Ethics In Financial Services Insights

The Fork in the Road for Social Enterprises

Published: Brown, J. A., Forster, W. R., & Wicks, A. C. The Fork in the Road for Social Enterprises: Leveraging Moral Imagination for Long-Term Stakeholder Support. Entrepreneurship Theory and Practice, DOI 10422587211041485 (in 2021); in print ET&P, 2023, 47(1), 91-112 (2023).

This manuscript was accepted for a special issue on stakeholder theory and entrepreneurship. It went online September 20, 2021, and in print in 2022/23. Entrepreneurship Theory and Practice (ET&P) is considered a top, AJG-4 rated journal,1 applied to journals that “publish the most original and best-executed research.”2 It has a five-year impact factor of 14.105. The paper has been downloaded over 1000 times as of May 2023. I am lead and corresponding author on the article. In 2022, it won the Best Published Paper Award at the annual International Association of Business & Society (IABS) conference—an international conference and institution dedicated to research and teaching about the relationships between business, government and society.

This article was motivated by reading about the popular philanthropic shoe company, the TOMS company. Founder Blake Mycoskie introduced a “one-for-one” business model, where he promised that for every purchase of shoes, the company would give away a pair of shoes to some needy child or person. The initial response from customers was highly supportive, but less than five years from its formation, the company found itself subject to a firestorm of critique from disillusioned observers who accused the company of being more focused on getting consumer dollars than making a tangible impact through their social mission. The cause of the criticism was associated mainly with TOMS’s failure to create opportunities for needy communities to better themselves. TOMS was accused of making people in developing countries dependent on the goodwill of others, in addition to preventing local markets from thriving.

Hence, my co-authors and I decided to unpack the issues that left TOMS (at least temporarily) on the bad side of its stakeholders. We were left wondering, what are the key factors for social enterprises (SEs) like TOMS that enable a company to sustain the support of their stakeholders beyond their nascent stage? Put another way, how can SEs capture positive social judgments and avoid a loss of moral legitimacy and stakeholder support, as happened in the TOMS case? And finally, what aspects of stakeholder theory are most relevant to social entrepreneurs in their quest to create and sustain long-term value creation?

To answer these questions, we develop a conceptual process model and testable propositions that have both theoretical and practical significance. The model shows that after SEs secure the support of primary stakeholders like financiers, suppliers and customers, they then face a “fork in the road” where they are assessed for social impact. If they continue their focus on primary stakeholders to the exclusion of secondary stakeholders like communities, they risk losing the moral legitimacy of both their primary and secondary stakeholders, which will ultimately cause their failure (i.e. they end up on the “low road”). However, our model shows how social entrepreneurs and their enterprises can leverage their moral imagination---the ability to understand the activities of business from a number of perspectives---to affect the ways their stakeholders envision their legitimacy (i.e. they end up on the “high road”). They can do this: 1) in broadening stakeholder awareness and engagement, 2) in empathizing with secondary stakeholders, and 3) in establishing microsocial norms. Thankfully, TOMS became aware of broader stakeholder concerns and chose to engage with both primary and secondary stakeholders, using moral imagination to regroup and take ‘the high road’. In sum, our manuscript provides a nuanced stakeholder lens that identifies factors critical to the longevity of SE businesses.

I use the TOMs case study and my developed process model in my current graduate classes, in executive education and in my pro bono ethics/stakeholder training for compliance professionals. There is a message for social entrepreneurs in the need to pay attention to secondary stakeholders, and I find that it is received well by leaders across all stages of entrepreneurship.

In sum, this article has been recognized by a highly regarded journal and is beginning to contribute to the advancement and refinement of stakeholder theory and social entrepreneurship.

Ethics In Financial Services Insights

Can You Tell the Difference Between Acceptable Networking and Wrongful Hiring Practices?

Prudential PLC’s CFO resigned earlier this year because of an investigation into a code of conduct violation. A recent WSJ article reveals that the breach was in connection with the CFO’s efforts to help the son of an insurance regulator in Hong Kong, who had approached him about a potential job opportunity.

The regulator led the Insurance Authority of Hong Kong’s oversight of Prudential PLC and other life insurance companies. She too left her job at the Insurance Authority at the termination of her contract this summer. The company has declined to comment on the case to the Journal.

Networking and doing informational interviews are the norm in business for job seekers. It’s an understandable approach to recruitment, as hiring managers would generally prefer to hire someone that comes with a known reference than one selected at random by an algorithm. But when do relationships cross the line towards nepotism and unethical favoritism?

Conflicts of interest in hiring can be a murky area of ethics for employees. Many believe that using your relationships and networks are critical to finding a good hire. LinkedIn’s top tip for how to get hired by a large company is to develop a strategy to get an internal referral. Reconnect with an old friend, they suggest, or befriend someone who works there.

Yet favoritism and conflicts of interest are among the highest incidents of observed unethical behavior in practice, according to the annual Global Business Ethics Survey (GBES). The Ethics and Compliance Initiative has been administering this research for 20 years. One of their conclusions from the 2023 results is that the observations of all types of misconduct are at an all-time high level, at 63 percent.

Two-thirds of employees around the world indicated that they’ve observed at least one instance of a violation of a company code, policy, or law. Among the top observed misconduct is favoritism among employees, and inappropriate hiring practices.

The discrepancy between the norms of hiring and these survey results may be because of the differing characterizations of conflicts of interest. A common description of a conflict is a circumstance when you or your company benefits at the expense of another person or company – e.g., the company makes money by doing a financial trade that benefits the company but not the client, who suffers a loss. Consistent with this view, when there are decisions that make everyone better off, then it’s not a conflict. Both parties are better off when that decision is made, so it’s a win-win.

An alternate view is that even when both parties benefit, there is a potential conflict of interest when one party stands to benefit and could sway the situation without full disclosure of those influences; or when there are personal relationships involved that could have skewed the decision-making in favor of a third party.

I’ve observed these divergent perspectives when teaching. One case I often use involves an employee who is responsible for hiring company vendors. He’s identified two vendors that are, on paper, equally qualified. In a casual conversation with one vendor, the employee mentions that his wife has a rare cancer and is struggling to find good care. The vendor knows a specialist at the local hospital and can get her to the top of the list for treatment.

The case is designed to heighten the emotional sensitivity of the situation, yet the key takeaway should be that the employee should remove himself from the decision-making process and let someone else lead. Students often resist that recusal is necessary because the employee can make everyone better off. By choosing the vendor who has the relationship with the hospital and helps his wife at the same time, it’s a win-win!

Managing conflicts matters not only because favoritism is unfair to others, but also because it could be an early warning signal for other issues. In 2016, JPMorgan Chase paid a $246 million penalty to settle FCPA charges relating to their referral hiring program in China. Over the seven-year period reviewed, the company retained $100 million in revenues by hiring approximately 100 interns and employees of high-level government officials. These practices seemed to have slid down the slippery slope beyond favoritism to bribery.

Being precise about the definition of a conflict of interest can help thwart potential misperceptions. Prudential PLC said the CFO’s resignation was “in light of an investigation into a code of conduct issue,” according to the WSJ, that was “flagged by Prudential [PLC’s] HR function as a potential conflict of interest.”

Ethics training should also go one step further to provide guidance on conflicts of interest. Many companies provide employees a bonus for referring their friends to the firm. This referral practice is not problematic but when embedded within a goal-oriented, high-paced business culture, employees need clarity to identify the line where banking on personal relationships is indeed a win-win.

Ethics In Financial Services News

Sierra's St. Aubin: What's Uncertain is the Depth of the Coming Recession

Ethics In Financial Services Insights

Perspectives on Ethical Leadership 2023

Specifically, the group talked about SEC enforcement action against a financial services firm for a recent cheating scandal among employees and how the importance of ethics education can be stressed as something to embrace, rather than an obstacle to work around.

Ethics In Financial Services News

From Principles to Laws: Consumer Protection Can Galvanize AI Regulation

Ethics In Financial Services Insights

How Personal Relationships Affect Trust in Financial Services

The results showed that while the industry has come a long way since public trust in financial services cratered in the wake of the 2008 financial crisis, there is still a long way to go when it comes to earning the confidence of diverse groups of clients and those outside the system of traditional financial services companies.

In a new report released in April 2023, the Center for Ethics in Financial Services continued to highlight the sources of consumer anxiety when dealing with financial services companies and which companies were more likely to earn the public’s trust.

In the report, experts from the Center write that consumer trust in financial services comes with some latitude for mistakes but is also easily lost when consumers have negative experiences that question whether it was wise to trust in the first place. In addition, there is significant complexity around the factors that drive whether individuals trust an organization. These include three general domains of trust factors: psychological, experience, and demographics.

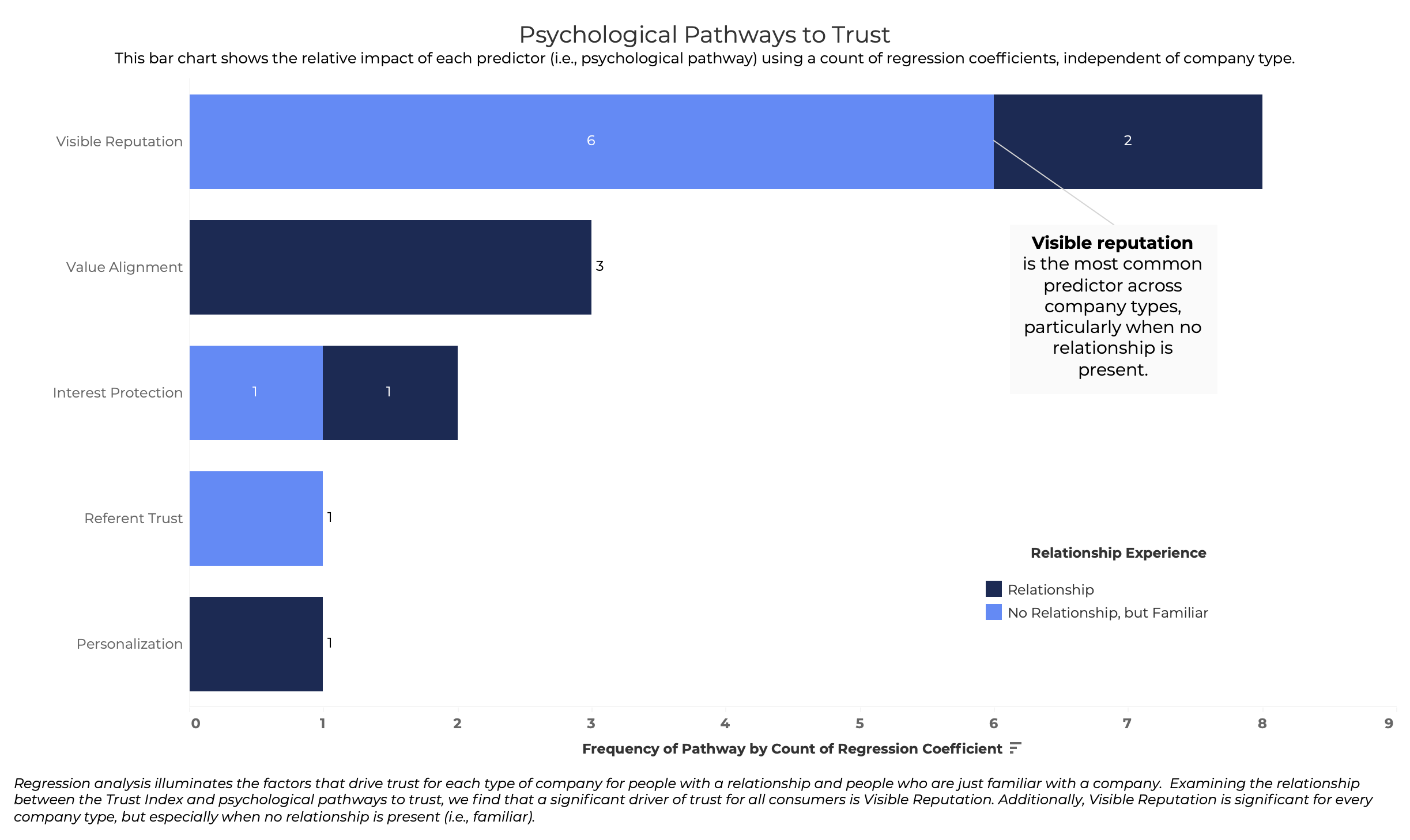

Among the psychological factors that drive trust for consumers, the Center’s research identified five key points: company behavior and values; what consumers hear about experiences with a company from others; levels of personalization and individualized service; how organizations protect their clients from fraud and act transparently toward them; and what kinds of reviews a company has from reputable sources. All can play a significant role and, when taken together, provide a potential blueprint for how financial services companies can approach consumers who may tend toward lower levels of trust.

The Center found that more often than not, personal relationships formed due to experience with a financial services professional or company matter significantly. In addition, an important marker of an organization consumers feel they can trust is the consistency with which they are present in the community: are employees treated well? Is the community treated well?

Organizations, such as investment app companies and online-only or mobile banks, tend to have fewer opportunities for direct engagement or to form personal relationships. In this study, they also trended lower on trust indexes – proving the “experience gap” is a real and enduring factor the industry must consider.

Access our research brief offering pathways to trust in financial services.

Ethics In Financial Services Insights

Perspectives on Ethical Leadership 2020

Specifically, the group examined the role big data plays in the financial services world and the potential ethical dilemmas that arise when data collection comes into conflict with profit and ethics regulations. Participants also looked at case studies dealing with data privacy and shareholder vs. stakeholder interest.

Read the full 2020 Forum report here.

Ethics In Financial Services News

Investors’ ESG Demands: Will More Plan Sponsors Be Forced to Act?

Ethics In Financial Services Insights

ESG: U.S. and European Rules Reveal Differing Perspectives on the Topic of “Materiality” in Business

Azish Filabi, Executive Director of the American College Center for Ethics in Financial Services, examines the concept in this article.

Ethics In Financial Services Insights

Perspectives on Ethical Leadership 2001

Specifically, the group discussed what is needed to run an ethical business in the financial services industry. Topics included processes, incentives, and responses to current hot-button trends.

Read the full 2001 Forum report here.