Diversity, Equity & Inclusion On-Demand Webcasts

Helping to Build a Pipeline of Women Working in Wealth

Diversity, Equity & Inclusion On-Demand Webcasts

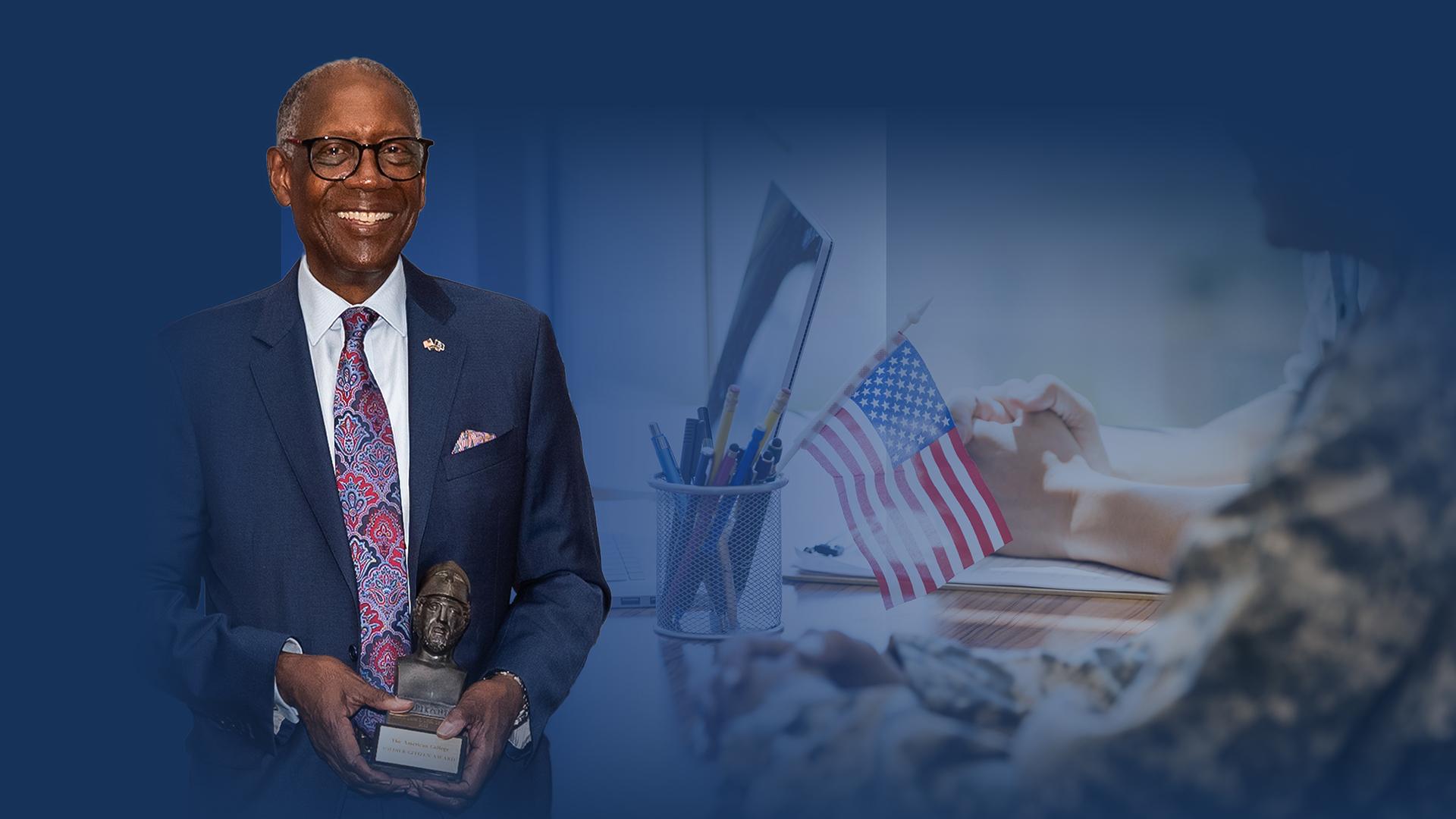

George Nichols III on Increasing Diversity in Financial Services

Diversity, Equity & Inclusion On-Demand Webcasts

Service and Sacrifice of Military Members from a Command Team View

Diversity, Equity & Inclusion Insights

COVID Exacerbates Financial Planning Issues in Underserved Communities

These underlying causes are complex, but can be partially explained by the prevalence of high-risk factors like obesity, respiratory diseases, and diabetes, as well as economic factors such as lower rates of health insurance and inadequate hospital resources.

A COVID-19 illness can be significant and prolonged, causing financial hardship to families due to loss of the income usually earned by the patient while they’re ill, permanent loss of income if they pass away, and incurred debt from medical costs related to any treatment. In addition, while the long-term health effects of COVID aren’t yet fully known, the Mayo Clinic reports that the permanent organ damage suffered by many COVID patients increases the likelihood of developing significant illnesses in the future, such as heart failure or other heart complications, pneumonia and long-term breathing problems, stroke, seizure, Parkinson's disease, Alzheimer's disease, and a higher probability of developing dangerous blood clots.

Financial advisors should be mindful of the impact of the effects of the pandemic, particularly to provide strategies to protect lower-income families against financial ruin. Advisors, who are well aware of the risks of failing to plan, should be mindful that those risks are more pronounced at present.

The potential for financial insecurity is staggering: More than half of adults under age 64 don’t have a will. In lower-income communities, the numbers are even lower, with only 55 percent of families with household income $75,000 or greater having a will, and only 31 percent with household income under $30,000 having a will. For minority populations, only 28 percent of non-white adults have wills compared to 51 percent of white adults.

These statistics are more cause for concern among low-income populations, who, without a financial plan, are at higher risk of negative financial impact from the long-term illness or death of an income earner and related medical expenses.

Financial planning does not need to be a costly endeavor. The following are some low-cost planning strategies that can be implemented to protect clients. If your client is also a member of a minority population, cultural sensitivity, including multi-lingual offerings, will also be necessary to integrate into an advisory plan.

Healthcare planning. If your clients are young and healthy, they should explore options for obtaining health insurance. In addition, the long-term health impacts of COVID-19 bring long-term care planning to the forefront. Long-term care insurance adds another layer of protection to protect against overwhelming debt due to costs from a prolonged illness. Such insurance covers costs that may not otherwise be covered by health insurance, such as nursing home costs, custodial care, and care for assistance with daily activities like bathing and getting dressed.

In addition to insurance coverage, clients need to plan for incapacity. This includes formalizing a client’s wishes about their medical care in the event they are incapable of making those decisions. In the most severe COVID cases, the patient is put on a respirator or ventilator and may be sedated or unable to speak, in which case a predetermined plan of action would be critical. A living will, also known as an advance medical directive, is a document that details the client’s wishes about treatment options for end-of-life care. Similarly, a Physician’s Order for Life Sustaining Treatment, or POLST, is a document created between a patient and physician discussing end of life treatment options. A springing durable power of attorney for health care appoints an individual to make healthcare decisions for the patient during the time when they may be incapacitated. Lastly, a Do Not Resuscitate Order (a DNR) advises emergency healthcare providers to avoid resuscitative measures. An attorney must be consulted for preparation of the will and powers of attorney.

Income protection. Income protection measures should be taken to protect against a long-term illness or death of an income earner. The loss of income is particularly impactful in lower income communities for a couple of reasons. Research by the NY Fed shows that higher density households have markedly higher rates of COVID-19 cases. Moreover, where the number of individuals living in each household is higher, more individuals may rely on the income earners, multiplying the financial loss of one death.

Disability insurance. Short- and long-term disability insurance can protect against some loss of income if a person suffers a long-term illness from COVID. Disability insurance is particularly important for single-parent homes or one-income homes.

Life insurance. A whole life insurance policy or a term policy can provide financial security if the income-earner passes away from COVID. There are several planning goals that can be accomplished with a death benefit, including:

- A term policy can provide a “safety blanket” while an income-earner may be exposed to COVID, particularly for essential workers and healthcare workers.

- A term policy can replace lost income for an income-earner who is caring for minors for the time period until they reach the age of majority or graduate college and can gain employment.

- A term or whole life policy can provide funds to care for dependents in the event that the primary caretaker passes away.

- A term or whole life policy can provide funds to satisfy the debts of the decedent, including funeral costs and debt related to the decedent’s last illness, which may be prolonged and significant due to COVID,

Estate planning for property. A low-income individual may not have significant assets to pass wealth, but that doesn’t mean estate planning for property is irrelevant. A will can protect the decedent’s assets against estranged family members who may have a legal claim under the state’s intestacy laws. In addition, if the client has minor children or dependents, a will can name a guardian and establish a financial foundation to provide care for the children/dependents. The primary residence is typically the most significant assets that individuals own, and in fact, 54 percent of wealth owned by Black households is made up of home equity, so planning for the transfer of the home is crucial. If the client is not married but has a partner they would like to provide for, a will can provide assets for the surviving partner or ensure they can remain in the home for the remainder of their life or for a term of years, after which the home can pass to the client’s children or other family members. Unmarried partners would otherwise be ignored under the state’s intestacy laws. Lastly, a power of attorney for property can be created so that another individual can access bank accounts to pay expenses in the event that the COVID patient is incapacitated.

There is a cost to providing this security, which can be an obstacle for lower-income families to seek professional advice. Even for small estates, an estate planning attorney’s services can run between $1,000 to $5,000. However, many states offer pro-bono community services through legal aid or state bar associations.

Some community organizations offer services to help advance financial education and access to resources relating to financial planning – as the AKArama Foundation did recently with a free webinar targeted to help Black people in the context of the pandemic threats. Partnering with communicating organizations could help advisors develop stronger relationships and establish trust with individuals new to financial planning.

Diversity, Equity & Inclusion Insights

Small Business Advisory Services in Diverse, Underserved Communities

The Centrality of Small Businesses in the U.S. Economy

According to the Small Business Administration’s 2020 Small Business Profile, there are 31.7 million small businesses in the United States, including six million from communities of color. The small business sector has a significant impact on the economy, comprising 99.9% of all business and employing 60 million people. Small businesses' survival and growth is vital to the growth and sustainability of the U.S. economy.

COVID’s Impact on Small Businesses and Especially Minority Owned Firms

Additionally, McKinsey Consulting reports that Black and minority owned business have a much higher failure rate than the national average, mostly due to undercapitalization of the business. A working paper from Fairlie (2020) reports recent data from the National Bureau of Economic Research indicating small businesses have been hard hit by the pandemic. Active business operations dropped by 22% during a two-month period between February and April 2020, with black-owned businesses down 41%. Other minorities were also harder hit than the average. Data from the New York Federal Reserve paints a similar picture. The Small Business Credit Survey found minority business owners hit much harder than average. Overall results indicated 57% of firms characterized their financial condition as “fair” or “poor”. Unfortunately, this figure jumped to 79% for Asian-owned firms, 77% for Black-owned firms, and 66% for Latin-owned firms.

While we don’t yet have data on the connection between small business survival rates and access to a personal financial planner, one area of further study should be whether financial advisory relationships have improved outcomes for small business owners. Moreover, studying the characteristics of those relationships, such as the length of advisory services, whether services began prior to small business formation, and how comprehensive the advisory work was could provide qualitative research details to facilitate small business sustainability.

Financial Planning is Important for Entrepreneurs and Small Business Owners

Entrepreneurs have unique qualities that set them apart, whether it's family relationships, personal and business goals, economic and noneconomic goals, and behaviors and attitudes. Providing financial planning services for entrepreneurs and small business owners can be both challenging and intellectually fascinating at the same time. The intertwined business management, personal relationships and firm ownership issues and goals create financial planning complexities, rendering the advice of an advisor particularly valuable. Indeed, researchers that study this topic found that women entrepreneurs' access to capital was predicated more on the quality of their personal finances than the assets of the business.

Central to theirs and other findings was that a significant contributing factor in the failure of entrepreneurs was the inadequacy of their personal capital, personal liquidity shortfalls, and poor personal tax planning. This finding could lead small business lenders and those who serve women entrepreneurs to include personal financial planning services as part of the portfolio.

Small Business Advisory Services as a New Market Opportunity

The guiding assumption in financial planning and counseling is that those who use the help of a financial professional to build and implement a goals-based plan will ultimately achieve success. Most would agree that's best done by working with a financial professional that understands the business and personal goals and objectives of the individual or entrepreneur. Many financial planners are looking for ways to build their client base, and opportunities to market to potential client segments that they feel might be lucrative.

From a business standpoint, entrepreneurs (family and non-family businesses, and solo operators) can be an important source of business for planners, mostly due to their complex situations. Most practitioners and researchers point to the intertwining nature of an entrepreneur’s personal goals, such as retirement and estate planning, coupled with business goals such as firm leadership and business development. Many financial planners are also looking for ways to contribute to societal value. Advising underserved individuals and communities would advance these dual goals.

What You Can Do Next

- Keep in mind that many small businesses, especially minority owned, are struggling right now just to keep their doors open. If that’s the case, find some businesses in your community and help them by being a cash-flow thought partner to help them stay afloat until things improve. Don’t underestimate your abilities as a business person. You may not know their business, but being available to help them make good decisions could open new doors and pivot opportunities. As the economy recovers, long-term planning services can be integrated into the relationship.

- Most communities have non-profit organizations that serve small businesses and entrepreneurs, such as the Small Business Development Centers, sponsored by the Small Business Administration. Some specialize in underserved groups. Establish relationships with these associations to offer financial planning or education services to their members. Services could include group-based education seminars about the importance of financial planning in their business. Some accept volunteers to serve as mentors (for example, Pacific Community Ventures). Small steps such as establishing an emergency fund, or finding a good CPA to help with taxes can reap big rewards.

- Consider beginning with Pro Bono services, and once the business recovers and starts to grow again, then slowly develop a trust-based long-term relationship that enables mutual financial benefits.

Conclusion

Small business survival and growth are vital to the sustainability of the economy. Improving access to personal financial planners could be an important factor in the mission to help close the racial and gender wealth gap. Advisors can play a vital role, and simultaneously develop a new market at the same time.

Diversity, Equity & Inclusion Insights

Celebrating Black History in the Making

Thasunda Brown Duckett

President and Chief Executive Officer, TIAA

Thasunda Brown Duckett is President and Chief Executive Officer of TIAA, a Fortune 100 provider of secure retirements and outcome-focused investment solutions to millions of people working in higher education, healthcare, and other mission-driven organizations. Duckett joined TIAA after serving as Chief Executive Officer of Chase Consumer Banking, where she oversaw a banking network with more than $600 billion in deposits and 50,000 employees. Previously, she was the CEO of Chase Auto Finance, one of the leading U.S. providers of auto financing, and National Retail Sales Executive for Chase Mortgage Banking, where she managed 4,000 mortgage bankers. Earlier in her career, she was a Director of Emerging Markets at Fannie Mae, where she led the implementation of national strategies designed to increase homeownership among Black and Hispanic Americans. She also founded the Otis and Rosie Brown Foundation in honor of her parents to recognize and reward people who use ordinary means to empower and uplift their community in extraordinary ways. She is passionate about helping communities of color close achievement gaps in wealth creation, educational outcomes, and career success.

Rosalind Brewer

Chief Executive Officer, Walgreens Boots Alliance, Inc.

Rosalind Brewer joined Walgreens Boots Alliance as Chief Executive Officer in March 2021. She also is a Director on WBA’s Board. Brewer most recently served as Chief Operating Officer and Group President at Starbucks from October 2017 to January 2021. Prior to Starbucks, she served as President and Chief Executive Officer of Sam’s Club, a membership-only retail warehouse club and division of Walmart, Inc., from February 2012 to February 2017. Before joining Walmart, she served as President of Global Nonwovens Division for Kimberly-Clark Corporation, a global health and hygiene products company, from 2004 to 2006, and held various management positions at Kimberly-Clark beginning in 1984. She is currently ranked #6 on Fortune’s 50 Most Powerful Women in Business and was named one of the 25 most influential women by the Financial Times in 2021.

Sharon Bowen

Chair of the Board of Directors of the New York Stock Exchange

Sharon Bowen joined the Intercontinental Exchange, Inc. Board of Directors in December 2017. She serves as the Chair of the Board of Directors of the New York Stock Exchange, our subsidiary, and serves on the boards of certain NYSE U.S. regulated exchanges. In addition, she co-chairs the NYSE Board Advisory Council. She served as a Commissioner of the U.S. Commodity Futures Trading Commission (CFTC) from 2014 to 2017. During that time, she was a sponsor of the CFTC Market Risk Advisory Committee. She was previously confirmed by the U.S. Senate and appointed by President Obama on February 12, 2010, to serve as Vice-Chair of the Securities Investor Protection Corporation (SIPC). She assumed the role of Acting Chair in March 2012. Prior to her appointment to the CFTC, she was a partner in the New York office of Latham & Watkins LLP.

Mellody Hobson

Chairman of the Board of Trustees, Ariel Investment Trust

Co-CEO & President, Ariel Investments

Chair of the Board, Starbucks Corporation

As Co-CEO of Ariel Investments, Mellody Hobson is responsible for the management, strategic planning, and growth for all areas of the company outside of research and portfolio management. Additionally, she serves as Chairman of the Board of Trustees of the Ariel Investment Trust—the company’s publicly traded mutual funds. Prior to being named Co-CEO, she spent nearly two decades as the firm’s President. Outside of Ariel, she is a nationally recognized voice on financial literacy. Her leadership has also been invaluable to corporate boardrooms across the nation. She currently serves as Chair of the Board of Starbucks Corporation, and is also a director of JPMorgan Chase. Her community outreach includes her role as Chairman of After School Matters, a Chicago non-profit that provides area teens with high-quality after-school and summer programs. She is a member of the American Academy of Arts and Sciences, The Rockefeller Foundation Board of Trustees, and serves on the executive committee of the Investment Company Institute. In 2015, Time Magazine named her one of the “100 Most Influential People” in the world.

Roger W. Ferguson, Jr.

Former CEO, TIAA

Former Vice-Chair of the Federal Reserve

Roger W. Ferguson Jr. is an American economist who served as Vice-Chair of the Federal Reserve from 1999 to 2006 and is the former President and Chief Executive Officer of the Teachers Insurance and Annuity Association – College Retirement Equities Fund (TIAA). He is currently a member of the Board of Directors of Alphabet, Inc. Between 2008 and 2012, Ferguson served as an economic advisor to President Obama, initially as a member of the President-elect's Transition Economic Advisory Board and subsequently as a member of the President's Economic Recovery Advisory Board and the President's Commission on Jobs and Competitiveness. Ferguson has co-authored, edited, or led study groups or commissions that have produced numerous publications, including monographs, occasional papers, study group reports, and commission reports Alan Greenspan has called Ferguson "one of the most effective Vice Chairmen in the history of the Federal Reserve."

Tyrone Ross, Jr.

CEO and Co-Founder of Onramp Invest

Tyrone Ross Jr. is a licensed investment advisor and the CEO and Co-Founder of Onramp Invest. He is a powerful storyteller with a passion for digital assets and their ability to disrupt our current way of life. He was recognized by Investment News 40 under 40 (2019), and WealthManagement.com as a top ten advisor set to change the industry in 2019. FinancialPlanning.com named him as one of 20 people who will change wealth management in 2020. He was also recently named as Investopedia’s Top 100 financial advisors, and Think Advisor’s 2021 IA25: VIP’s Pushing Advisors Forward.

Diversity, Equity & Inclusion Insights

Introducing the 2023 Women Working in Wealth<sup>SM</sup> Award Winners

The Women Working in WealthSM Award was created to showcase and celebrate women who have rolled up their sleeves to advance women in financial services through mentorship, sponsorship, and advocacy. Each award winner documented concrete examples of how she removed obstacles, created allies, and executed novel solutions to gender parity.

The Women Working in WealthSM Awards are presented each year to a group of mission-driven and passionate female professionals who are making a significant impact in financial services. The 2023 group of award recipients includes:

- Natalie Baires, WMCP®, JPMorgan Chase

- Lauren Oschman, CFP®, CDFA®, Vestia Personal Wealth Advisors

- Sahar Pouyanrad, EMBA, CTFA, AEP®, CEP®, ChSNC®, PFP®, JPMorgan Chase Bank

- Raquel Tennant, CFP®, 2050 Wealth Partners

- Andi Madden Wrenn, AFC®, Zeiders

Nominations for next year’s Women Working in WealthSM Awards open in October!

Diversity, Equity & Inclusion Insights

2023 Women Working in Wealth<sup>SM</sup> Summit

Over 180 women and their allies from across financial services attended the event in New York City on International Women’s Day. Presentations and discussions covered a variety of topics, ranging from education, changing perspectives, and self-care to rising interest rates and economics.

“You don’t necessarily have to be the subject matter expert. You need to have great leadership skills that are transferable.”

— Kristin Lemkau, CEO of J.P. Morgan Wealth Management

Speaking to a packed room of leaders and practitioners, CEO of J.P. Morgan Wealth Management Kristin Lemkau emphasized that employees and clients are critical to an organization’s success. “I think a person is a sum of their parts,” she said, and “you have to care about the whole person.” She also spoke about team building and stressed the importance of starting with the right people. Lemkau advised aspiring female leaders in the audience that acquiring leadership skills and focusing on organizational growth is critical to career advancement.

Our CEO, @KLemkau closed out the 2nd Annual Women Working in Wealth Summit to discuss her career and driving growth at J.P. Morgan Wealth Management. @TheAmerCol pic.twitter.com/Ms0Ehrz9h5

— J.P. Morgan Wealth Management (@JPMWealth) March 16, 2023

Informed industry experts discussed the future of financial services

Presentations covered a range of topics, with insights including:

- As part of the practitioner breakout: “Catching the Philanthropy Wave with your Clients Estate Planning Essentials,” Dien Yuen, JD/LLM, CAP®, AEP®, executive director, Center for Philanthropy & Social Impact at The American College of Financial Services, reminded the audience to ask the question about philanthropy to everyone, and often, and ask business owners what’s going to happen to their business when they aren’t here. Figure out what the client is trying to do, and then figure out the tools in order to do it. These important questions all need to be addressed. She stated you can gain access via greater education and applied knowledge, and then become a “lifelong learner.”

In the practitioner breakout: “Alternative Investments Post-FTX,” panelists stated that the average individual has no access to an immediate money transfer while explaining that it’s expensive to be poor. There are still secrets around money and investments, along with deep historical roots, and panelists believe access is what drives people to gravitate toward crypto markets.

Tyrone Ross, Jr., CEO/co-founder of Turnqey Labs, urged advisors to “meet clients where they are” to guide their journey forward. He mentioned that portfolios were first derived in the 1940s and they weren’t informed by research, which can further fracture a client’s knowledge base and experience with investing. This requires making financial services accessible to more people in order to change the lens and perspective of wealth management.

Kelly Ann Winget, founder, Alternative Wealth Partners, believes it only takes one person to make a difference, and eventually mindsets shift while you uplift and mentor the next cohort of women on your heels. She challenged those in the audience to be someone to stand up in the room for what they believe. “You are here saying you want to support women, but are you a “way” maker? You have to be willing to change the narrative. When you have the power to anoint a woman to put her in power, you have to do it.” Her message was to “be the little flame within the organization” and make a way while serving as a beacon for others.

In her leadership breakout: “How to Get Ahead of Burnout, Read the Signs, and Assess the Risk,” author and burnout expert Cait Donovan conveyed that companies are now changing their corporate culture in as few as 3 years, immersing employees in cycles of constant change. She highlighted workplace risk factors for burnout as: workload, lack of community, lack of control/autonomy, lack of fairness, lack of recognition, and values mismatches.

Donovan emphasized that the best companies out there are practicing psychological safety, are aware of burnout risk factors, and support team members in need while she acknowledged the importance of advocating for and advancing women in the industry.

Wonderful start to the day hearing from @TheAmerColPrez and Kristi Rodriguez at the @TheAmerCol Women Working in Wealth Summit. pic.twitter.com/YUvbI34e5n

— Mary Kate Gulick (@MaryKateGulick) March 8, 2023

Staying in the struggle and the state of progress

The American College of Financial Services President and CEO George Nichols III, CAP®, addressed the audience by invoking Frederick Douglass’s quote, “If there is no struggle, there is no progress.” He acknowledged the progress already achieved and left the audience with compelling questions: “How do we stay in the struggle and advance the progress? And how do we determine the voids we’re trying to fill?”

Nichols invited everyone to engage with the Center for Women in Financial Services to define the voids and meet those needs. By doing so, advisors can better focus on their clients. He believes “it cannot be about ‘what you sell,’ but rather, it has to be about ‘what they need.’”

Women Working in WealthSM Walk advocates for pay equity

Director and Chair Lindsey Lewis, MBA, ChFC®, CFP®, of the American College Center for Women in Financial Services kicked off the annual event by leading a brisk morning walk to the “Fearless Girl” statue on Wall Street. The walkers struck their best power poses with “Fearless Girl” while a placard reminded everyone why the meeting was so important, reading: We won’t overcome pay inequality for 300 years unless we do something now.

Five Women Working in WealthSM honored for uplifting women

The Center for Women in Financial Services announced a list of accomplished and dedicated women in the profession honored as this year’s Women Working in WealthSM Award recipients. Created to showcase and celebrate women who have rolled up their sleeves to advance women in financial services through mentorship, sponsorship, and advocacy, each award winner documented concrete examples of how they removed obstacles, aligned with allies, and executed novel solutions to improve gender parity. The 2023 group of award recipients includes:

- Natalie Baires, WMCP®, JPMorgan Chase

- Lauren Oschman, CFP®, CDFA®, Vestia Personal Wealth Advisors

- Sahar Pouyanrad, EMBA, CTFA, AEP®, CEP®, ChSNC®, PFP®, JPMorgan Chase Bank

- Raquel Tennant, CFP®, 2050 Wealth Partners

- Andi Madden Wrenn, AFC®, Zeiders

Speaking at the inaugural @TheAmerCol’s Women Working in Wealth Summit and Awards Ceremony last year was a POWERFUL experience. This year, I hope you'll join me, my @2050WPs & colleagues from across the country to celebrate #FinServ women! #WWW2023https://t.co/f4Rc7IcGng pic.twitter.com/ZCMG2oVA5K

— Lazetta Rainey Braxton, MBA, CFP® (she/her/hers) (@lazettabraxton) February 20, 2023

Great to be taking a deep dive into economic challenges during the closing panel at the American College’s WOMEN WORKING IN WEALTH SUMMIT, 4/7-8, NYC with Sitara Sundar and Carly Doshi, managing director, Wealth Planning @jpmorgan. @FAmagazine https://t.co/SDv3hjSB4U

— Tracey Longo (@TraceyFAMag) March 6, 2023

“Today is such a good day to change the world.”

— Hillary Fiorella, Executive Director, Center for Women in Financial Services

As a proud leader, Hillary Fiorella, executive director for the American College Center for Women in Financial Services, exuded excitement for all the women in the room working in financial services, along with their allies who play an essential role in advocating for and advancing women.

She also reminded everyone that the work is still unfinished because it “takes 30% longer for women to get promoted to the C-suite.” She pointed everyone to the Center’s research to help determine if it is more effective to stay in the same firm or to move around to different firms to receive promotions.

CFP Board Director of Diversity & Inclusion Dawn Harris connected w/ CFP Board volunteers at the #WomenWorkinginWealth Summit! From left to right, Diversity Advisory Group Member Rianka Dorsainvil, CFP® (@Rianka_D), Dawn, & Women’s Initiative Council Member Angela Ribuffo, CFP®. pic.twitter.com/YkEFuux9Qo

— CFP Board (@CFPBoard) March 8, 2023

During the Women Working in Wealth Summit held by @TheAmerCol, recruiting experts discussed how as women prefer remote work, firms need to learn how to adapt to create a more inclusive and diverse workplace. #diversity #women @ericacarnevalli https://t.co/uhjllqRsGm

— Financial Planning (@finplan) March 10, 2023

See the recap video from our event: