead work together. Once financial professionals begin to consider the benefits of using robo-advisors as part of their operations, the possibilities for helping clients meet their financial goals are endless.

AI and Wealth Management

Joel Bruckenstein is the head of Technology Tools for Today (T3) and an internationally recognized authority on applied technology for financial professionals. He also produces the T3 Advisor Conference, the premiere technology conference for independent financial advisors.

Bill Winterberg is the founder and president of FPPad.com and is widely known as an independent expert on technology in financial services. He has been recognized for his work by many top industry publications, including InvestmentNews and Investment Advisor Magazine, and hosts the weekly video series “Bits and Bytes” on technology news and information for financial professionals.

With nearly 40 years of combined financial services and technology experience between them, Bruckenstein and Winterberg were perfect fits to host discussions on the intersection of AI and wealth management with key figures from The College’s team of industry thought leaders. In our series of audio interviews, you’ll hear from:

- George Nichols III, President and CEO

- Michael Finke, PhD, CFP®, Professor of Wealth Management and Frank M. Engle Chair of Economic Security Research, WMCP® Program Director, and Director of the Alfred Granum Center for Financial Security

- David Blanchett, PhD, MSFS, CFA, CLU®, ChFC®, CFP®, Adjunct Professor of Wealth Management and Head of Retirement Research at Morningstar Investment Management

- Hilary Fiorella, Executive Director of the Center for Women in Financial Services

- Azish Filabi, JD, Associate Professor of Ethics and Executive Director of the Cary M. Maguire Center for Ethics in Financial Services

- Sofia Duffy, JD, CPA, Assistant Professor of Business Planning, and Assistant Vice President and Director of Regulatory Compliance

Up Your Game

Yet, Williams’ journey to the wealth management firm specializing in investments, insurance planning, and financial planning took a far more circuitous route – aspirations that came with a prestigious collegiate golf career at Auburn, a victory that vindicated the lengthy days spent “rounding the edges of the circle,” as his swing coach liked to preach, a taste of competition at the pinnacle of the sport on the PGA Tour, and a chronic back injury that required a dramatic course-correction.

Williams’ win at the Web.com Tour’s 2012 Mexico Open – at a golf course in the central Mexican state of Guanajuato, some 1,550 miles from Alexander City – was metaphoric of the nomadic journey many professionals take with the game, a suitcase-and-continental-breakfast lifestyle required to chase the dream.

Reaching the winners’ circle led to PGA Tour status – a card Williams held for two seasons, before his journey was derailed by a bad back that limited his ability to play without pain.

From One Beginning to Another

Williams never put pressure on himself as a junior player, understanding it was just the first step in his golfing career. That perspective – underlying his immense skill and drive – helped him land a golf scholarship at Auburn, where he earned three-time All-American status and helped the Tigers capture the 2002 SEC championship.

Ten years later, he lifted the trophy on the Web.com Tour, and with it shook off the immense pressure that came with carving out a sustainable golf career. Yet, just months later, he felt a twinge in his back following a gym session at an event in Knoxville, Tennessee. What started as nagging pain grew sharper, more persistent, and eventually chronic.

Despite his best efforts on the PGA Tour in 2013 and 2014, Williams’ physical limitations curbed his ability to compete, and after taking a major medical exemption in 2014, he left the game he’d pursued since childhood.

Despite this, Williams never considered himself to be at a crossroads. He took his studies seriously at Auburn, earning accolades as a two-time Academic All-American with a degree in Economics. “That balance between golf and school was a crash course in time management,” Williams said. “It also meshed with my mentality to be the best I could at everything, giving energy and effort on the course and in the classroom.”

Williams parlayed his academic accomplishments and affinity for finance into an opportunity as a financial advisor.

“I always had something else other than golf that I enjoyed,” Williams said. “So, I naturally jumped at the opportunity to transition to a career in financial services.”

Williams approaches the business, and the value he provides to his clients, with the same mentality that he approached his career hitting fairways and greens. “It’s all about creating a network of peers to grow your skills and forging relationships with your clients, understanding their needs, and then honing my skills to meet those needs,” he said.

His client-first mindset is rooted in his experiences at the Walker Cup, a team amateur competition between the United States and Great Britain and Ireland. Williams played on two teams alongside current PGA Tour players Bill Haas, Ryan Moore, J.B. Holmes, and Bryan Harman.

“Golf is an individual sport, except in these team events, where it’s about something far bigger than you,” Williams noted. “In financial services, it’s the same way. It’s not about you, it’s about your clients, their family, their business, their legacy. It’s an immense and humbling responsibility.”

How The College’s WMCP® Program Changed The Game

Williams is accustomed to taking advantage of opportunities – a fortuitous bounce off a tree into the fairway during his golf career, and an open invitation to take The American College of Financial Services’ Wealth Certified Management Professional® (WMCP®) program to expand his applied knowledge.

“I got an email from Ameritas Growth Leaders (AGL) – a study group for financial professionals in their first decade in the business, and Ameritas was offering to pay for our continued education through The College’s WMCP® program. They wanted to invest in me, and I wanted to invest in myself and my clients,” Williams said.

After doing his due diligence, Williams was sold. “I liked everything I saw – the program offers an expansive view of wealth management that’s more than portfolios; it’s managing accounts, tax issues, and estate planning. I was ready to go,” he said.

Despite running into a testing delay due to the COVID-19 pandemic, Williams is now a Wealth Management Certified Professional®, growing his skills in “tax management and a whole lot more.”

“I learned so much about putting certain investments into certain accounts for tax efficiency,” Williams said. “I now grasp estate planning at a foundational level, and I understand its value. I’m now connected to an estate planner and sit in those meetings with my clients. I’ve identified greater growth and value possibilities that truly enhance the potential for greater client outcomes and business growth.”

As Williams looks to the future, he holds his WMCP® credential proudly – just as he held that trophy in 2012. It’s indicative of the beginning of a new career journey, one that brings him great pride and satisfaction.

“I like to follow Wayne Gretzky’s words, ‘I skate to where the puck is going, not where it’s been,’” he said. “Just building portfolios is the past, but WMCP® has set me up to expand my expertise and my services now and in the future.”

5 Steps to Handling High Inflation

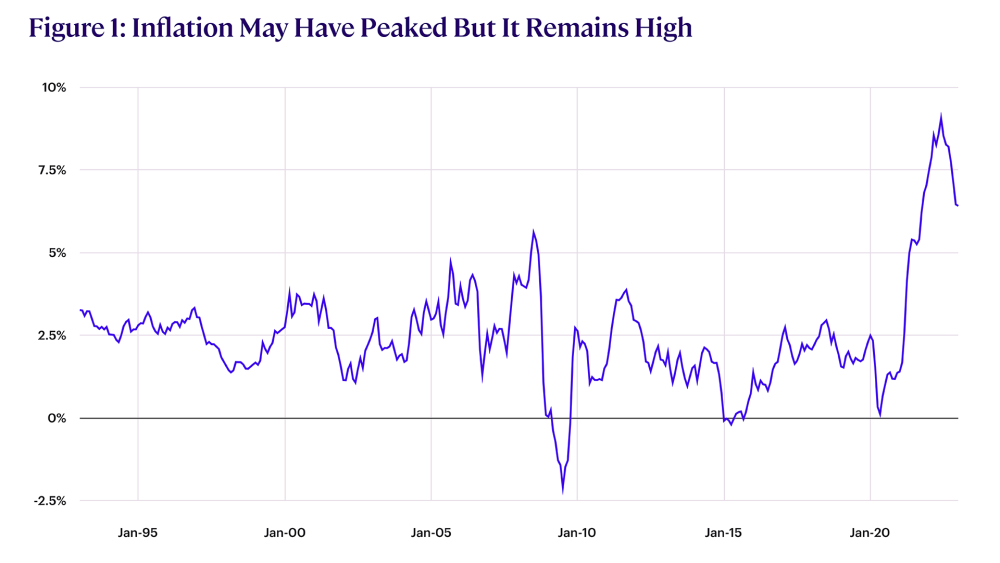

While the pace of inflation has slowed, it remains uncomfortably high (see Figure 1). Consumer prices continue to rise, and persistent inflation is eroding the value of savings and – combined with rising interest rates and struggling markets – hurting investors.

The good news is that there are practical steps you can take to reduce the impact of inflation on your family, budget, and portfolio.

Step 1: Do Not Panic

While inflation can be a source of stress, it is important to maintain perspective. Although prices are high and still rising, most households have a surprisingly robust capacity to adjust to high inflation and there are many things you can do to protect yourselves and your family.

So, do not allow yourself to become overly stressed – instead, focus on what you can do to thrive despite high inflation.

Step 2: Review Your Income

If you are currently employed, consider the impact inflation has had on your income. Has your salary kept pace, or have you accepted a stealth pay cut as inflation eats away at the value of your paycheck?

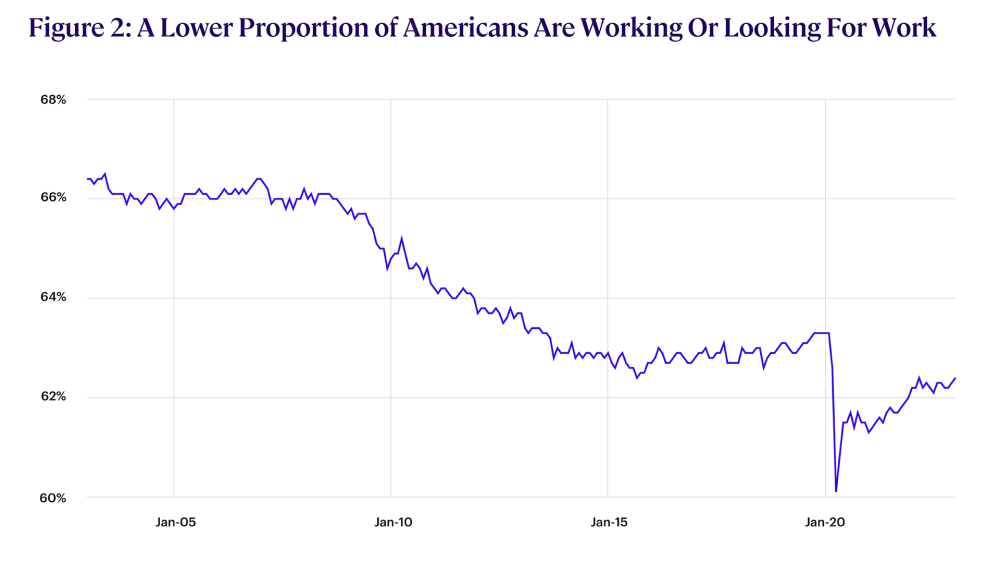

Remember, despite some easing, labor markets remain tight, with the labor force participation rate – which measures the proportion of Americans that are either employed or seeking employment – still well below pre-pandemic levels (see Figure 2). If your income has not kept up with inflation, it may be time to consider a new job.

For those in retirement who are worried about their income, there was some good news on the Social Security front – Social Security checks were increased by 8.7% for 2023 to account for higher inflation.

However, if you are drawing an income from your retirement savings, talk to your financial advisor. You may need to increase your drawdown rates to cover today’s higher cost of living but this may pose a risk to your long-term plans. Your advisor can help you balance your need for higher income against the need for capital preservation.

Step 3: Review Your Expenses

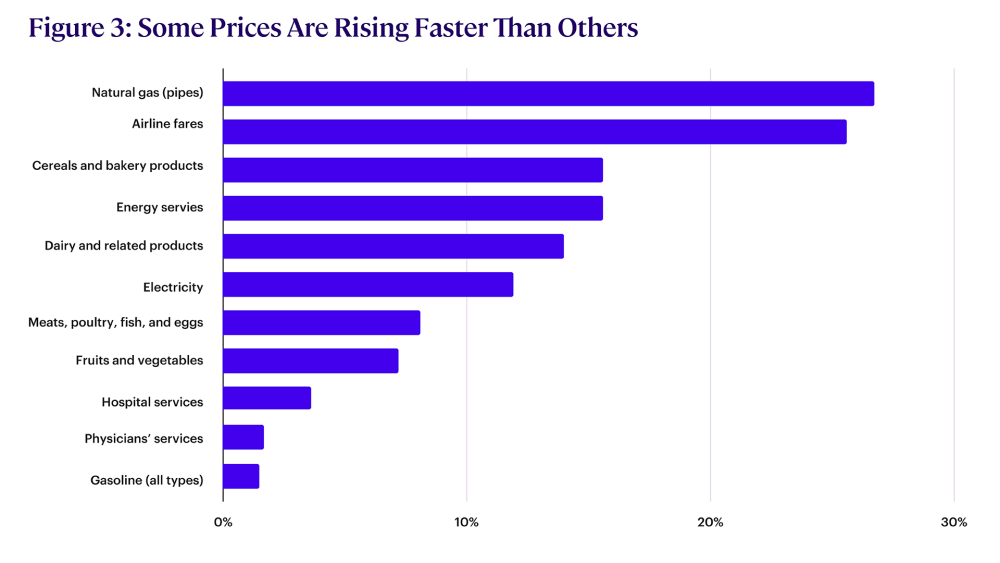

As prices rise, it makes sense to review your spending and budget. Some products and services have seen more significant price spikes than others, so adjusting your activities to reduce your exposure to especially expensive items can improve your personal inflation rate (see Figure 3).

For example, you could plan a vacation within driving distance to avoid high airfares or use an air fryer rather than a gas stove to prepare your meals.

Step 4: Review Your Debt

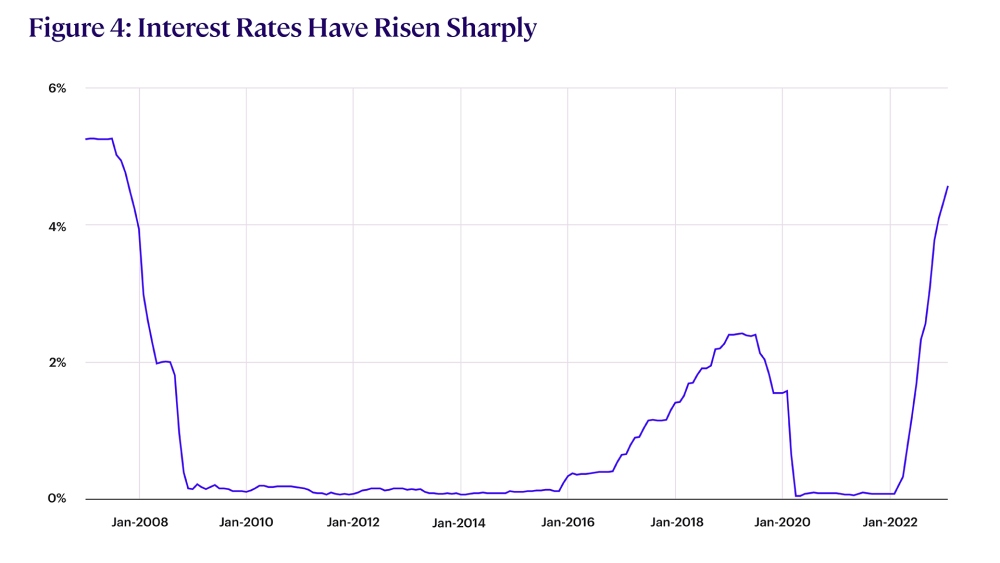

To fight inflation, the US Federal Reserve has been steadily raising interest rates, which are now at their highest level since 2007 (see Figure 4).

As rates rise, payments on variable-rate debt rise, and this could be putting a squeeze on your budget. If possible, therefore, it makes sense to pay down variable-rate debt or to consolidate it into a low-rate or fixed-rate pool.

Step 5: Check Your Portfolio

The key to financial well-being is generating inflation-beating returns. But after the painful contraction in asset prices over the last two years, you may feel that this goal is unachievable.

However, by making sure you have a balanced and diversified portfolio, you can set yourself up for long-term success. Review your portfolio and make sure you include allocations to assets that have traditionally served as a hedge against inflation, such as real estate, Treasury Inflation-Protected Securities (TIPS), or gold. This, combined with risk-appropriate allocations to equities and bonds, will help you outperform inflation in the long term.

More From The College:

Get specialized retirement planning knowledge with our RICP® Program.

Get the details of our WMCP® Program.

Subscribe to Newsletter

Related Posts

Subscribe to Newsletter

Related Posts

Subscribe to Newsletter

Related Posts