Financial Planning Retirement Planning Insights

2024 Advisory Services Survey

The new 2024 Advisory Services Survey explores key similarities and differences in service offerings and client needs among three types of financial professionals: dually registered advisors (Duals), investment advisor representatives (IARs), and those who are either insurance agents (IAs) or registered representatives (RRs). The results reveal opportunities for independent advisors to differentiate their practices, as well as areas in which captive advisors have clear advantages.

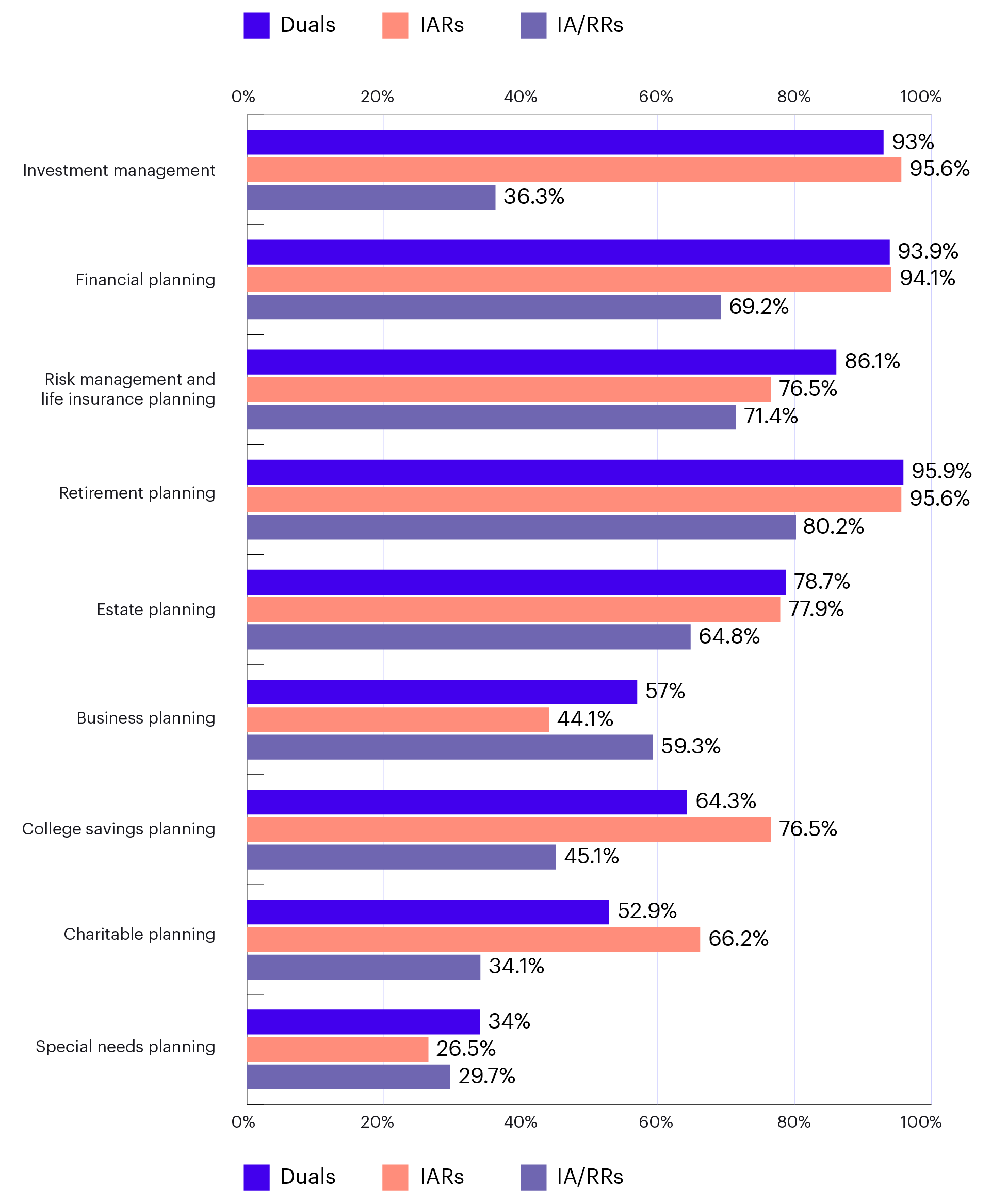

What Services Do Advisors Offer?

The survey began by asking advisors about the services they are currently offering to clients. Across all three advisor types, the data shows independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients, including: charitable planning, college savings planning, estate planning, retirement planning, risk management, financial planning, and investment management.

“Independent advisors, both dually registered and IARs, are leading the way in delivering a wide gamut of services to their clients.”

However, IARs are less likely to offer special needs planning and both IARs and Duals fall short in offering business planning services – with only 57% of dually registered advisors and a mere 44% of IARs offering such services.

Services Currently Offered

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

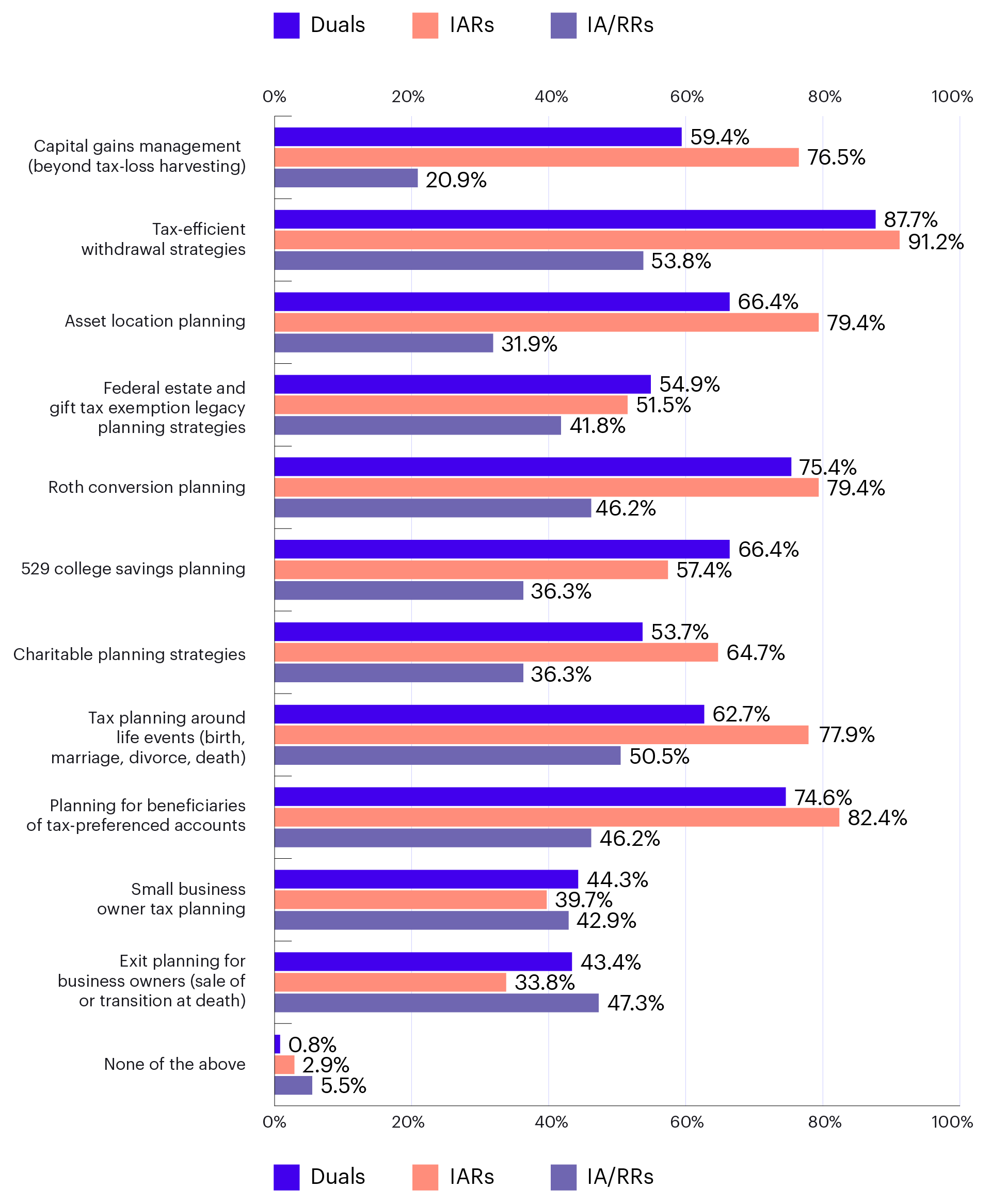

What Strategies Do Advisors Use?

The data further suggests that independent advisors are leading the way in using various strategies – especially tax-informed planning strategies – to deliver the many services they offer clients. Financial professionals who are dually registered or IARs have a competitive advantage in delivering tax-informed planning strategies to differentiate their practices.

In contrast, insurance agents and registered representatives are often required to comply with the restrictions of their home office in regard to tax planning services. However, our research suggests that over half of these insurance agent and registered representative respondents employ tax-efficient withdrawal strategies (54%) and conduct tax planning around life events with their clients (51%).

Strategies Currently Used

By Advisor Type:

The American College of Financial Services. Advisory Services Survey. 2024.

Unfortunately, with many home offices not offering a comprehensive education on tax planning services, it would seem that the respondents currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.

“[Advisors] currently utilizing these tax-efficient withdrawal strategies and conducting tax planning related to life events could benefit from some form of formal education to improve their effectiveness and raise overall client satisfaction.”

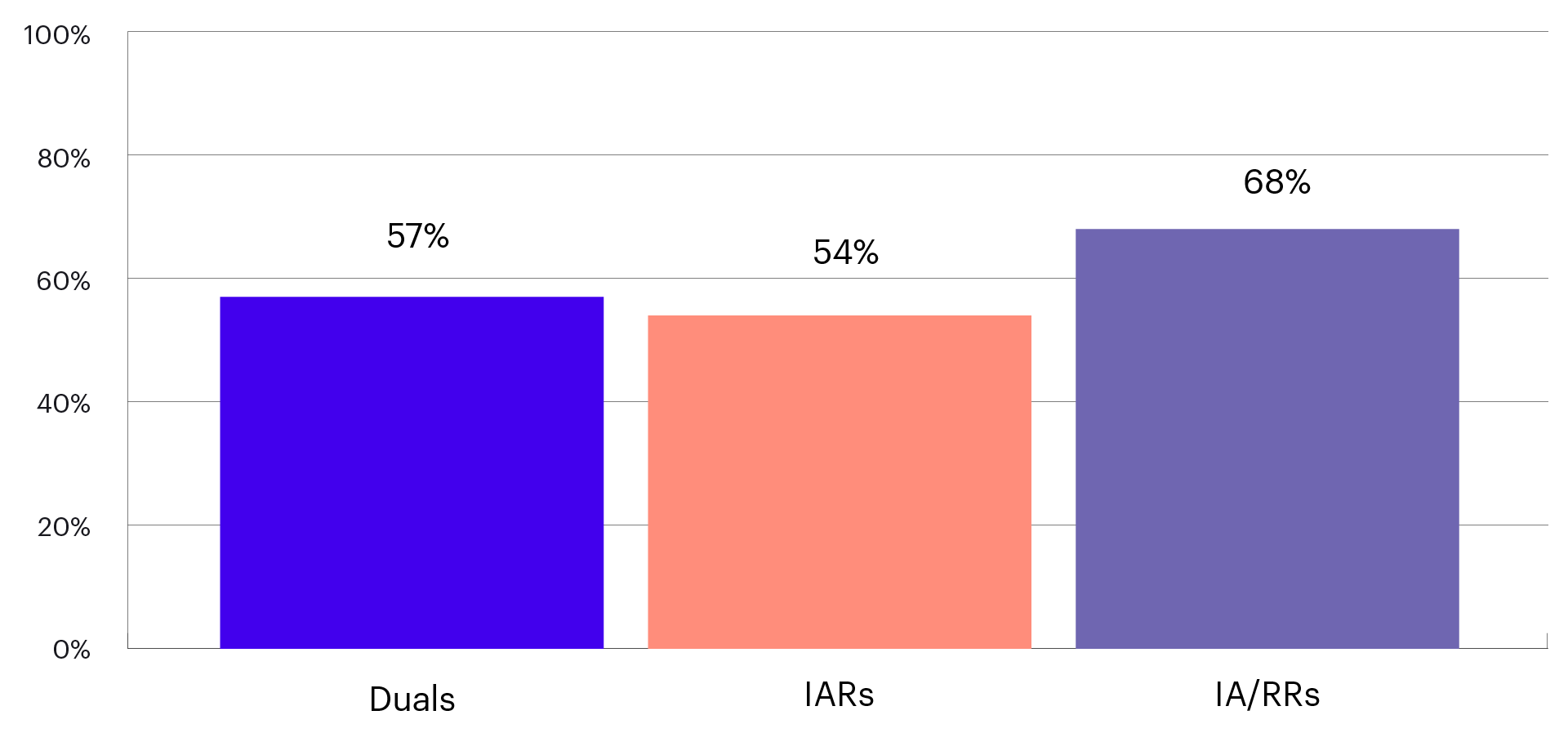

What Services Are Not Being Offered?

Finally, the survey asked advisors about the services their clients frequently request – to reveal any gaps in their current offerings. When reviewing this data, one significant outlier emerges. More than 68% of insurance agents and registered representatives, 54% of IARs, and 57% of dually registered advisors reported small business owner tax planning as the most frequently requested service among those they are not currently providing.

This represents a sizable unmet need that could prove to be a differentiator for any advisors willing to add these services to their menu. Yet, without comprehensive education on tax planning services or robust tax planning resources, how can we ensure that financial professionals across the financial services ecosystem do tax planning well?

Strategies Not Used But “Always” or “Often” Requested

Small Business Owner Tax Planning:

The American College of Financial Services. Advisory Services Survey. 2024.

Financial Planning Is Tax Planning

When reviewing the results of this survey in totality, an interesting trend emerges. Many advisors partake in some form of tax-informed financial planning. Independent advisors are more likely to say they engage in tax planning than others – but more than half of all types of advisors are currently employing tax-advantaged strategies. However, across all categories, advisors are not meeting the needs of their clients when it comes to small business tax planning, a valuable service that many advisors could benefit from offering to their clients.

Fortunately, financial advisors can address this gap through a new designation at The College. The Tax Planning Certified Professional™ (TPCP™) program is The College’s latest offering to the financial services industry and addresses this need. As advisors look to implement advanced tax strategies in their own practices, the TPCP™ program can help them by equipping participants with the skills to identify and evaluate these strategies for individuals and small businesses with a focus on maximizing tax benefits while ensuring compliance with current legislation.

The program covers a number of different topics including tax planning during the accumulation phase and the less frequently covered topic of tax planning during retirement (or the decumulation phase).

Enrollment for this powerful new designation launches in November and, with advisors already lining up to be among the first to call themselves a Tax Planning Certified Professional™, the time is perfect to seize this opportunity and join them as you look to grow your practice by improving your ability to meet the needs of your clients.

More From The College

Learn About the Fundamental Principles of Tax Planning

In the financial services industry, and most other industries, the goal is to provide value to your clients. In today’s financial landscape, tax planning has emerged as a growing service. In fact, according to the 2023 Herbers & Company Service Market Growth Study, tax planning is the most demanded service among clients with at least $250,000 in household assets. As such, there has never been a better time than now for financial advisors to familiarize themselves with the key concepts of tax planning. Fortunately, The American College of Financial Services and tax expert Jeffrey Levine cover these key concepts in Principles of Tax Planning for Financial Advisors.

Why Should You Care About Tax Planning

As Levine points out, the ability to offer sound tax planning advice is a valuable differentiator. Clients are unique individuals, but they all share one common trait: “All clients have the common thread of wanting to pay as little in taxes as possible.”

In addition to guaranteeing that advisors have desirable advice that clients want, knowing the principles of tax planning offers several other advantages as well. Tax planning aligns the interests of the advisor and the client, creating a unified goal of minimizing tax liabilities.

Furthermore, being a strong tax planner offers a financial advisor a significant amount of market resiliency. Paying minimal taxes is a common goal regardless of market conditions, and by mastering these principles, financial advisors will have something to offer clients in any market.

Ultimately, financial advisors should care about tax planning because it is a universal goal shared by nearly every client in nearly every situation, regardless of circumstances.

Key Principles of Tax Planning

Levine goes on to dispel several tax myths and share key insights that are important for financial advisors to remember as they look to help their clients achieve their goal of minimal tax payments. Included amongst these topics are several of the following key ideas:

- Tax rate and tax bracket are not the same. Levine points out a common misconception in tax planning, stating that advisors can often fixate on what tax bracket a client is going to be in. However, as Levine states, “The tax bracket is just one of the components, if you will, that goes into informing what the client’s true tax rate is.”

- There is no such thing as permanent when it comes to taxes. When arguing this point, Levine begins by emphasizing how often tax law changes. Essentially, even laws stated to be “permanent” are only permanent as long as Congress doesn’t change their mind. For this reason, Levine believes that advisors must take advantage of provisions that exist today, because: “We don’t know how long it will stick around for. What’s here today should be used when we have that opportunity.”

- The lowest lifetime tax bill wins. Obviously, everyone wants to pay as little in taxes as possible. However, we all have to pay them eventually. Levine argues that instead of looking to pay the least taxes year after year, advisors should plan for their clients to determine their payment schedule based on rates, saying, “The name of the game is simple: Pay taxes when your rates are the lowest.”

By mastering these principles, advisors can help clients achieve lower lifetime tax bills and navigate the complexities of tax laws with confidence. Levine goes into greater detail on these ideas and more in Principles of Tax Planning for Financial Advisors, available exclusively on Knowledge Hub+.

To access this learning opportunity, visit Knowledge Hub+ and unlock the potential to transform your financial advisory practice today.

To learn more about the Tax Planning Certified Professional™ (TPCP™) program, join the waitlist.

Register now for Jeffrey Levine's upcoming webcast, "Planning Strategies to Mitigate the Impact of the 10-Year Rule," on Tuesday, October 29, 2024, 2 - 3 PM EDT.

This live webcast is exclusively available on Knowledge Hub+. To register, access Knowledge Hub+ via your Learning Hub or learn more about Knowledge Hub+ and subscribe today.

Financial Planning Retirement Planning Research

Retirement: The Power of Tracking

If you’ve used a fitness app, you may have noticed that activity goal reminders motivate you to exercise. Reminders force us to make active choices. Are you okay with not meeting your step goal today? Have you exercised less this month than you did last month? Are your friends working out more often than you are?

Academics have generally embraced the power of doing nothing in 401(k) plans. The Pension Protection Act of 2006 increased the percentage of employees who sock money away for retirement at the default savings rate and 68% of employees now invest in target-date funds (ICI, 2024). Defaulting to passive savings means that more workers save and the least knowledgeable save more and earn a higher rate of return on investments than if they made active choices.1

A recent survey from the American College Granum Center for Financial Security conducted with AGEIST.com finds that people who track their health are also more motivated to save for retirement. This makes sense if the real power of tracking is that it forces us to make an investment in our ability to imagine the future and take control of decisions today that affect how long and how well we will live decades into the future.

Nobel Laureate Gary Becker (1997) believed that the time and effort we spend imagining how decisions today affect future outcomes is an investment. If we spend more time thinking about how our actions today impact, for example, how much money we can spend after retirement or whether we will be physically active in our 70s and 80s, then we can make better decisions about how much to save and exercise. Imagination is a resource that helps us make better decisions.

While imagination helps us recognize the future consequences of our decisions, we might forget about these consequences when we wake up in the morning and follow a routine that doesn’t include exercise. This is because the brain often operates in automatic mode where habits control how we spend much of our day.

Breaking out of habits requires conscious choice. This is where tracking comes in.

Using tracking devices forces a break in our habits. After we wake up and brew a cup of coffee, our tracker reminds us to at least think about going for a run. If you’ve built the imagination capital that allows you to recognize the importance of running today to increase your health and longevity, then you might decide to get some exercise. In other words, imagination capital alone isn’t enough to reach your goals. You need a tool that helps you change habits.

We all face a struggle between what we do today and what we want in the future. In economics, this is referred to as “time inconsistent preferences.” In other words, we may want to save more for retirement, but when we get to work, we don’t walk down to the benefits office to increase our savings rate. We might want to be healthier, but can’t resist choosing a burger instead of a grilled chicken salad at the cafeteria. Smart people who value the future recognize that they need a little help to make better choices in the present.

Effective trackers give us a short-term boost of positivity when we do something that helps us meet long-term goals. They might congratulate us for reaching our step goal or encourage friends to give us kudos for going on a run. The best trackers leverage the power of short-term emotion to motivate small behavioral changes that result in big, long-run improvements toward our goals.

Tracking progress in retirement can also give us a boost as we see our savings grow over time. The positive emotional response we get from seeing our nest egg grow can motivate us to save more. If we never check our balance, we may forget about the importance of savings and investing. Tracking can provide a short-term reward and remind us that we need to stay on track to meet long-term retirement security goals.

Do People Who Track Save More for Retirement?

Yes, quite a bit more. More than half of survey respondents who check their retirement balance daily (13% check daily!) save more than 10% of their income for retirement. Those who check their balance weekly or monthly were about 30% more likely to save 10% of their income for retirement than those who check quarterly or annually, and only 10% of those who never checked their balance saved more than 10%.

Save More Than 10% for Retirement

How often do you check your retirement savings balance?

Is tracking associated with taking the time to estimate how much savings is needed to meet retirement spending goals? Yes, more than 80% of respondents who check their balance daily, and 67% of those who check their balance at least every month have made the effort to estimate how much they need to save to meet retirement spending goals. Only 14% of those who never check their balance have estimated how much they’ll need to save to meet retirement spending goals. Those who track progress have also taken the time to imagine how much they will need to save to meet their future spending goals.

Have Estimated Savings Needed to Meet Retirement Spending Goals

![]()

How often do you check your retirement savings balance?

Those who track their retirement balance are also more likely to track their health. Tracking health using a wearable device (such as an Apple watch, Oura ring, Fitbit, etc.) is strongly associated with tracking one’s retirement savings balance. Both health and retirement savings are short-run behaviors that lead to positive long-term outcomes. It’s not surprising that those who make an effort to measure progress toward health goals also track progress in their finances.

Track Health Using a Wearable?

How often do you check your retirement savings balance?

Do those who follow a specific plan or health app save more for retirement? The results are striking – just over half of those who follow a specific workout plan or app save more than 10% of their income for retirement. Only a quarter of those who don’t follow a workout routine save at least 10%. Those who have created a habit of exercising have also made a habit of saving 10% of their income for retirement.

Save More Than 10% for Retirement

Do you have a workout routine?

Before diving into retirement planning as a math problem, it might be more important to help a client imagine how they’re going to live in retirement, what they hope to spend money on, and how this spending will open up opportunities for travel, moving into a dream home, or achieving financial security or a legacy goal. Conversations that build imagination capital can help individuals see how small choices today can lead to a better life in the future.

Likewise, people save more when they track short-term progress. Seeing one’s savings rise over weeks and months can trigger positive emotions and a feeling of accomplishment. In fact, there appears to be similarities in tracking health and the propensity to create specific short-term plans and saving more for retirement. Tracking motivates active choices in both health and retirement that lead those who value the future to be rewarded for making decisions in the present.

There may be a dark side of tracking that doesn’t show up in these results. In March 2020, workers who managed their retirement investments were far more likely to phone up their recordkeeper after the market dropped to sell stocks after they fell in value. Target-date fund investors were generally unaware of the drop and didn’t make a change in their investments. Access to an advisor, however, increased the probability of initiating contact and significantly reduced the likelihood of an ill-timed trade. If frequent trackers are more aware of a loss, they’ll likely benefit more from the counsel of an advisor who can help them manage their emotions and maintain savings habits to meet long-term goals.

About The College Financial Planning Podcasts

The AICPA Engage Tax Planning Road Show

In this episode of our Shares podcast, recorded on the floor of AICPA Engage 2024, Michael Finke, PhD, CFP® engages thought leaders and financial professionals in attendance to discuss the impact of The College’s upcoming Tax Planning Certified Professional™ (TPCP™) Program. He talks specifics about the content of the program and dives deeper into the value of specialized tax planning knowledge for advisors in all areas of financial services.

Any views or opinions expressed in this podcast are the hosts’ and guests' own and do not necessarily represent those of The American College of Financial Services.

Financial Planning Philanthropic Planning Retirement Planning Insights

FinServe Ambassador Charts Career Evolution Through Specialization

Tudor says he entered the financial services profession via banking in 2008 during a volatile and chaotic time for the industry. Despite this, he says he found great satisfaction in his work in leadership roles – running several bank branches around Cincinnati, Ohio – and especially in areas involving lending. That was where he first started to sense the industry might have blind spots and think about how he wanted to address them.

“I really enjoyed helping people buy houses and start small businesses, but I saw gaps in knowledge and access, especially when it came to investment management,” he said. “The bank often had a minimum level of assets they would service, and I often saw more resources being afforded to affluent communities. I knew I wanted to focus on those who had been historically excluded.”

Tudor eventually transitioned into a role with Northwestern Mutual and spent several years at the company becoming a licensed advisor and directly working with clients. From those interactions, he continued to refine his sense of who he was as a professional and who he wanted to serve.

“Most people, especially those from historically excluded communities, need more education in and access to financial services and are looking for deeper advice than just receiving products,” he said. “I’ve always felt we should be building in systems to protect and educate these groups.”

In 2020, amid the COVID-19 pandemic, Tudor finally decided he wanted to start his own firm and launched Alchemist Wealth – with a focus on fee-only planning and serving women and other historically excluded communities – with his brother. Four years later, he merged the successful practice into Zenith Wealth Partners, where he continues to work as an advisor in a variety of planning fields, from investment portfolios to retirement and philanthropic planning. It’s all in service, he says, of his mission to help his clients align their money with their values.

The Role of Retirement Planning

While at Northwestern, Tudor availed himself of the company’s connection to The College to earn multiple designations and certifications: first through the CFP® Certification Education Program to get a strong financial planning foundation, and later through the Retirement Income Certified Professional® (RICP®) Program for the specialization he was seeking in retirement preparation and planning.

“The first time a client came to me and asked me questions about retirement I couldn’t answer, I knew I had to get more knowledge,” he said. “The RICP® is powerful because it impresses upon you that accumulation planning and retirement income planning are two very different things. When I was at Northwestern, we would answer questions about retirement planning with material from College thought leaders like Michael Finke, PhD, CFP® and Wade Pfau, PhD, CFA, RICP®. Their advice on using tools like annuities, home equity, and other income streams to stabilize retirement income may not be popular in some circles, but they’re mathematically proven to be better solutions.”

“[The RICP® Program]’s advice on using tools like annuities, home equity, and other income streams to stabilize retirement income may not be popular in some circles, but they’re mathematically proven to be better solutions.”

Tudor says thanks to the RICP®, he is now well-versed in retirement planning concepts and can simplify them enough for his clients to understand. He also says he sees a growing need for this specialized knowledge as America continues to age.

“The industry to me is still five to 10 years behind what’s necessary in retirement income planning, and it’s exciting to see The College continue to be out in front of the latest ideas and blaze the trail for doing things the right way,” he said.

Investing for Impact

In addition to his focus on retirement planning, Tudor says he’s always been interested in the technical side of planning and the potential of money in general to benefit society. Because of this, he enrolled in the Chartered Advisor in Philanthropy® (CAP®) Program at The College to gain more specific knowledge about how to use investment strategies to help his clients live their values.

“We often ask clients about their goals for impact: whether they’re broad or specific, for family, community, globally, or causes they support,” he said. “Clients constantly bring these subjects up, and I don’t know how I would be an advisor without being able to have those conversations. I believe eventually those kinds of conversations will be table stakes for the industry, and everyone will need to know how to talk about charitable giving with clients and organizations.”

While he loves working directly with clients, Tudor says it’s the institutional side of giving that he’s fallen in love with thanks to the CAP® Program.

“It’s about how you use money and make it work for what you believe in the real world, not just on your spreadsheet,” he said. “That kind of mission-aligned investing, where organizations use their capital to benefit society, is exactly where I want to be. The CAP® Program’s donor strategies were helpful, but its full course dedicated to working with nonprofits has allowed me to sit on board committees and lead conversations about aligning investment portfolios with an organization’s mission. I think that’s a serious gap in the market to be addressed.”

“[The CAP® Program] has allowed me to sit on board committees and lead conversations about aligning investment portfolios with an organization’s mission. I think that’s a serious gap in the market to be addressed.”

Finding Community and Purpose

After being inaugurated into The College community as a recipient of the NextGen Financial Services Professional Award, Tudor says he has been consistently impressed by what The College is able to do for financial professionals – especially in its events like the annual Conference of African American Financial Professionals (CAAFP).

“CAAFP feels like a homecoming every year for me,” he said. “It’s my one opportunity to see and reconnect with a lot of people I know from the industry, and the workshop and keynote sessions are consistently incredible. It’s a safe bet for me to invite a new advisor to CAAFP. There aren’t many places Black professionals in financial services can go and see mostly people who look like them, and the level of excellence in the execution of the event is always impressive.”

“It’s a safe bet for me to invite a new advisor to CAAFP. There aren’t many places Black professionals in financial services can go and see mostly people who look like them.”

Tudor says he’ll be present at this year’s CAAFP, to be held August 12-14 in Atlanta, Georgia. In the meantime, he advises young professionals in the field to be open to challenging themselves and thinking intentionally about their career path.

“Go to places that stretch you and be mindful of how you feel when you’re doing things,” he said. “This field affords you 40 years to build a career and have an impact, so thinking long-term is key. I love working with personal clients and enjoy financial planning in general, but I really live for doing organizational and institutional planning. Fill your day with things you enjoy doing, and success will come.”

FinServe Ambassador Supports Fellow Women Working in Wealth

Welsh is a 17-year veteran of Sequoia Financial Group, a growing RIA firm based in Akron, Ohio. Founded in 1991, the practice has seen explosive growth over the last several years and currently features 14 offices in eight states, as well as $18.3 billion in AUM as of 3/31/2024. She says her time with Sequoia has been an incredible journey – not least of which is because financial services wasn’t the life she had originally planned for herself.

“I didn’t know I wanted to go into finance at first: I double-majored in that and dance in college,” she said. “I’d also never been to Ohio before I come to Sequoia, which I did because my cost of living math as a dancer wasn’t really adding up. I had initially been in the Midwest for college, but after interviewing back east and deciding I loved this company, I moved and have been here ever since.”

Welsh described her company’s driving belief to be the idea that planning and investment strategy inform one another to create a foundation that enriches the lives of clients. She also explains that her current position as a senior vice president and leader of the group’s wealth planning department wasn’t something she had planned either.

“Originally I was on the advisor track with Sequoia, working directly with clients and doing typical advisor work – but a year or so into my time with the firm, the country went through a massive market crash,” she said. “All our clients, no matter how well-off, seemed to want to work on their wealth plan or put one in place if they didn’t have it. It was an all-hands-on-deck situation, and some of us junior advisors were called on to help the planning team. I was one of them, and I found I had a real passion for it.”

Specializing for Success

As the market recovered, Sequoia’s leaders decided to dedicate more employees to their technical planning endeavors – and that included Welsh. She rededicated herself to professional development, seeking additional learning opportunities to get the expertise she needed to succeed. The College and its specialized knowledge offerings, she says, were a huge help.

“My initial contact with The College was through my master’s degree, the Master of Science in Financial Planning (MSFP) – then the MSFS,” she said. “I was looking to build my technical depth of knowledge on the planning side and looked at many options, including an MBA, but I didn’t think they were deep enough. The strength of The College’s curriculum is what drew me to it, and it’s what allowed me to expand my opportunities and accelerate my career through that knowledge.”

“The strength of The College’s curriculum is what drew me to it, and it’s what allowed me to expand my opportunities and accelerate my career through that knowledge.”

Welsh also went through The College’s CFP® Certification Education Program to attain her CFP® mark, along with the Accredited Estate Planner® (AEP®) Program to specialize further in retirement and estate planning areas. Like many advisors in the business, she sees retirement planning as the next vital frontier for professionals looking to expand their knowledge.

“Everyone wants something different out of retirement. For some clients it’s about financial independence – how much can they spend safely, or before they run out of money?” she said. “For high-net-worth clients it’s about how they can transfer their assets to future generations in the most efficient way possible. The people I work with are asking about taxes especially, and how things will change as of 2026 with Roth conversions, charitable distributions, and other things. No one can know everything, so the power of specialization is that your business can have a much larger impact on clients the more team members who can help.”

“No one can know everything, so the power of specialization is that your business can have a much larger impact on clients the more team members who can help.”

When considering her plans for the future, Welsh says she remains dedicated to lifelong learning and is interested in pursuing the Chartered Special Needs Consultant® (ChSNC®) designation, which would provide her with an in-depth understanding of the financial planning challenges those caring for individuals with special needs face.

“Sequoia recently acquired a firm that specializes in working with caregivers, and it’s helped us realize it’s not such a niche focus: special needs or similar areas like aging issues or disabilities can affect any client, regardless of net worth or occupation – and all of these issues tie into retirement planning,” she said.

Being a Woman Working in Wealth

Welsh says she remains a champion of this kind of professional development, as does her firm: ongoing learning is at the core of Sequoia’s business model and her own beliefs as a financial professional. However, she has also looked outside the company for further opportunities – especially when it comes to networking with other women in financial services. For her efforts in mentoring, supporting, and advocating for women in the profession, Welsh was honored with the American College Center for Women in Financial Services’ Women Working in Wealth Award.

“I was part of the Women Working in Wealth Summit when we walked down Wall Street together,” she said. “We all took pictures with the famous “Fearless Girl” statue, including me, and at the time I didn’t think much of it. Later on, though, I had several male colleagues tell me they showed my picture to their young daughters to prove to them that financial services could be a place for them to succeed.”

Welsh described recent industry trends that have, in her view, greatly benefited women: the trend away from commission-only models that remove barriers to entry or to staying in the industry for women, who are traditionally the caregivers to their families; companies setting aside more time for their female employees to take maternity leave; and the growing popularity of hybrid work models that allow for the juggling of personal and professional responsibilities. She recognizes, however, that there are still challenges to overcome, including a lack of visibility and confidence that many women face.

“If you’re not physically in front of your leaders regularly due to hybrid work or other reasons, are they overlooking you more?” she said. “Financial services is still a highly male-dominated industry – most of the faces of the business are men, and not even 25% of CFP® professionals are women.”

To combat these issues, Welsh suggests young women and especially advisors find opportunities to build their confidence in professional settings – and calls on their senior leaders to offer those opportunities more readily.

“Think about how you’re introducing a junior member of your team in a meeting: build them up, or maybe spend a little extra time having a prep call or post-call to talk about results of a meeting,” she said.

Welsh also advised financial services leaders to avoid falling into the stereotypical thinking that women aren’t interested in finance, especially when it comes to working with female clients or families.

“Planning is a process, not an event. We need to be prepared to serve clients’ changing needs, and that means continuously enhancing our knowledge.”

“If you’re working with a couple and the woman isn’t at the meeting, there’s probably a good reason for that,” she said. “If both partners are there, make sure you engage both of them equally as much as you can. Most statistics say women live longer than men, and there’s an increasing rate of divorce among older adults, so there are more and more times when women are in control of the money. Not all women want to work with women, of course, but having a depth and diversity of talent available is important and something the industry needs to take seriously.”

Welsh also advised financial professionals working with women to try to avoid jargon in conversations and elevate their clients’ knowledge without talking down to them. She says explaining financial terms in ways that are more digestible and encouraging clients to ask questions removes a discomfort about asking them – and empowers better decision-making. First and foremost, she says lifelong learning is the key to being successful.

“Planning is a process, not an event,” she said. “As financial professionals, we know the economic and legislative landscape is always changing; we can’t just give clients a written plan and tell them they’re good to go. Things around them will change, and their circumstances will change. We need to be prepared to serve their changing needs, and that means continuously enhancing our knowledge.”

Shares: Let’s Talk Taxes

Join our host Michael Finke, PhD, CFP® and Jeffrey Levine, CFP®, CPA, PFS, CWS, AIF, RICP®, ChFC®, BFA™, Chief Planning Officer at Buckingham Wealth Partners, for a detailed conversation on what financial advisors get right and wrong when thinking about tax planning, as well as key strategies to help your clients keep more of their hard-earned money.

Jeffrey Levine, CFP®, CPA, PFS, CWS, AIF, RICP®, ChFC®, BFA™ is Chief Planning Officer at Buckingham Wealth Partners, working closely with the Buckingham team to create a seamless and enjoyable experience for clients that makes it easy to plan and instill confidence as they work towards their most important goals. He serves as a technical resource for advisors and the firm’s primary thought leader regarding evidence-based planning concepts and strategies. He excels at distilling complex financial laws and policy into understandable resources. His work at Buckingham gives him the ability to train and educate hundreds of advisors and support them in their pursuit of helping clients fulfill their financial dreams. Levine is a nationally recognized thought leader within the financial planning community. He is the lead financial planning nerd for Kitces.com, home of the popular Nerd’s Eye View blog, and the founder of Fully Vested Advice, Inc., which provides financial education and consulting services to industry professionals. He is a regular contributor to Forbes.com, as well as various industry publications, and has promoted retirement and tax education on television stations such as CNBC, Fox Business News, CBS and PBS. He is regularly sought after by journalists for his insights and is frequently quoted in publications throughout the country.

Any views or opinions expressed in this podcast are the hosts’ and guests' own and do not necessarily represent those of The American College of Financial Services.

Mark McLennon, Seasoned Tax and Estate Planning Professor, In His Own Words

In March, McLennon joined The College as a full-time assistant professor in tax and estate planning and also serves as the Clark/Bardes Chair in Retirement Planning and Non-Qualified Deferred Compensation. Students in the CFP® Certification Education and Chartered Financial Consultant® (ChFC®) programs will benefit from his immense knowledge in business planning, estate planning, executive compensation, life insurance planning, retirement planning, and vast experience having served in a variety of positions over a 25-year successful career in financial services.

We posed a few questions to McLennon, and in his own words, you can learn more about his journey back to The College as a full-time faculty member and what he enjoys most about working with students.

1. How has The College impacted your career in financial services?

My experience with The College began as I pursued my CLU® and ChFC® designations over 25 years ago while transitioning from corporate tax into an "Advanced Planning" role at a major financial services firm. Despite taking every trust, estate, and tax class I could at my law school and working as a research assistant for the tax professor, none of that prepared me as much for the practical and real-world client/advisor issues I would face as did The College's curriculum.

The knowledge and credibility that came with achieving those designations and the great people I subsequently met through The College have served me well in the varied corporate and client-facing roles I have taken on. Over the years, as organizer and host of several wealth management and financial planning conferences, I have also had the privilege of working with some of the distinguished faculty of The College. I first began teaching at The College about five years ago and am now very excited to be doing that again as a full-time member of the faculty.

2. What are today's most significant challenges and opportunities for financial professionals?

Advisors need to know or access relevant information from multiple disciplines to provide the type of holistic advice clients expect as the marketplace has responded to such demand over the years. Combine that with the time needed to truly know your clients, much less acquire new relationships, and the significant challenge for financial professionals is how to best utilize those limited working hours.

Of course, no one can be expected to know everything, and bringing in outside expertise is something savvy clients have come to expect. The good news is that opportunities exist to acquire timely, relevant knowledge through programs such as those at The College, where one can also get assistance identifying situations where outside expertise is warranted.

3. How do The College's CFP® Certification Education and ChFC® Programs work together to enhance advisors' skills?

Both the CFP® and the ChFC® programs cover the core knowledge that clients come to expect when financial service professionals hold themselves out as dedicated to providing a higher level of expertise.

The College's requirements are the same across the two programs with one additional specialized course needed for the ChFC®. It is how that knowledge is applied in practice that has somewhat differentiated the two over the years, as each has its own unique background and history.

4. How is The College ensuring that students who enroll in the CFP® Certification Education Program achieve success in the CFP® exam?

There is deep and continuing coordination between the particulars of the programs at The College and the ongoing requirements of achieving the CFP® designation. The College is very much invested in the ongoing success of its students, and maintaining the curriculum to help students succeed with the exam is a priority while still emphasizing the critical importance of the application of that knowledge in practice.

5. What do you enjoy most about working with The College's students and being part of The College's community?

I most enjoy seeing that light bulb go on over students' heads. A few subject matter areas in the financial services world have historically seemed daunting to students, even those who are experienced or "seasoned" financial advisors. I like to relay stories to my classes about how I would initially dread getting calls on certain topics, like ESOPs or generation-skipping taxes for example, as a newer Advanced Planning attorney as I felt out of my comfort zone.

However, I add, I chose instead to step back, take some time, and break down these "daunting" concepts to their core components, thus replacing that dread with the anticipation of helping someone else get past their anxiety over the issue. That is one of the things I enjoy most about working with students at The College: taking what may seem a difficult concept at first, breaking it down to its core components, shedding a little light on what something truly means, and shining a larger light on its application in practice.

Being part of The American College community has been a great experience for me, and I know my colleagues feel the same way about the importance and satisfaction of getting through to students and helping them help their clients.

Audrey Snell Analyzes the Market Outlook for 2024

In her article, Snell, an assistant professor of financial planning at The American College of Financial Services, reflects on the performance of the American economy in 2023 and uses this information to predict what’s next for 2024. She also presents two likely outcomes, detailing the bull case for a soft landing in 2024 and the bear case for a potential recession.

Read on to learn more on Snell’s thoughts on the economic outlook for 2024!

Financial Planning On-Demand Webcasts

Elevate Your Practice While Ensuring Compliance With New Fiduciary Guidance

Watch as leaders from The College and the National Association of Certified Fiduciaries (NACFF) take part in an informative discussion on the Certified Financial Fiduciary® certification and new Department of Labor fiduciary rules. By taking part in this webcast, you’ll gain valuable insights on how to elevate your practice, gain trust, and drive growth, all while ensuring compliance with new fiduciary requirements.